.

As we look back on the last 30 years of neo-liberal “reforms”, including User Pays; the canning of “Labour’s” superannuation savings plan in 1975 (by Muldoon – after being elected into office with his infamous “Dancing Cossacks“ TV ad); and National’s continuing high popularity in the polls, despite their avowed proposal to sell-down 49% of several State assets, – it seems abundantly clear who has been pulling the “strings”.

No, it’s not Washington. Nor the Bilderbergers. Nor the UN/New World Order/Illuminati.

The answer is mind-numbingly far more prosaic: it’s us – the Baby Boomer generation. The 1960s and 1970s rebellious youth weren’t just an “aberration” – they were a clear signal that the Baby Boomers had arrived; could be inclined to incredible selfishness (hence the term the “Me Generation”); and we voted individually for personal gain – on a collective basis.

Yep. We have seen the “enemy” – and it’s us; graying; self-centered; resentful of the young (who we’ve well and truly shafted); and looking back at ourselves in the mirror, wondering where it all went wrong.

The case of Surgeons Ian Penny and Gary Hooper, who tried to rort the tax system using Trusts and companies – even though they had graduated BEFORE student loans and fees were implemented in 1992 – is the clearest example ever of our collective unbridled selfishness.

To re-cap;

.

A court battle is over for two surgeons who challenged Inland Revenue over claims they tried to avoid tax bills worth tens of thousands of dollars.

The Supreme Court has ruled unanimously against Ian Penny and Gary Hooper, saying they underpaid themselves from their own businesses to avoid the top personal tax rate.

The issue arose after the previous Labour-led Government raised the top personal tax rate to 39%, compared to the company rate which was then 33%.

The orthopaedic surgeons openly paid themselves a lower salary than the market rate, arguing that they had a choice about how they operated their business.

They tried to challenge a Court of Appeal decision that found in favour of Inland Revenue, which said the surgeons had paid themselves salaries too small to be commercially realistic.

It said they were therefore able to avoid paying the top tax rate, while the balance of their businesses’ profits went as dividends to family trusts.

The trusts funded items such as a loan for one surgeon, and a holiday home for the other.

Inland Revenue said using those business structures to create artificially low salaries amounted to tax avoidance, saving each man between $20,000 and $30,000 a year for three years, beginning in 2002.

Supreme Court Justice Blanchard on Wednesday delivered a judgement supporting that argument, ordering Mr Penny and Mr Hooper to pay Inland Revenue $25,000 in court costs.

Mr Hooper told [Radio New Zealand ]Checkpoint the court has created a salary benchmark that is higher than the one countless private practitioners have been using.

He says they have been following Inland Revenue advice and calculating their salaries based on public hospital rates.

An Inland Revenue deputy commissioner welcomed the ruling, telling Checkpoint it clearly states and reaffirms what the department’s commissioner felt was the case all along. Carolyn Tremain says IRD has yet to fully absorb the implications and consequences of the ruling.

PricewaterhouseCoopers John Shewan, who appeared as a witness for the surgeons, said the case is important for individuals and firms. He said tens of millions of dollars may now be claimed by Inland Revenue from cases it still has open on this matter.

Source: Radio New Zealand

.

Specifically,

Surgeons Ian Penny and Gary Hooper set up companies, owned indirectly through trusts, to buy their surgical services and paid themselves artificially low salaries.

After 2000, Hooper’s personal income fell from $650,000 to $120,000 a year. Penny’s dropped from $302,000 to $125,000, and then to $100,000, while the income of their companies grew.

Source: Dominion Post

.

What makes this case of case of tax avoidance stand out is that none of it was ever necessary in the first place.

Dr Ian Penny received his Bachelor of Medicine Bachelor (MB ChB) of Surgery from Otago University in 1981. He became a Fellow of the Royal Australasian College of Surgeons in 1990.

Dr Gary Hooper received his Bachelor of Medicine Bachelor (MB ChB) of Surgery from Otago University in 1978 and became a Fellow of the Royal Australasian College of Surgeons in 1985.

In simple terms, they graduated as doctors in the late ’70s and early ’80s. Tertiary education then was still nominally free. Plus, student allowances were available to most students,

“Up until 1992, nearly every student (86.4 percent) studying at a public tertiary education institution in New Zealand received a living allowance or grant while they studied.

Prior to the mid 1970s, student support was based on a system of bursaries and scholarships. In 1976, a new system of government-funded tertiary bursaries was introduced. This included a study or living costs grant that was available to most students.”

Source: NZUSA

.

Student fees and student loans came into effect in 1992, during the Bolger-led National Government, when Ruth Richardson was Minister of Finance (and coincidentally the same year that Shortland Street came on air).

In simpler terms, Dr Penny and Dr Hooper enjoyed the benefit of near-free tertiary education before fees were raised in 1992. They had no student loans to repay, as medical students currently do, and may well have benefitted from receiving a Student Allowance.

Contrast their free tuition with that of medical students, in the 21st Century: “on average medical students will graduate with around $80,000 of debt and nearly 90% will have a student loan“, according to the New Zealand Medical Students’ Association in April, last year.

So with a free education; in receipt of student allowances; and no student loan; Dr’s Penny and Hooper were, as Revenue Minister Peter Dunne stated;

“… the important thing about this decision is to bear in mind the scale of what was happening. This wasn’t people minimising their income because they were reinvesting in their business. This was people minimising their income because they were actually minimising their tax liability but still enjoying the full benefits of the income they were in reality earning.“

.

So not only did these gentlemen benefit from a free education – but they were now minimising their income because they were actually minimising their tax liability [whilst] still enjoying the full benefits of the income they were in reality earning.”

God, you’ve no idea how sick this incident has made me. Let me explain why.

Prior to the introduction of “Rogernomics” in 1984 (and National’s addition from 1990 onward), education in this country had been free (or as close as possible to free) to nearly all New Zealanders. Education whether at Primary School or University was funded by the previous generation; our Mums & Dads; Grandmothers & Grand dads. The idea was terribly simple; education was a right, and not to be determined by ability to pay.

In turn, as we graduated from schools and Universities, we – my generation, the “Baby Boomers” – were to fund our children through their education, through our taxes.

Except, it did not quite happen that way.

In 1984 we unknowingly elected a Labour Government that had been taken over by a secret cabal of neo-liberals, conservatives, and proponants of the Free Market. A raft of radical changes were implemented throughout the economy and impacting directly on society.

Despite public objection; mass protests; and even vocal opposition from within the Government by some Labour MPs such as Jim Anderton, Labour was re-elected in 1987. Curiously, they had increased their majority from 55 to 57.

During Labour’s two terms (1984 to 1990), they cut taxes twice, and implemented a new tax in 1986, called GST.

National followed, implementing User Pays in tertiary education whilst cutting taxes in 1996 and 1998.

In 2008, despite evidence that the world was plunging into a global recession, John Key promised that National would again cut taxes. As New Zealand went into deep recession; unemployment rose; businesses closed down – National cut taxes in April 2009 and October last year.

Most of the public, it seems, will swallow User Pays if they stand to reap a benefit from tax cuts.

The social contract therefore, was well and truly broken between our (the Baby Boomers) generation, and our parents/grandparents.

We had taken their gift – that of free education which they had paid for – but we decided not to pass it on to our children. Instead, we accepted one tax cut after another. And social services were either cut or User Pays applied, to pay for those tax cuts.

To my generation of fellow Baby Boomers, I say this; we’ve well and truly shafted our own children. We denied them the very same opportunities of a free education that our parents had bequeathed to us. Instead, we voted ourselves six (seven, including Cullen’s “bubblegum” taxcut) hefty tax-cuts; instigated User Pays; and left our children saddled with $13.9 billion in student debt.

Is it any wonder that our children our leaving New Zealand in greater and greater numbers? They’re not just emigrating to seek better paying jobs – they’re sticking it to us for our unmitigated greed. Whether consciously or sub-consciously, our children realise what our generation has wrought, and by god, they are not happy.

No doubt there are some folk who will cheer on Drs Penny and Hooper. These people feel that paying taxes is “unfair” and that it is unreasonable for the State to take the money that they have worked hard for.

Perhaps I should take a moment to remind these people what their taxes were, and in many cases are still, used for…

.

.

Many of these assets no longer reside in public ownership – but they were originally built and maintained by previous generations of taxpayers; our parents, grandparents, et al.

As the Baby Boomer generation, what have we built and left our children?

$13.9 billion in student debt?

No wonder they are departing our shores…

.

.

But I leave the last word to this expat Kiwi, now living in Australia,

A Victorian-based Kiwi with a student loan debt, who did not want to be named because he did not want to be found by the Government, said he did not intend to pay back any of his student loan.

The 37-year-old’s loan was about $18,000 when he left New Zealand in 1997. He expected it was now in the order of $50,000. The man was not worried about being caught as the Government did not have his details and he did not want to return to New Zealand.

“I would never live there anyway, I feel just like my whole generation were basically sold down the river by the government. I don’t feel connected at all, I don’t even care if the All Blacks win.

“I just realised it was futile living [in New Zealand] trying to pay student loans and not having any life, so I left. My missus had a student loan and she had quite a good degree and she had paid 99c off the principal of her loan after working three years.”

Source: Dominion Post

*

.

Further Reading

Greed of boomers led us to a total bust

New Zealand’s wealth gap widens

Over-55s own most of NZ’s wealth

.

.

= fs =

UPDATE

Source: http://www.radionz.co.nz/news/business/137555/reserve-bank-hints-new-loan-rules-soon

Raising minimum deposit rules, which will require 20% equity, will push home ownership out of the reach of predominantly young, first home buyers. Despite what our grinning Dear Leader says, this will make it harder for young people to buy their first homes.

It will not affect property investors as much as what the Reserve Bank thinks. A property investor can easily use existing assets to make up the 20% deposit.

All this will do is lock out competition for speculators, who are well resourced to keep adding to their portfolios.

National will do anything and everything to maintain the status quo and not look at other options such as a Capital Gains tax.

We may soon arrive at a situatiion where a CGT on investment properties may have to be levelled at the same rate as the Company Tax – 28% – and even the family home may require a nominal 15% tax, to dampen speculation.

This is what we bequeath the next generation.

There is already a tax on investment gains from the sale of investment properties.

Not true, Gosman. That is a common mis-conception held by many.

Any tax on properties is applied by the IRD only if it is a regular business activity. Ie; the investor regularly buys and sells properties, and the IRD deems it to be their main source of income.

It is the intention of the investor that the IRD looks at.

To quote,

Source: http://www.ird.govt.nz/property/property-common-mistakes/mistake-dealing-with-investment/

You do realise that if the investors main source of income is from selling property (i.e. capital gains) then the situation you mention is not applicable. So therefore if I buy a bunch of properties and then rent them out for say a net gain of $20,000 per year but then sell one of them for a capital gain of $100,000 which I include as income I pay tax on that $100,000.

Read the IRD statement.

Exactly frank. Not only is it considered “untaxable capital” they can claw back tax from depreciation on the dwelling!

Gosman, do you actually read anything before spouting your rubbish? He was pretty damn clear and you still didn’t get it!

All of this is true, but there’s more.

The boomers never grew up. They’re the reason for the infantilisation of contemporary culture, partly because they believe that the counterculture of the 60s was a replacement for high culture. It wasn’t. All it has meant is that our culture is based on the values of teenagers.

Their hyper individualism and distrust of authority have also robbed us of our ability to get the big stuff done. As a number of people have pointed out, we seem incapable as a society of executing on the big stuff any more. If something requires a massive collective effort, like winning a war or sending a person to the moon, we can’t do it. We can’t even rebuild Christchurch in a timely manner without squabbling and corner cutting.

Yes, the boomers are a complete write off as a generation. It sucks, but the rest of us just have to wait for them to die.

Tom – that is the best analysis of the Counterculture/Baby Boomer psyche that I’ve seen in a long time. You’ve totally nailed it.

It also explains why there is such difficulty in the concept of Food In schools – which is fairly straight forward to many of us – but cuts across the hyper individualism and distrust of authority that Baby Boomers/Teenagers hold.

Ditto!.

I’m becoming impatient even (for them to die) – even though I fit the demographic.

I’m contemplating a move to a TOTALLY different culture in northern India (if i can manage it money-wise), but my contemporaries have a SHITLOAD to answer for – and they actually can’t (answer for it – other than selfishness, greed, et al).

You just have to watch them daily – even in passing.

You can send me dead flowers, and I won’t forget to put roses on you’re grave (except I wont be alive).

If the British experience in anything to go by, (and there is no real good reasons why the trends wouldn’t be similar here), then waiting for the Baby Boomers to die off might not be in the best interests of the economic left.

http://www.economist.com/blogs/blighty/2013/05/britains-classically-liberal-youth

Gawd Strewth Gos – never thought I might have to agree. Actually I don’t – if only because of those subscribers to, and adherence to any sort of “greed – is – Good” ideology. I’m not going to opt for any sort of intellectual discussion with you but it’s just that their current path is not only unsustainable – it’s suicidal.

“Yep. We have seen the “enemy” – and it’s us; graying; self-centered; resentful of the young (who we’ve well and truly shafted); and looking back at ourselves in the mirror, wondering where it all went wrong.”

Yes Frank -SHAFTED in Bolded, italicised, underlined, biggest font size in the World characters that any ascii or ebcdic characterset is capable of producing.

It certainly is “US”. That “ME generation” who often (usually? – at least in my pond) professed to be of a left-wing persuasion – and who professed to have a concern for our fellow like-minded (Except that in the only explanation I can come up with – they DIDN’T and that they were so very shallow, and I failed to notice):

They rode on a wave of near full-employment; the freebie university accessibility you mention; busy having ‘love childs’; protesting about various injustices that now seem pretty bloody pathetic in comparison with the basic Human Rights, the fundamentals of democracy, the dismantling of all that is sensible (from financial systems within the economy: e.g. the banking system – to the de-regulation/self-regulation/free-market-private-is-best that (DESPITE warnings) gave us everything from Pike RIvers, DOC Estate platform collapses, BNZ bailouts [whose rescue coincided almost exactly to the cost savings incurred by benefit cuts], the corporatisation of so-called PUBLIC service [a bit of an oxymoron in and of itself] in the name of “efficiency, effectiveness, DE-POLITICISATION” – but also (and instead) – gave us OVERPAID “CEO’s” ffs! running little feifdoms whose genuine and committed underlings usually work IN SPITE of their economic superiors rather than BECAUSE of them ……… I could go on, and on, and on, and on. Just bear in mind though, that is this ilk that are the generally incompetent, the fat and flabby, the greedy, the holier-than-thou, THE GREEDY – that now seem to invade all and everywhere along with their gated communities; their intentional misinterpretation of nationhood and statehood; and usually who wonder at night before they wonder about their kuds – wonder where they went wrong. Your post sums it up really – especially with the various video wonderments from the past.

It would be pointless to do so though.

We now have a generation (RESENTFUL), that has grown up knowing nothing else.

Btw, these ‘boombers’ are content to explain things in terms of that ‘generation GAP’ that used to be sufficient. It isn’t now.

Many of those ‘boomers’ wonder why they have children that are hard to ‘manage’. Indeed MANY of them see their offspring as possessions (entirely at odds with the way they once would have wished to portray themselves).

Fucking pathetic really, BUT both SAD and SERIOUS in the sense that these ‘Me Geeration’ folk [ilk], are now running the world.

I actually see this (I’m trying to think of an appropriate word – but…) ENVIRONMENT in effect (operation).

I once worked with a guy for quite a long time …. an utterly decent man, and a bit of a campaigner. He was once a protester and campaigner for those fathers that are the exception to the ‘Deadbeat Dad’, but who was the object of punitive legislation that could not cater for that exception. I had/have a great deal of sympathy and empathy for the man (and his brother) – except that I want to SHAKE the shit out of him and say “WTF were you thinking”

Unfortunately – I actually know that deep down there isn’t any explanation other than the ‘Greed Addiction’. The man is/was highly intelligent, astute (or so I thought), and not particularly extremist in a political sense.

The first consequence of that neo-lib agenda popped up late 80s/early 90s.

A man with a “portfolio” no less!. A man in times of the still practiced:

‘spread your risk’, ‘have faith in the free-market-driven e-c-n-o-m-y’ when Cisco was the darling, the interest of ‘the working man’ was being represented by the caring and sharing Labour Party, but also when the likes of Nik Leeson were at play, alongside the likes of Phil Goff and others who saw value in student loans, pyramid scheme upskilling educational facilites – and so on. (Hard to take them seriously these days but they’re pathetically trying)

The thing that pisses me off – and probably the reason for this expose – is that now – my NPV (net present value) is probably better than the Bruce (AND BRO) that succumbed to the greed (the Promises of the Madoff-like Ross trading on word-of-mouth and exlusivity.)

WTF were/was he thinking?.

Well Frank …. this post sums it all up pretty damn well.

The psyche and the greed-is-good Generation-Me attitude.

Shame there is an expectation that I/we should now feel sorry for the ripped off.

We – of course I DO – but I can assure my former colleague (Bruce) that it’s not the way the next generations are, and will be thinking.

Yes, there is a lot to put on to the Boomer generation and not just the economics. The ‘me’ ethos has escalated with succeeding generations, all because of something called the Enlightenment, and a French philosopher who said ‘I think, therefore I am’. Individualism and the ‘me’ culture rules, and the West only has itself to blame, specially when you add in mass production, marketing, globalisation and consumerism, and all that damned electronic communication technology.

While I certainly don’t disagree with you Frank I have to point out that as a Boomer I do not fit this profile nor do most of my hardworking peers. We ( my partner and I) have paid for our children’s education we have lived sustainably we have saved for our retirement we have worked our guts out. The advantages we had over the young ( who I have been at pains to point out to any one who will listen for 25 years, are being horribly shafted )were not only a fees paid education and ample employment BUT we were paid a LIVING WAGE. That is the essence of the generation income gap. Wages and working conditions. And if we hadn’t worked in Aussie for 7 years and continued to commute there for work for 30 fucking years we would not have been able to provide so comfortably for our family or to support our NZ community to the extent that we have. The kiwi diaspora is a fucking tragedy. There are no winners. Our country is being shat on every where you turn. One of my offspring is on an excellent salary I still have to help him buy a home for himself tho’ oh and it’s an investment not shelter anymore.The boomers were the Punks not just hippies and we suffered regular rounds of unemployment right from our early twenties and insane levels of high interest on mortgages. It has not been as easy as you would have the world believe. It is the erosion of working conditions and workers rights that is at the core of the whole thing. So broaden your focus. We were all shafted by Rogernomics.

Some more than others, I think, Shona. As a Baby Boomer myself, I get where you’re coming from. The unfortunate thing here is that New Zealanders generally chose to stick with Rogernomics – the 1993 and 1996 general elections being the main indicators.

Indeed, voters could have made their decision as early as 1990, by voting for Jim Anderton’s Newlabour Party.

The most recent examples were the 2008 and 2011 elections.

In 2008, the Nats promised the electorate tax cuts despite the GFC and global recession starting to impact on the NZ economy. Voters were told that tax cuts were unafforable – yet they still voted National.

Same again in 2011; most voters (66%-75% according to various polls) opposed National’s policy to part-privatise state assets – and still voted for Key.

There’s an old saying that in a democracy we get the government we deserve. That may or may not be true. But one thing I do know is that successive governments were put in power by New Zealanders. That includes right-wing governments which fed into the “aspirationist”, “greed is good”, meme.

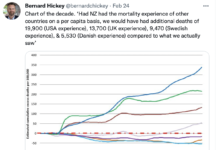

[…] Revolting young – Bernard Hickey asked such an interesting question on Twitter that it’s worth a post and discussion here… (Have a look – it is interesting. It also ties in with Frank Macskasy’s post on The Daily Blog, Greed is good?). […]

We need a Capital Gains Tax, a financial transactions tax, and maybe consider a variant on Gareth Morgan’s call to tax the family home with a CGT.

Maybe any home sold within two years of initial purchase would qualify as speculation and thereby incur CGT.

Comments are closed.