Prime Minister John Key is mistaken to rule out extending the In Work Tax Credit to all poor children (The Nation 11th Oct) and Child Poverty Action Group challenges government advisors to come up with a more cost effective way to reduce the worst child poverty.

The government will not significantly reduce child poverty without raising the inadequate incomes of beneficiaries with children. The In Work Tax Credit is the most cost effective, immediate way to do this.

More money is proven to make a difference. Ministry of Social Development research shows clearly that the child poverty rate in families in paid work reduced significantly due to the In Work Tax Credit payment. Of course extending the IWTC is just the first step. Other things are also important, such as affordable quality housing, but these are longer term measures.

Important improvements around adjustments for inflation are also needed urgently. The purchasing power of ordinary working incomes and the availability of jobs provide a decent standard of living for families are both in serious decline. Working families on low incomes are being hurt by the gradual changes National is making to thresholds and abatement as outlined in CPAG’s latest publication Our Children Our Choice .

CPAG says the government must acknowledge many sole parents can manage only part time paid work, and often that work is intermittent, children may get sick, and in many weeks the required hours of paid work may not be fulfilled. Keeping the payment for children consistent and allowing the sole parent to retain more income when they are on a benefit is a much better policy to incentivise paid work and reduce child poverty, while also acknowledging the huge effort involved with parenting itself.

There are many ways to reward paid work that are more sensible and constructive than the In Work Tax Credit. John Key says he will govern for ‘all New Zealanders’, but his refusal to consider extending the IWTC perpetuates highly discriminatory policy that excludes the poorest children from assistance.

The Working for Families’ In Work Tax Credit was found to be discriminatory under New Zealand’s Human Rights legislation by the Courts. The court ruling of discrimination required that the high test of material harm to 230,000 of New Zealand’s poorest children was met, but the courts were ill equipped to assess whether that harm was justified.

John Key’s government must decide if the marginal and unproven impact on work incentives is worth the harm inflicted on thousands of children. There is no such discrimination amongst the deserving and undeserving elderly. New Zealand also lags behind Australia where all children get the same access to tax-funded child-related tax credits. Children there are not used as a labour market tool.

CPAG is urging the Government to take another look at the design of Working for Families and consider children’s needs, particularly those in the most deprived families. Spending $450m to extend the In Work Tax Credit to beneficiary families would re-establish the principle of equal treatment of all poor children while acknowledging the rights of the child under the UNCROC convention to full social security.

Despite the name, the In Work Tax Credit is just a part of the weekly payment to the caregiver to help with the needs of children. She can get it while not in the paid workforce even if the family income is over $100,000 just because the partner works. At these income levels it is false to argue there is a need for a work incentive, or need to make work pay. In this example, she does not have to do any paid work at all, while the children of a struggling sole parent in the casualised workforce is penalised if her hours dip below 20 hours a week.

The In Work Tax Credit is taken away if the family loses paid work in a personal or natural disaster, or in a recession, if made redundant, if they happen to be on a student allowance, or they are unable to leave the benefit system for enough hours of paid work.

The needs of the children do not magically reduce when parental income is cut. This policy denies parents who cannot fulfil the required hours of paid work, a minimum of $60/week in order to provide a work incentive for others. Families who cannot respond to a work incentive, living in very deprived situations because of sickness, study or care-giving of young children, are prevented from accessing this tax-funded assistance.

A sole parent has to work 20 hours a week to qualify for the IWTC, but if they do this, say at the minimum wage, they cannot afford to leave the benefit system unless their ex-partner can provide significant private child support. Many get very little from ex partners. The government needs to be honest about this. To survive off-benefit working 20 hours, a sole parent is likely to need the top up provided by the Minimum Family Tax Credit.

The Minimum Family Tax Credit is very badly designed. The policy has a 100% effective marginal tax rate proving a maximum disincentive to work more than 20 hours. It provides zero incentive to the employer to increase the hourly rate of pay and is rightly described as a wage subsidy. Under this policy, state subsidies to the sole parent can be even more substantial than if she had remained on a part benefit.

John Key says work is the way out of poverty but it is actually the payment from the state for children that lifts families out of poverty.

Associate Professor Susan St John, CPAG

John Key has said that it is not really more money that the poor need it is more complex than that, then went on to describe how the COST of housing, food, study etc had risen and presented difficulty for people. Um if the COST of stuff is the problem then the answer is……………………..

The cost of housing is the big one – as Bill English has been saying. I totally agree with this. Highly inflated property prices are the source of most of the hardship in NZ today, for small business as well as individuals. To fix that would go a long way to fixing poverty.

And just to throw more money at a problem that may have a specific cause (such as the housing/property problem) is inflationary and ultimately only makes it worse.

Heaven help us if inflation were to get over 2%!!!!! The sky will fall in and rich people will be forced to worry about their investment portfolios! No need to worry about the hungry children though – if inflation stays low their parents will be able to get low-interest loans to buy food for their children.

The possible negative is more a case of price inflation of property prices themselves than going via the general inflation rate. Inflation in the cost of specific goods can far exceed the general inflation rate.

Ummmm…. reduce the cost of housing as a proportion of someone’s income?

@ Raegun . Exactly .

I came here to write the exact same thing .

” John Key says work is the way out of poverty ”

What a fucking liar . That’s exactely what I’d expect a little punk like him to say .

A quick guide to Snake Speak .

Logical fallacies .

https://yourlogicalfallacyis.com/

Any increase in wages , salaries etc will ultimately go straight to the foreign owned banks never to be seen again . Like our national assets , and more worryingly , our people to other countries like Australia .

Never mind the pittance of any wage increase . ( I know . Not a short term solution . ) Get rid of the Banks . Get rid of the scourge that are the so called finance companies who buy bad debt off those banks who then pursue their ‘ investment ‘ with the zealousness of blood thirsty vampires .

Get rid of any politician who trumpets pro corporate banking interests .

Write off all mortgage debt .

Firewall our dollar against foreign manipulation .

Reconnect with our traditional trading partners .

Re- Nationalise our assets .

Conduct a Royal Commission of Inquiry into the past , and present , relationships between NZ politicians and Big Business .

Charge and imprison accordingly .

And I have to say . Mindful of preaching to the converted while in fear of repeating myself .

That to make sure a significant sector of our society lives in abject poverty is to provide a huge resource of capital to the Banks . Banks thrive on the distress and desperation within our communities and since we have a jonky-stien strutting about with his little shoes freshly polished , a died in the nylon Bankster , we’ll have wee kids going hungry and the only thing they’ll remember from their childhood are horrors caused by poverty .

In New Zealand .

In New Zealand , of all places .

We should all hang our heads in shame that this continues . Much less those 48% who voted for the continuation of this abomination .

I have a problem with your “wipe off all mortgage debt” idea.

This rewards those who have indulged in massive over leveraging, i.e. most of the middle classes. They’ve taken out more loans on their increased value on their properties, and they’re buying up what little “affordable” housing is left as investment properties. When that increases in value they do it again.

Rinse and repeat.

There is a large number of people excessively in debt in NZ to own property. It’s our national obsession.

The markets have begun their next crash, they turned on 19th September, 2014. NZ will follow. Our property market bubble will burst. These people will lose their jobs and be forced into bankruptcy.

Meanwhile… there are some of us who have seen this coming and have prepared. We are not in the property market because we’re not prepared to pay ridiculous amounts of money and we can see the bubble. So we’ve saved and saved and saved… and been prudent and patient.

No. I would not like to see the prolific debtors awarded for their greed by having their mortgages written off. That would just entrench divide between those who own property and those who don’t, and it would reward greed.

The only hope many NZers have to own property is for the bubble to burst, and for prices to come down to affordable levels. This absolutely must happen. Then we will be able again to buy our own homes.

The bubble will burst. The markets have turned.

Yes . You are correct re mortgage write-offs in saying that some will be more advantaged than others . Tough . Get over it . All will win ultimately . Some will arguably win more than others . That’s life . The long term would mean that the rare and exquisite madness that is allowing Banks to over leverage domestic properties would cease immediately . Who the fuck cares if some are relieved or more debt than others ?

That’s kind of the problem actually . Let it go ! The over the neighbours fence , enviously peering at what they’ve got fuels the madness . Advertisers , bankers , insurance scum , sundry low life money lenders love that mentality . I have a house with a capital value of $ 120 k with an $80 K mortgage . If the guy down the road had a capital value of $1.2 million with an $800 K mortgage and it was also written off ? I could not give one small flying fuck . The overall effect is that the Banksters would no longer have their fangs in our necks . Just think about it .

Trust me , a wholesale mortgage debt write off would be the last one and the one and only and that reward for us all would far exceed any envious pissed off-edness . Rise above it .

except if you write off the debt for those greedy enough to indulge in over leveraging… then the bubble doesn’t pop

and prices won’t come down

and we shall not be able to have affordable homes

and I’m not indulging in being envious of those over the fence, I don’t give a damn about what they have or don’t have

I just don’t want to over leverage and I don’t want to face bankruptcy

if all mortgage debt were written off then people would just keep on doing what they’re doing… over leveraging, indulging in greed which causes price bubbles…. they’d be rewarded for it… and we’d never have a change

it needs to stop, its the cause of the bubble

rewarding that kind of behaviour would ensure that behaviour continues

Nats think ordinary people have got it too good as it is, so they are not going to alleviate poverty any more than they absolutely have to to stay in power.

The whole point of their programme is to get working class people used to expecting less out of life. That is what Austerity is all about. It is their way of making developed economies competitive again. Rather than lose profits by increasing the standards of living in the Third World, they prefer to decrease them in the First World. Globalization 101.

IWTC is the taxpayers subsidizing the employer. Am I the only one that thinks that is wrong? I’m totally for pushing up the minimum wage to $16 p/h and maybe some sort of WINZ support for the horticultural or primary industry. i.e. job training on orchards etc. I hate seeing the taxpayer subsidize (for example) supermarket workers on minimum wage so that supermarkets can make massive profits while the taxpayers top up their employees wages through the IWTC. The whole thing is rotten. The reason government won’t pay beneficiaries families the credit is that they will earn more than the minimum wage earners in real terms and then who will work for minimum wages in the crap jobs for $14p/h? Bizarrely the ‘corporation’ is now king and the government supports the ‘corporation’ before the people. I’m not against corporations but there is an imbalance that is happening all over the world.

*Also the supermarket ‘home brands’ are making people sick, but the corporate supermarkets don’t want us to know they are making crap products and we have no choices any more, the home brands are taking over and leaving no variety on the shelves, this seems wrong to me.

The In Work Tax Credit is actually a payment for children. It is included in what the caregiver gets per week for the children and to alleviate child poverty. It has saved the government money by excluding children who should have it.

Calling it an In Work Tax Credit doesn’t make it a subsidy to employers. In Australia they don’t mark off a portion of their child tax credits this way- all low income children get full support regardless of whether parents are working a given number of hours. Their scheme is MUCH more generous than ours and more effective in reducing the depth of child poverty.

Can’t find money for poverty alleviation but available for joining the “coalition of the willing” fighting ISIL, with NZ included in the 22 countries meeting in Washington to finalise war strategy. The only contribution NZ can make is insignificant in that “war” but how many lunches for poor children or state houses could those wasted funds build? What does it gain except put us on the retribution map? Well, it insures Key stays in good stead with his Hawaii retirement golfing buddy.

I completely agree with giving the IWTC to all families who are missing out.

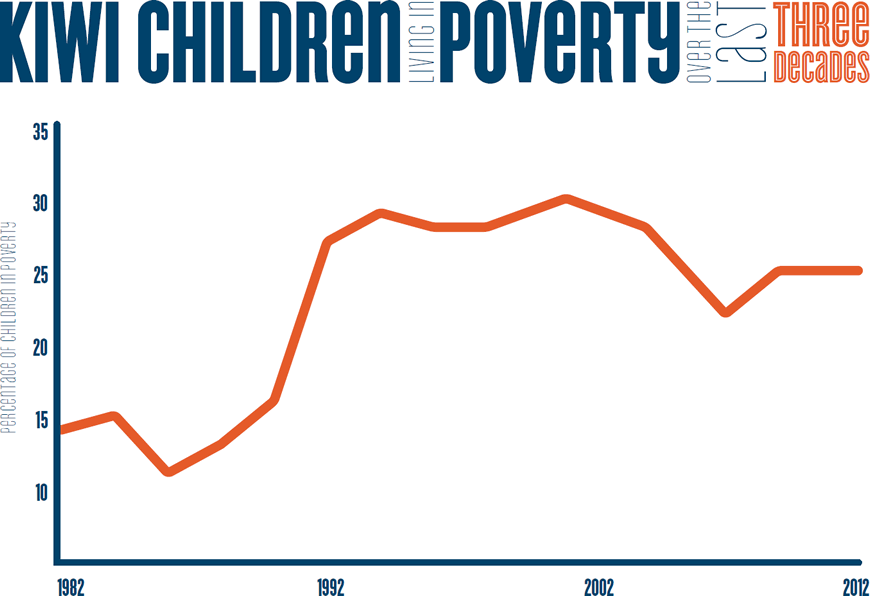

However, I question the 25% rate of poverty. Where does this number come from? (and trust me, i’m as left wing as they come, so i’m not just saying that)

According to the OECD, the poverty rate in 2011, after taxes and transfers, for children aged 0-17 (which is set at 50% of median income) is 14%. (Still a relatively high number but not the worst in the OECD in the least, we rank about 12th in the OECD- compared to 21% in the US, 10.8% in France, 14.2% in Canada, 9.5% in the UK, and 3.8% in Denmark). So it’s bad, but I question the 25% number.. I doubt child poverty is worse than the US, where a benefits system barely even exists.

They could be using the 60% of median income measure, but I think that overstates poverty. 60% is a measure of people ‘at risk’ of poverty or social exclusion, while 50% is a measure of people actually experiencing poverty.

So we can say that a quarter of kids are at risk of experiencing poverty, which is still a terribly high number.

We should look to Denmark and see what they’ve been doing there.

I think the best solution to the whole IWTC and WFF issue, and benefit cliffs etc is to move towards universal entitlement. Whether on a benefit, in a working household earning $25,000 or a working household earning $250,000, all children (and therefore their families) should be entitled to a child benefit.

You may ask, why pay benefits to families who earn $250,000? Because of social solidarity, simplicity, and fairness. European countries have successful and effective welfare states because of universal entitlement. If everyone is entitled to a certain degree of benefits – a return from the welfare state – politicians will protect it. Politicians have no issue cutting benefits from a small portion of population who are seen as scroungers. They can play up the idea of WFF being ‘communist’ or whatever. However, can right-wingers say “those lazy benefit scroungers need to get off their arses and off benefits or wff!”, when their own families are receiving child benefit?

Not to mention, it reduces the rhetoric that we see now. Both conservative and social democratic parties in the Scandinavian countries support and expand the welfare state.. they know that because things aren’t means-tested, it’s political suicide to cut them, and it makes welfare into a ‘right’. Everybody has equal rights, so everybody should have equal rights to social security. Especially children.

And then we also appease the right-wingers, because things like minimum family tax credit, which create 100% marginal tax rates, are taken away. As income increases, you don’t lose any of your child benefit.

Let’s hope for a 3.8% child poverty rate, like Denmark’s. Or maybe even 0%. 🙂

I envision a universalist social-democratic welfare state, based upon welfare as a right.

I agree universal entitlement for family benefit. It’s like maternity – make it fair and for everyone to avoid fighting. A lot of families including my parents saved for their first home this way. If the elderly get universal entitlement, why can’t the kids?

After watching TV news on Wednesday night I realise where the word poverty should be applied, and it is NOT in NZ.

It’s not for nothing that television is called idiot box.

As for relying on TV news for keeping informed….LOL

Paragraph 4 has been a reality for me as a sole parent……the proverbial gap has to be addressed, there is no if buts or maybes about it

There is little real, significant help that people on benefits can expect from John Key and his new government. There will certainly be no extra cash in their pockets or even hands.

Prepare for more disappointments, perhaps they will offer some additional, humble services in the form of childcare, but all else is geared and targeted for getting people off benefits, even when they are sick and disabled.

And by having changed the criteria to qualify for certain types of benefits, few even get onto any benefit, or easily drop out of entitlements.

This article in stuff.co shows it, how figures are achieved, also the result of staff in WINZ Offices forced to meet “targets”:

http://www.stuff.co.nz/national/10633360/Govt-playing-the-figures-on-welfare

Comments are closed.