Headline: Do tax cuts for rich help growth?

Question 25: The government claims that they need to reduce tax on the rich and companies to boost growth in the economy. What is the record in New Zealand and overseas?

Unfortunately for the government the periods of highest growth in NZ and the USA were associated with higher not lower taxation. The Treasury estimates that the 2010 tax changes will produce a total increase in growth of 1% over 7 years!

As Gordon Campbell explained in his May 18, 2010, Scoop column:

“When asked by Scoop at post-Cabinet press conference on May 17 to name a couple of countries where tax cuts had resulted in economic growth, Prime Minister John Key cited the United States. Surprising, given that

“(a) over half of the benefits from the Bush tax cut programme have accrued to only five per cent of the population, http://www.ctj.org/pdf/bushtaxcutsvshealthcare.pdf

“(b) they cost more than the health reforms enacted by Barack Obama and

“(c) since they were deficit financed, the Bush tax cuts have also added a huge $379 billion bill in interest payments to their initial $2.11 trillion in revenue foregone.

“More to the point, the Bush tax cuts did not result in economic growth. For wider yet related reasons, the Bush era ended in the worst recession in decades. As New Zealand’s own recent history has also shown, there is no causal link between tax cut programmes that disproportionately benefit the wealthy, and economic growth. At best, such tax cuts appear to trigger only brief, import-driven retail binges that drive up inflation – what we get in tax cuts, we pay for soon after in higher interest rates – and leave us with a worse current account deficit.”

A similar point is made in more detail by CTU Secretary Peter Conway in a pre-budget address to the Fabian Society on May 12, 2010 (Peter Conway: “Tax: A Budget preview”)

“Slemrod and Bakija(1) examine the relationship between the marginal income tax rate and productivity in the USA. They found that from 1950 to 2002, periods of strong productivity growth actually occurred when the top tax rates were the highest and, on average, high-tax countries were the most affluent countries.

“Also in the USA, in a study looking at the effect of tax cuts in 2001, the Center on Budget and Policy Priorities noted that in 1993 the US increased the top marginal tax rate from 31% to 39.6%. But this did not damage growth. In fact the economy experienced its longest economic expansion in history during the 1990s. Real GDP grew by an average of 4% a year from 1993 through to 2000, almost 50% faster than the average from 1973 to 1993.

“Despite major tax cuts in 2001, 2002, 2003, 2004, and 2006, the economy’s performance between 2001 and 2007 was far from stellar. Growth rates of GDP, investment, and other key economic indicators during the 2001-2007 expansion were below the average for other post-World War II economic expansions.

“In New Zealand, the average annual growth rate in the five years before the 2000 increase in the top tax rate was 1.9% whereas in the five years after the increase in tax it was 3.52%.

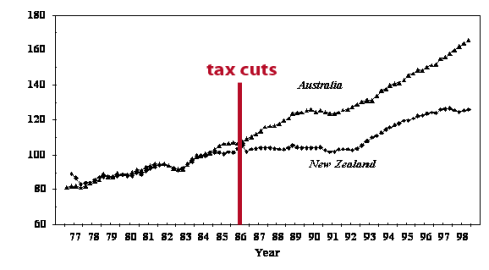

“Economic growth in the period after the major 1986 reductions in personal and company taxes was not impressive. Essentially it flat-lined.

“In the 1984-92 period our average annual growth rate in real per capita GDP was 0.4% compared with 3.02% in Australia and even when the growth rate recovered from 1992 to 1998, the average annual rate was 3.3% compared with 4.24% in Australia.

“The graph below essentially tells the story before and after the 1986 changes. It is as depicted by Paul Dalziel(2) using quarterly seasonally adjusted real Gross Domestic Product for Australia and New Zealand between 1977 and 1998, scaled so that the average value for the calendar year of 1984 equals 100.

Graph 14

“I have added a vertical line showing the timing of the huge cuts from 66 and 48 cents to 33 cents for both the top personal and company tax rate. (See Graph 14)

“These statistical juxtapositions do not show anything particularly useful and five years is not a long period in terms of a lagged effect on economic growth. I would not argue these figures prove that lower tax harms economic growth. But they at least show that tax cannot be a major factor compared with other significant influences on economic growth. Surely if after a massive cut in both income and company taxes in 1986 we see no evidence of an impact on economic growth, that particular line of argument should be abandoned by its proponents. And if we see a growth rate in the five years after an increase in the top tax rate in 2000 that is almost double that of the average rate for the five years before the cut, again it is hard to see a growth dividend. But we all know that lots of other things are affecting those numbers. That’s the point.”

(1) Joel Slemrod and Jon Bakija (2008). Taxing Ourselves: A Citizen’s Guide to the Debate over Taxes, 4th edition.

(2) Dalziel, Paul. (2000) New Zealand’s Economic Reform Programme was a Failure, Department of Economics and Marketing Canterbury, New Zealand.

(Part of a series of extracts from “Exposing Right Wing Lies” by Mike Treen, Unite National Director)

—