.

.

Introduction

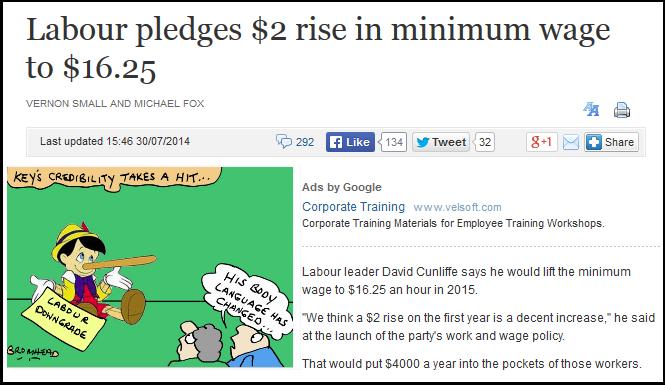

Labour recently announced a policy which evidence strongly indicates will impact positively on every low-wage earner in this country; families; as well as benefit small-medium businesses;

.

.

The knee-jerk reaction from Dear Leader Key and his little wannabe side-kick, Simon Bridges, was as predictable as the sun rising;

Key hit back at the announcement.

[…]

New Zealand already had the highest minimum wage relative to the average wage in the developed world, he said.

Pushing it up too too fast would cost jobs.

“It’s pretty well documented around the world that, yes, you can make changes and do that over time but if you think about the mass of employers in New Zealand they’re not the big companies like Fletcher Building or Fonterra they’re actually the hundreds of thousands of small businesses around New Zealand and they simply will employ less staff, fire people or ultimately not take on staff in the future.”

Labour Minister Simon Bridges, reiterated Key’s claims, saying the policy would hurt businesses.

“Labour’s policy to immediately increase the minimum wage to $16.25 would cost at least 6000 jobs … If you want to make people unemployed this is a good way to go about it,” he said.

So how true is it that raising the minimum wage “would cost 6,000 jobs”?

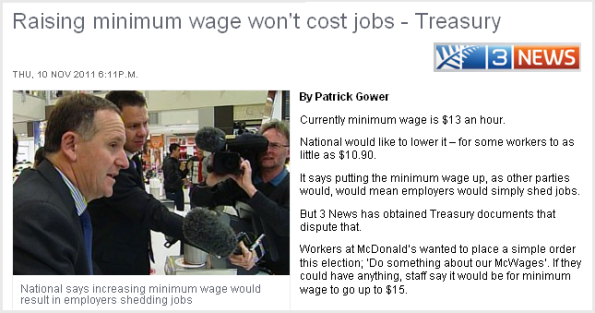

As far back as November 2011 (the previous election campaign) Key repeated the mantra that 6,000 jobs would be lost if Labour increased the minimum wage to $15 an hour.

.

.

However, those bright young things at Treasury seemed to hold a radically different view;

“The Department of Labour says the rise will cost 6000 jobs. But Treasury has a counter view; “This has not been true in the past. The balance of probabilities is that a higher minimum wage does not cost jobs.”

Indeed, according to a report on the Australian Business Insider, the notion that increasing minimum wages led to unemployment was “exploded as a myth”, after it was revealed that;

“… a November 2011 study from Barry Hirsch and Bruce Kaufman of Georgia State University and Tetyana Zelenska sheds light on how businesses respond to increases in labour costs, and the results were surprising.

The group surveyed managers of fast food restaurants in Georgia and Alabama as they contended with three annual increases in the federal minimum wage between July 2007 and July 2009.

They asked the managers if they were taking any steps to offset increases labour costs.

[…]

…only 8 per cent of managers surveyed thought that firing current employees was at all important to make up for lost wages.

Indeed, raising the minimum wage allowed management to extract more performance from current employees in more than half of all cases.

Higher labour costs weren’t only offset from cuts to total labour cost, either. Management also took several steps to increase efficiency and productivity to compensate for the higher costs… “

The Georgia State University study also asserted (page 31);

Further, our study does not find evidence of clear-cut employment losses – even

over three years and a 41% increase in the MW. Possibly over a still longer time span, or with a larger

sample of restaurants, a negative effect might appear. Discussion with owners and evidence outside our

study period suggest that negative effects may manifest through reduced store openings and increased risk

of store closings. Given this important qualification, the message from our study, along with other results

in the literature, is that employment effects in the short-to-medium run are small, perhaps near zero in

many settings, and certainly smaller than expected based solely on the competitive model. It would be

surprising (at least to us) were an important reason for this result not the behavioral dimensions of wage

setting and human resource management (e.g., discretionary effort, equity concerns, management heterogeneity)

that the standard competitive and monopsony models largely ignore.

The data

Here in New Zealand, the minimum wage has risen fifteen times since March 2000;

Previous minimum wage rates

In force from: ADULT YOUTH TRAINING 1 March 1997 $7.00 $4.20 6 March 2000 $7.55 $4.55 5 March 2001 $7.70 $5.40 18 March 2002 $8.00 $6.40 24 March 2003 $8.50 $6.80 $6.80 1 April 2004 $9.00 $7.20 $7.20 21 March 2005 $9.50 $7.60 $7.60 27 March 2006 $10.25 $8.20 $8.20 1 April 2007 $11.25 $9.00 $9.00

In force from: ADULT NEW ENTRANT TRAINING 1 April 2008 $12.00 $9.60 $9.60 1 April 2009 $12.50 $10.00 $10.00 1 April 2010 $12.75 $10.20 $10.20 1 April 2011 $13.00 $10.40 $10.40 1 April 2012 $13.50 $10.80 $10.80 1 April 2013 $13.75 $11.00 $11.00

In force from: ADULT STARTING OUT TRAINING 1 May 2013[4] $11.00 1 April 2014 $14.25 $11.40 $11.40

Notes:

-

From 2001 to 2008 the adult minimum wage applied to employees aged 18 years and over. Prior to that, the adult minimum wage only applied to those aged 20 years and over. From 1 April 2008, the adult minimum wage applies to employees aged 16 years and over, who are not new entrants or trainees.

-

The youth minimum wage applied to employees aged 16 and 17 years. From 1 April 2008, the youth minimum wage was replaced with a minimum wage for new entrants, which applies to some employees aged 16 or 17 years.

-

The training minimum wage was introduced in June 2003.

-

From 1 May 2013 the minimum starting-out wage replaced the minimum wage for new entrants and the training minimum wage for trainees under 20 years of age.

[Above chart and information-notes courtesy of MoBIE/Dept of Labour]

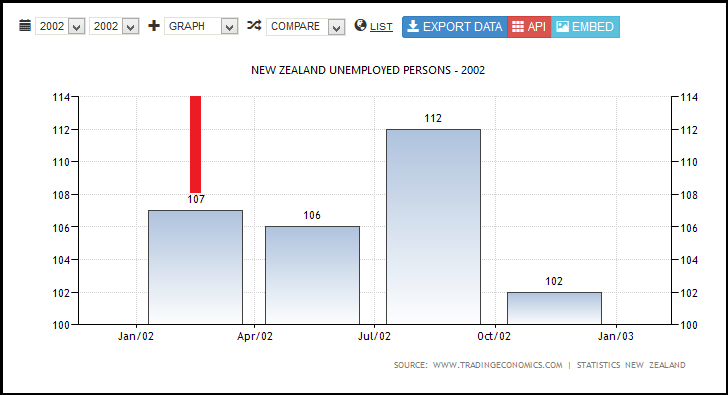

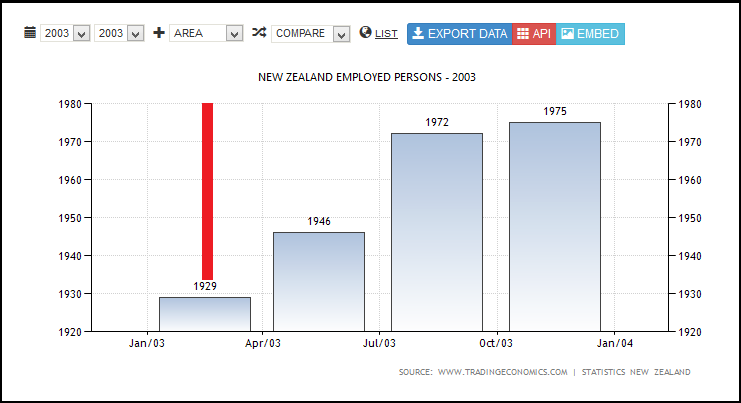

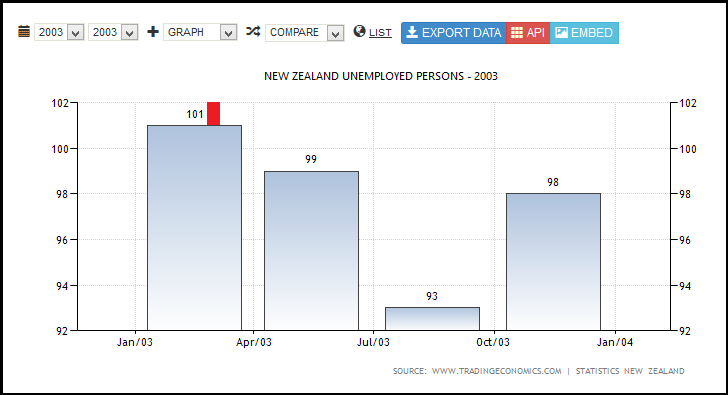

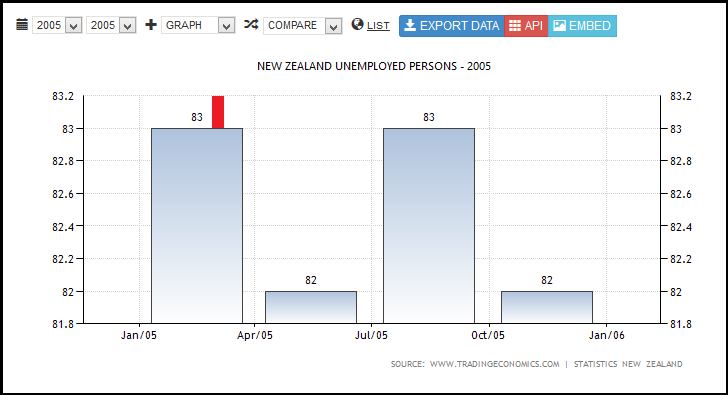

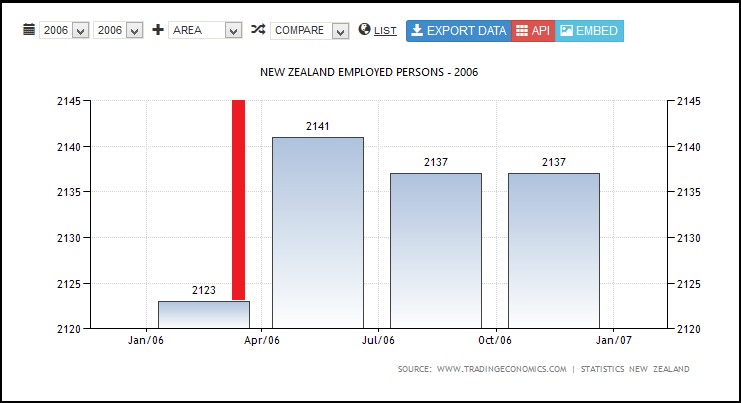

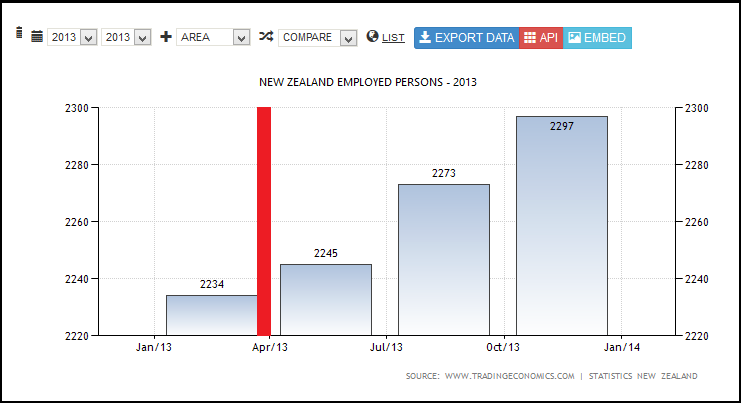

So how do those increases compare to our employment/unemployment rates? Let’s superimpose the dates for each increase in the adult minimum wage with numbers of employed persons. (Red vertical bars indicate increase in minimum wage. All data courtesy of Dept of Labour/MoBIE.)

6 March 2000 – Increased from $7.00 to $7.55 p/h

(Labour)

.

.

5 March 2001 – Increased from $7.55 to to $7.70 p/h

(Labour)

.

.

18 March 2002 – Increased from $7.70 to $ 8.00 p/h

(Labour)

.

.

24 March 2003 – Increased from $ 8.00 to $8.50 p/h

(Labour)

.

.

1 April 2004 – Increased from $8.50 to $9.00 p/h

(Labour)

.

.

21 March 2005 – Increased from $9.00 to $9.50 p/h

(Labour)

.

.

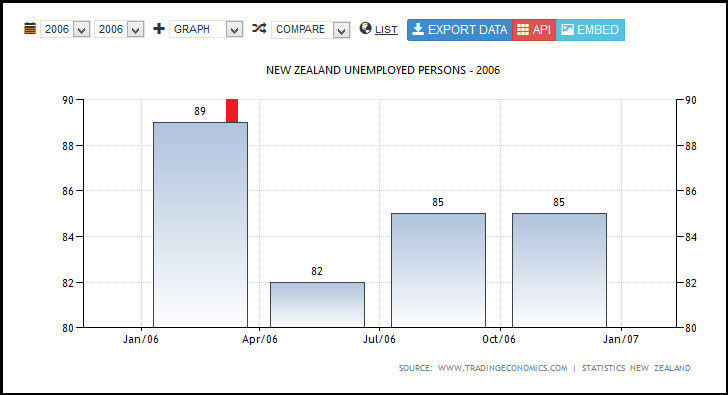

27 March 2006 – Increased from $9.50 to 10.25 p/h

(Labour)

.

.

1 April 2007 – Increased from 10.25 to $11.25 p/h

(Labour)

.

.

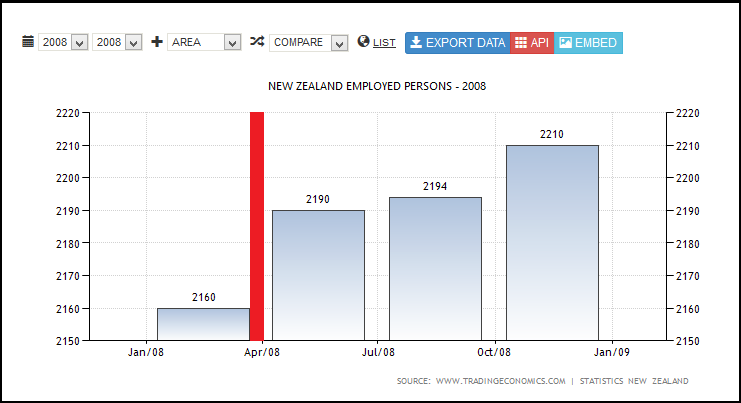

1 April 2008 – Increased from $11.25 to $12.00 p/h

(Labour)

.

.

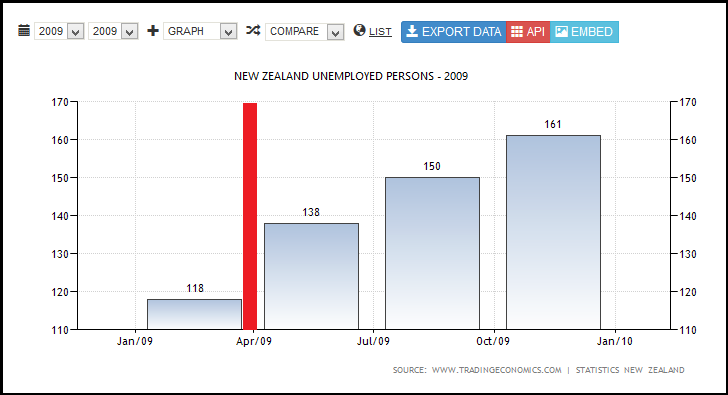

1 April 2009 – Increased from $12.00 to $12.50 p/h

(National)

.

.

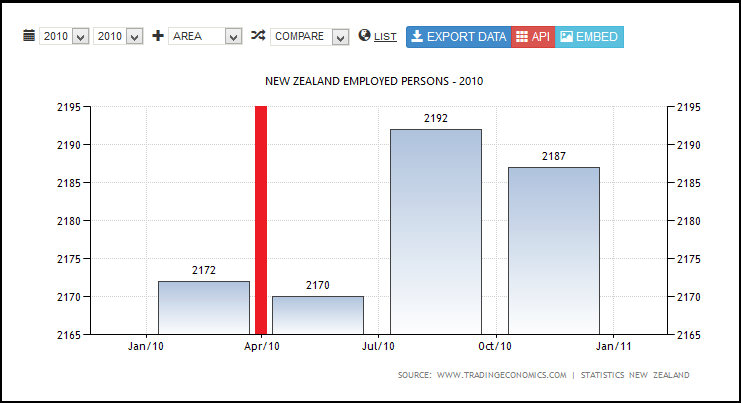

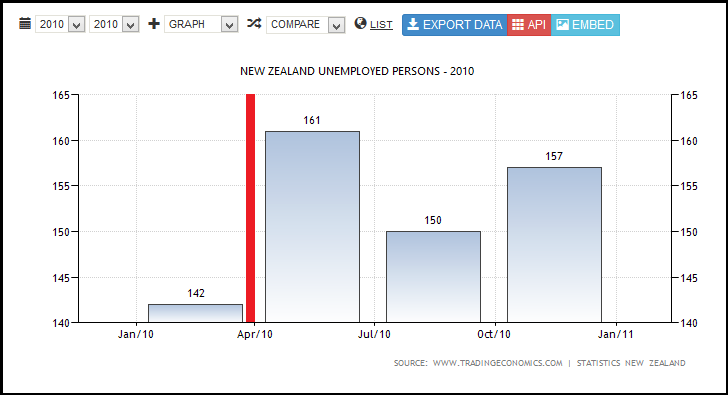

1 April 2010 – Increased from $12.50 to $12.75 p/h

(National)

.

.

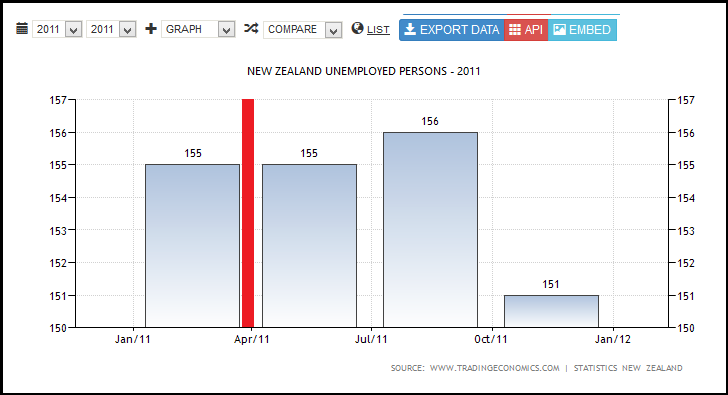

1 April 2011 – Increased from $12.75 to $13.00 p/h

(National)

.

.

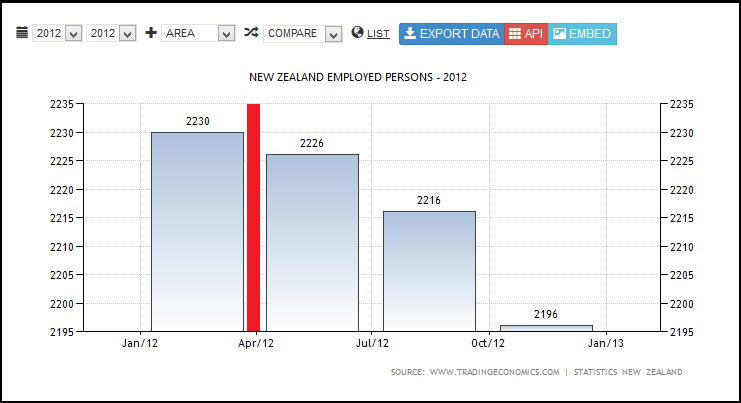

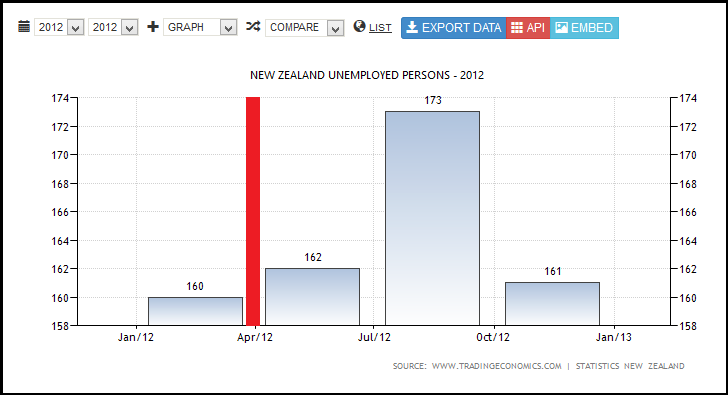

1 April 2012 – Increased from $13.00 to $13.50 p/h

(National)

.

.

1 April 2013 – Increased from $13.50 to $13.75 p/h

(National)

.

.

The above graphs reveal the following;

- In eleven out of fourteen years, numbers of employed rose after a minimum wage increase.

- Nearly all the years which show a fall in employment numbers are post-Global Financial Crisis; 2009, 2010, and 2012.

- The fall in employment numbers in 2009, 2010, and 2012, occurred post-minimum wage increases which were smaller amounts than pre-2008 minimum wage increases. Ie; 50 cents, 25 cents, and 50 cent incremental increases for respective years 2009, 2010, and 2012.

- One of those three years – 2010 – showed a drop in employment for only one Quarter before rising again.

- By contrast, increases between 2000 and 2008 range from 15 cents an hour (2001) to $1 an hour (2007) – and show continuing, sustained, employment growth.

- Employment fell in 2006, due in part to a “… slowing in growth over 2005 was largely driven by the external sector. A relatively high exchange rate and some relatively poor agricultural production seasons resulted in weak export growth, while a strong domestic economy contributed to considerable growth in import volumes. Recently, however, growth in the domestic economy appears to have eased with weakness in the household sector as growth in private consumpti on and residential investment slow. This has led to a significant slowing in import volume growth and has seen some rebalancing towards net exports following strong increases in agricultural production“.

So would increasing the minimum wage benefit every low-wage earner in this country; families; as well as benefit small-medium enterprises (SMEs)?

Why do critics – usually adherents of neo-liberal dogma and National Party ministers, supporters, and fellow-travellers – vociferously deny the advantages of raising the minimum wage?

Neo-liberals who maintain that increasing the minimum wage creates job losses see only one half of the Grand Picture. They see money flowing from employers to employees – and that’s as far as they see what is happening.

What they are missing is the second half of the Grand Picture; those employees do not bury their extra pay in the back yard, forever consigning it to the earth as compost.

Instead, employees spend their pay increases.

There are currently 54,600 workers currently on minimum wage in this country.

Increasing the minimum wage from $14.25 per hour to $16.25 per hour means an extra $80 per week for a worker (gross). That means 54,600 workers’ spending power increasing by a staggering $4,368,000 per week (gross).

That’s a whole lot of extra groceries, clothing, shoes, appliances, medication, and other essentials and consumer goods being purchased in our economy.

All of a sudden, small-to-medium businesses will have 54,600 potential customers spending an extra $227,136,000 annually(gross). Plus additional tax-revenue gained by the State. Plus less paid on welfare, as more people are employed.

Right-wingers will make the oft-parroted, plaintive cry, “But where will the money come from?”

The answer; from the productivity created by those 54,600 workers. They just get to keep more of that productivity, instead of into the bank accounts of invisible share-holders or disappear off-shore to corporate owners.

And as those 54,600 workers spend more, SMEs will sell more; which will mean higher turn-over; more profits; more investment; more jobs…

The logic is clear-cut; increasing the minimum wage increases spending power; generates more economic activity; and achieves the same goal which Key & Co used to justify their 2009 and 2010 tax-cuts;

“…The tax cuts we have delivered today will inject an extra $1 billion into the economy over the coming year, thereby helping to stimulate the economy during this recession. More important, over the longer term these tax cuts will reward hard work and help to encourage people to invest in their own skills, in order to earn and keep more money.”

If tax cuts for the rich can help “stimulate the economy“, then so can a livable wage increase for 54,600 low income earners.

It cuts both ways.

Even as Key has stated on numerous occassions,

“We think Kiwis deserve higher wages and lower taxes during their working lives, as well as a good retirement.” – John Key, 27 May 2007

“We will be unrelenting in our quest to lift our economic growth rate and raise wage rates.” – John Key, 29 January 2008

“I don’t want our talented young people leaving permanently for Australia, the US, Europe, or Asia, because they feel they have to go overseas to better themselves.” – John Key, 15 July 2009

“Science and innovation are important. They’re one of the keys to growing our economy, raising wages, and providing the world-class public services that Kiwi families need.” – John Key, 12 March 2010

“We will also continue our work to increase the incomes New Zealanders earn. That is a fundamental objective of our plan to build a stronger economy.” – John Key, 8 February 2011

“We want to increase the level of earnings and the level of incomes of the average New Zealander and we think we have a quality product with which we can do that.” – John Key, 19 April 2012

Summation

Evidentially speaking, the data above shows;

- More often than not, employment numbers rise after an increase in the minimum wage.

- Unemployment is affected by factors other than minimum wage increases (eg; Global Financial Crisis, drought, etc).

- Labour increased the minimum wage $5 per hour (2000 to 2008), and unemployment dropped to 3.4% by December 2007.

- National increased the minimum wage $2.25 per hour (2009 to 2014) and unemployment currently stands at 6% (new unemployment stats due for release on 6 August).

Key’s assertion that lifting the minimum wage would lead to “6,000 jobs lost” is therefore patently false, and electioneering with peoples’ lives.

.

References

Fairfax media: Labour pledges $2 rise in minimum wage to $16.25

TV3: Raising minimum wage won’t cost jobs – Treasury

Australian Business Insider: A 2011 Study Exploded One Of The Biggest Fears About Raising The Minimum Wage

Georgia State University: Minimum Wage Channels of Adjustment

MoBIE/Dept of Labour: Previous minimum wage rates

NZ Treasury: New Zealand Economic and Financial Overview 2007

MoBIE/Dept of Labour: Employment & unemployment – December 2007

Statistics NZ: Household Labour Force Survey: March 2014 quarter

MoBIE: Minimum Wage Review Report 2013

NZ Parliament: Tax Cuts—Implementation

Trading Economics: New Zealand Employed Persons

Trading Economics: New Zealand Unemployed Persons

Previous related blogposts

John Key’s track record on raising wages – 5. The Minimum Wage

Dollars and common sense – raising the minimum wage

Treasury’s verdict on raising the Minimum Wage?

Treasury’s verdict on raising the Minimum Wage? – Part II

.

Above image acknowledgment: Francis Owen/Lurch Left Memes

.

.

= fs =

Economic discussion in the country occurs at such a simplistic level. Money doesn’t disappear from the economy when wages go up, just like it doesn’t when beneficiaries receive their benefits but you’d think from the discussion that goes on in the mainstream that it does.

In reality the money keeps moving around the system and the only time is leaves is when foreign owned companies take their money home or when stock market crashes cause it to evaporate.

Or when National spend it all on God knows what.

Indeed, Aaron.

Strangely, when CEOs get million dollar salaries and bonuses, the same arguments don’t seem to rear up. It’s the whole “deserving/undeserving poor” argument taken to new ridiculous heights (or depths, depending on one’s inclinations).

‘We dont know how lucky we are, mate…we dont know how lucky we are’…

– And do we all remember Bill English who stated …..’We should all be glad we have a low wage economy because it encourages overseas foriegn investment’ ?

I think that is all we need to hear to realise just how much that character and others of his ilk really dont give a rats shit about a significant proportion of our working population.

Add to that poor senior citizens that freeze in winter with high power costs, add to that 300,000 children in poverty , add to that rural communities that are ghost towns,…..casualised insecure employment…

The list goes on and on and on and on…..the crap these neo liberals sound off about to cover their arses …and worst of all?….people are gullible enough with short memories to keep voting them in.

Vote these bastards out and keep voting the suckers out thereafter…they dont give a stuff about you at all.

Thanks for that Frank.

I’m not a great expert on neolib but it just seems there is a real disconnect there with workers and consumers – they don’t seem to take into account the fact that workers ARE consumers.They see wages as a cost to a business (correct in the academic laboratory) but not that wages – for most worker, particularly at the middle down -are what are used by comsumers(the people getting that money) to actually BUY the products/services and generate the company’s income. To expose another piece of possible rhetoric which really annoys me – does any one have figures on how many small businesses – as a percentage of all business -actually pay minimum wages? My experiences are most minimum wage payer are large businesses but would like to hear otherwise.

Also the ‘education/ training’ argument to higher wages. I am a community care worker. I’ve done some papers in this field and got no payrise. Are Mr Key, Bridges, Joyce etc prepared to pay me a fair wage for my fair days work or it that only for business owners and people with degrees and I should go get a ‘decent, proper job’. Should I tell the woman in charge of high end home mortgages at ANZ she’d better get back home to bathe her mother cos caregiving isn’t a proper job? Should the beehive cleaners tell John Key “Sorry you’d better go clean your own toilet, we’ve got degrees now?” No matter how qualified the population of NZ gets there will always be low end job that have to be done. They should just be paid fairly.

Thanks Frank for putting that all together. I will save this link to my “Important Links to Keep” note (FB, my eyes only !!) , that keeps a good record of all the crap that goes on. It is good to have those sorts of links available when seeing peoples posts on FB eg: Under a MSM post….I then have firing power back at the idiots who blindly quote the Nacts !!! (:>

You’re welcome, Sally. If folk use the material I’ve assembled as a resource, then it makes it all the more worthwhile!

Well put Frank.

I would like to point out a curious fact about this figure of 54,600 currently at minimum wage (which you quote from the 2013 cabinet review paper) – This figure either raises concerns for the validity of these figures and/or understates the real impact of raising it past $15/hr, this from the 2012 cabinet paper (minimum wage review).

“Currently, amongst the 2,227,000 people employed in New Zealand, 84,800 people are paid the minimum wage ($13.50 an hour). In addition there are approximately 221,000 low wage workers earning between $13.50 and $15 an hour.”

Curious how the figure dropped from 84,800 in 2012 to 54,600 in 2013, is it perhaps fiddling the figures to make it seem insignificant or could it be a result of the split to the youth rate?

Would Nats argue that those 30,000 represent job losses as a result of raising the minimum wage? (or the GFC depending on what the argument was).

So, rather than look at it from the perspective of the 2013 paper “2.4% of all employees” at minimum wage… better to conclude that 10% of all employees earn less than $15/hr – could we then conclude that perhaps as high as 20% earn less than $16.25? This is a huge impact policy Labour are bringing.

Anyone that cries job losses pretty much regurgitating what they have been told (forever) and not really thinking about it (flat earth society?). Clearly actual research and empirical evidence from countries/cities that have proven it wrong are not enough for some people. So in the spirit of “if you can’t beat ’em…” I have a simple example to illustrate how an increase in minimum wage will create wealth.

As a student with a family to support I know too well what it is like to have very limited discretionary income, an example of the consequence of this is that my children never go to the movies and I never buy coffee at cafes (something we might like to do given a higher income). Even though my income won’t be affected by an increase in minimum wage, if I did receive an $80 a week increase I would have some choice on where my disposable income went – If I did take my kids to the movies or stop in to buy a coffee, each of those businesses will pocket the extra margin, they will be unlikely to have to employ extra staff, with the exception of if 50,000+ people all spend a bit more where they weren’t spending.

In a much clearer example – Supermarkets won’t have to hire many extra staff if 50,000 plus people put an extra $50+ in their trolley each week, but even if a supermarket had 50 minimum wage employees at 40 hours each, $4000 – Even at 15% margin this would represent only 600 increased purchases, not hard to believe as achievable from a large format oligopoly.

Of course in my simplified example I am discounting all of the other inputs in the supply chain, but I believe the same theory could be applied on down.

One thing we can be sure of is that the supermarkets are not going to close, (relative) competition will keep the prices in check, maybe we might need to wait a bit longer in line – because of all the extra customers, not because of the all the job losses.

ps: I love this line from the 2012 report.

“International evidence suggests that a higher minimum wage reduces income inequality to a certain degree. However, marginal increases are unlikely to lead to substantial reductions in income inequality, because many minimum wage earners (particularly youth) come from higher income households”

Really?

What is sometimes overlooked in the debates about the minimum wage is the relativity gap between the minimum wage and those slightly above it. Although you can expect employers paying the minimum wage naturally to whinge about having to pay more, I suspect that a lot of the opposition actually comes from employers who currently pay slightly to moderately above the minimum wage. Workers on these wages see a rise in the minimum wage as reducing their wage relatively (and therefore their value at their job) so want their own wages increased by a similar amount. Those employers resent such pressure because they regard themselves as “good employers” (by paying above the minimum). A snowball effect, you might say.

Another thing that is sometimes overlooked is that a large proportion of those on the minimum wage are employed by contractors, or temp agencies. These people are basically exploited by being paid the minimum wage whilst the temp agencies take their cut out of what the workers would have been paid if they worked directly for the company.

Raising the minimum wage rate directly assists these workers and in most cases it is the only wage rise they will ever get. How many temp agencies have ever given a wage rise to their workers without government compulsion? Probably none.

But you couldn’t expect John Key, Simon Bridges and the rest of the National Party bluebloods to have any empathy with temp workers earning the minimum wage, often while working alongside permanent workers, doing much the same job and getting a couple of dollars an hour less. National sees the minimum wage as purely a financial and fiscal issue, it is also a social issue.

It is very often that people who get the minimum wage do the most unpleasant jobs. Cleaning toilets, cleaning pig-sty motel rooms, picking up rubbish, cleaning up people’s bodily fluids in rest homes, etc. Jobs that the rest of us take for granted that someone else will do and we seldom give it another thought. These people deserve a lot more recognition for their services than they get from this government.

Comments are closed.