.

Released today at the National Party annual conference in nelson;

.

Source: NZ Herald – National tackles first home affordability

.

Kiwisaver was set up in July 2007 by Labour Finance Minister, Michael Cullen, to motivate New Zealanders to save for their retirement. Our Aussie cuzzies already have about A$1.3 trillion saved in their compulsory super schemes – we are lagging way behind.

“After more than a decade of compulsory contributions, Australian workers have over $1.28 trillion in superannuation assets. Australians now have more money invested in managed funds per capita than any other economy.” Source

A similar scheme, implemented by the Norman Kirk-led Labour government in 1973, was scrapped by National’s then-Prime minister, Robert Muldoon, in 1975. National has a horrendous track record when it comes to planning and motivating New Zealanders to save for retirement.

Instead of saving for retirement, we tend to invest in “bricks and mortar” – rental properties. This is not saving as it relies heavily on borrowing from overseas lenders to finance. Those borrowings are other peoples’ savings.

So in effect we are borrowing other peoples’ savings to invest in rental properties which we are using for our retirement “savings” – other peoples’ savings being used to build up our own “savings”.

This is not just “false wealth” and damaging to our economy (those borrowings have to be re-paid eventually) – it is sheer economic lunacy on a grand scale. Note the green line in the chart below – it is private debt incurred from overseas;

.

.

And the National Party turns a blind eye to it.

As a result, our savings is meagre enough as it is.

The ANZ and ASB summed it up with brutal reality,

ASB’s executive general manager wealth and insurance Blair Turnball said someone who wanted to live off $40,000 a year needed to retire with a pool of around $600,000 if they wanted to make it last for 25 years – the timeframe in which people felt they could live beyond the retirement age.

“This [$70,000] is $530,000 less than the average respondent in our survey aspired to, and only 55 per cent of the aspiration annual $40,000 income. It is alarming how big the gap is.”

Source: NZ Herald – Kiwis ‘not saving enough to retire on’

John Body, managing director ANZ Wealth and Private Banking New Zealand, said New Zealanders were saving around 2 to 3 per cent of their take-home pay whereas Australians were saving 9 per cent and many in Asia were saving 12 per cent.

“We are just not saving enough.”

Source: IBID

For Key and his incompetant government to allow New Zealanders to tap into their Kiwisaver funds undermines the very purpose for it. In fact, he’s made the situation, as outlined by the ANZ and ASB, even worse.

We’re back to square one; people investing in bricks and mortar instead of saving for their retirement.

There are other ways to get Kiwis into their first homes without subverting Kiwisaver. National apparently chooses not to consider any of them.

In July 2008, Key made this public pledge,

“There won’t be radical changes. There will be some modest changes to KiwiSaver.”

Source: NBR – Key signals ‘modest changes’ to KiwiSaver

This most certainly constitutes a radical departure from Kiwisaver’s original intent.

Allowing people to withdraw from their Kiwisaver savings account to invest in housing may work for the very short term; Key has “solved” a potential election nightmare for himself and his Party.

But for the future of this country, and the hundreds of thousands of baby-boomers soon to hit retirement – he has left us a ticking time-bomb.

Political expediency wins out again.

.

.

= fs =

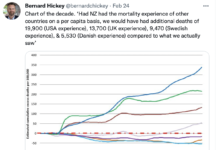

Another example of why New Zealand barely gets by economically when it could be so much better off. New Zealanders think this barely getting by economy is the best that we can achieve, when it is what you get when you actually make poor decisions when you have so many resources, that other countries don’t have, at your disposal.

John Key is obviously desperate to keep the housing Ponzi scheme going, since it the key player in the nation’s credit growth. This is critical, since if you subtract the growth in credit from our growth in GDP, you will quickly discover we are still very much effectively in recession, and probably have been for decades. Indeed this is why interest rates remain at record lows, since perpetually INCREASING outstanding credit can only occur if you perpetually DECREASE the cost of said credit, i.e. for the last few decades we have lived in a world of increasing leverage made possible by overall-declining interest rates. Wheeler and other central banksters know that this is the only way they can keep credit expanding and the economy “going”, but the problem is we are approaching a zero boundary – you can’t have a functioning credit market at near zero percent interest since no one lends money out at an intentional loss (after inflation).

Better my savings are in a house than in some dogdy investment firm.

Thanks for the explanation. I’m no financial whiz-kid but when I first heard this news item my instincts told me this was not a good idea. Now I know why.

Yep with the artificial holding down of wages with the decrease of government spending through ridiculous tax cuts for people who didnt need them private debt has gone through the roof over the last 30 years because we have had to borrow to exist.

Thanks again Frank.

I really do appreciate the graph, that has helped me understand this much better. I think the GOVT should see that graph, maybe it would help Donkey understand it better. They appear to be telling the New Zealand people something completely different. i.e. my partner actually thought National had almost gotten New Zealand out of debt.

Serious discussion needs to go into “What to do about our affordable Housing crisis?”

Money in the bank loses value over time while property appreciates – I know which one I prefer. Study the track record of managed funds before you get too enthused about them – and don’t forget the fees skimmed off by managers whether the fund makes money or not.

Nice little touch of irony misspelling “incompetent”.

Comments are closed.