.

People welfare, bad!

.

.

.

.

.

.

It’s fairly obvious what National thinks of New Zealanders who find themselves on the welfare safety net. Especially when those on welfare are there because of a global financial crisis brought on by unfettered, laissez-faire capitalism (aka naked greed) hitting a wall, and sending economies worldwide deep into recession.

But never mind. National has an answer for such dire events.

It’s called,

.

Corporate welfare, good!

.

Even as National continues to persecute, demonise, and blame the unemployed, solo-mothers (but never solo-dads), invalids, widows, etc, for their lot in life (because as we all know, the unemployed, solo-mothers (but never solo-dads), invalids, widows, etc, were directly responsible for the Global Financial Crisis that began in Wall Street’s boardrooms) – John Key and his cronies continue to lavish truck-loads of tax-payers’ money on corporate welfare.

.

1. ETS Subsidies for farmers

.

In June 2012, Business NZ CEO, Phil O’Reilly, wrote in the NZ Herald,

” There has been a lot of redesign and tinkering with the ETS. Established in 2008, reviewed and amended in 2009, reviewed again last year and about to be amended again – it’s no wonder that businesses involved in the scheme have review fatigue.”

See: Phil O’Reilly: Emissions trading scheme must bring investors certainty

Mr O’Reilly may well complain. But he is unfortunately too late. On the morning of 3 July, Dear Leader John Key announced that the 2015 postponement (of elements of the ETS) had formally become an “indefinite postponement” (ie; gone by lunchtime on that day).

Key stated,

“We’re not prepared to sacrifice jobs in a weak international environment when other countries are moving very slowly.”

See: Slow economy puts ETS plans on hold

Yet that hasn’t stopped National from levying ETS on the public. No fears there, evidently, of impacting on the pockets of ordinary Kiwis, and in effect, susidising farmers to the tune of $400 million per year since 2009.

In effect, this is a transfer of wealth from polluters to the ordinary taxpayer. After all, what else can it be called when the public have to pay for an ETS – but farmers, industries, coal & oil companies, etc, – the very groups that produce CO2 and methane – are exempt?

See: Public to pay tab for polluters

So much for Tim Groser – Minister for Climate Change Issues and International Trade – insisting,

“The National-led Government remains committed to doing its part to reduce greenhouse gas emissions, but it is worth noting that we are the only country outside Europe with a comprehensive ETS.”

National’s “committment” to reducing greenhouse gas emissions has gone up in smoke and carbon dioxide.

As the Sustainability Council NZ reported in November 2009,

- Households would bear half the total costs under the amended ETS

during its first five years (52%), while accounting for just a fifth of all

emissions (19%). Together with small-medium industry, commerce and

services, and transport operators, they would pay 90% of the costs resulting

from the ETS during CP1 while being responsible for 30% of total emissions.

- Pastoral farmers would gain a $1.1 billion subsidy and pay an amount equal

to 2% of their fair share of the Kyoto bill during CP1, while large industrial

emitters would gain a $488 million subsidy (at a carbon price of $30/t).

See: ETS – Bill to a Future Generation

On top of that, National appears unwilling to release actual financial data when it comes to the ETS. Critical data has been withheld, as the Sustainability Council discovered last year,

” Governments are legally required to provide an update of the nation’s financial position just before elections but those accounts do not recognise carbon obligations until they are in an international agreement, hence there is nothing concrete on the books until after 2012. “

See: Simon Terry: Carbon books reveal shocking gaps

And the Council report goes on to state,

” The Sustainability Council requested a copy of those projections eleven weeks ago.

After various delays, the Treasury delivered its projections the day before the election

– late in the afternoon and with much of the key material blanked out.

What arrived is the carbon equivalent of a finance minister presenting a budget and

saying:“Here is the estimated tax take for the next 40 years, and here is the total

spending. But we are not going to tell you how much tax is coming from any sector,

and we are certainly not going to tell you how tens of billions of dollars worth of

carbon subsidies and other payments are expected to be distributed. And no, we are

not giving you the figures for the past four years of the ETS either”.It looks to be the closest thing in the public domain to New Zealand’s carbon books

and yet: future agricultural emissions are a state secret; future deforestation rates are a

state secret; even projected fossil fuel emissions are a state secret – all blanked out. “

So what do we have here?

- Ongoing subsidies to polluting industries, with said subsidies paid by you and me, the taxpayer.

- Secrecy surrounding future ETS agricultural, deforestation, and fossil fuel emissions.

- Constant deferring of including polluters in a scheme that was designed specifically for dirty industries and farming practices.

- Importation of unlimited, cheap, foreign carbon credits.

Final point:

It seems a crying shame (as well as a fair degree of sheer madness) that we are paying subsidies to industry – whilst not offering the same deals to the generation of renewable energy and further research into renewable energy options (wind, solar, tidal, etc).

Ironically, the one subsidy that might have helped our economy and environment was scrapped in 2011, making Solid Energy’s biofuel programme uneconomic. (See: Biodiesel loses subsidy, prices to rise)

Instead, the taxpayer continues to subsidise polluters. On 27 August 2012, National finally ditched agriculture’s involvement in the ETS, giving farmers, horticulturalists, etc, a permanent “free ride” from paying for their polluting activities. (See: Farmers’ ETS exemption progresses )

This is the inevitable result of electing a corporate-friendly political party into government.

.

.

2. Subsidies to Private schools and Tertiary Providers

.

Subsidies to private tertiary education providers continues to increase,

” The Government is investing a further $29.503 million in the Private Training Establishment (PTE) sector over four years. This increases the funding rates for private training providers in line with the Government’s promise to treat them more equitably with public providers. The resulting funding difference is now half of what it was previously. “

See: Tertiary Education Commission – Private Training Establishments

So, if you’re a private company offering to train someone a course in “xyz” – expect a hand-out from a corporate-friendly National.

In the meantime,

- ” Student allowances are removed for post-graduate study the parental threshold for accessing allowances is frozen for the next four years. The Government says the changes will save $240 million in the first year and up to $70 million a year thereafter. The Budget cuts all funding for adult and community education in universities, saving $5.4 million over four years. “

See: Radio NZ – Benefits for research, science and engineering

- “ It also saves $22.4 million over four years by ending funding used to help tertiary education providers include literacy and numeracy teaching in low-level tertiary education courses...”

See: Radio NZ – Benefits for research, science and engineering

- ” Sunday Star-Times recently reported one in five young people left school without basic numeracy and literacy skills, despite the future workforce depending on advanced expertise. “

See: Not adding up on Easy Street

- ” Early childhood education subsidy cuts worth tens of millions of dollars are likely to be passed on to some parents through increased fees.

Education Minister Hekia Parata has kicked a total revamp of ECE funding into a future Budget, opting instead to stop cost increases to the Crown by cancelling the annual upward inflationary adjustment in rates.

The subsidy freeze takes effect on the next funding round, stripping about $40 million out of ECE payments to 5258 ECE centres. About 1427 of those centres are eligible for “equity funding,” however, and will get a boost through $49m extra directed to them over four years in a bid to enrol more children from the lowest socio-economic parts of the country.

But the scrapping of an annual inflationadjustment for other centres will be an effective funding cut as inflation pushes the cost of running ECE centres up. “

See: Parents face burden of preschool squeeze

National’s most recent hand-out went to private school, Whanganui Collegiate,

.

See: Govt ignored advice before private school’s integration

.

For a Party that advocates the “free market”, it certainly seems odd that they’re willing to throw bucketloads of our taxes at businesses such as private schools. After all, what is a private school, if not a profit-making business?

And don’t forget Charter Schools – which is the State paying private enterprise/institutions to run schools – whilst making a profit (at taxpayer’s expense) in the process. Why don’t exporters get this kind of support?

That was certainly Gerry Brownlee’s attitude when Christchurch’s post-earthquake housing crisis became apparent,

.

See: Christchurch rent crisis ‘best left to market’

.

3. Media Works subsidy

.

In 2011, this extraordinary story broke,

.

Prime Minister defends loan to MediaWorks

Published: 8:28PM Friday April 08, 2011 Source: ONE News

The Prime Minister is defending his decision to loan $43 million of taxpayer money to private media companies.

John Key claims the loan scheme was designed to help the whole radio industry.

But a ONE News investigation has revealed MediaWorks was the big winner after some hard lobbying.

Key is known for being media friendly, but he’s facing criticism from Labour that he’s become too cosy with MediaWorks which owns TV3 and half of New Zealand’s radio stations.

It has been revealed the government deferred $43 million in radio licensing fees for MediaWorks after some serious lobbying.

Key and the former head of MediaWorks, Brent Impey, talked at a TV3 Telethon event.

“I just raised it as an issue but we’d been looking at it for sometime. My view was it made sense. It’s a commercial loan, it’s a secured contract,” Key said.

It’s believed the loan is being made at 11% interest.

But in answer to parliamentary written questions, the Prime Minister said he had “no meetings” with representatives of MediaWorks to discuss the deal.

Two days later that answer was corrected, saying he “ran into” Brent Impey at a “social event” in Auckland where the issue was “briefly raised” and he “passed his comments on” to the responsible minister. ”

See: Prime Minister defends loan to MediaWorks

.

Aside from another example of Key’s mendacity, when he originally claimed to have had no contact with Mediaworks,

… in answer to parliamentary written questions, the Prime Minister said he had “no meetings” with representatives of MediaWorks to discuss the deal.

Two days later that answer was corrected, saying he “ran into” Brent Impey at a “social event” in Auckland where the issue was “briefly raised” and he “passed his comments on” to the responsible minister.

See: IBID

… this affair was another example of selective subsidies being offered to some business – whilst others are left to their own devices to survive,

.

.

We’ve lost 41,000 jobs in the manufacturing and construction sectors over the last five years. To which National’s Minister-Of-Everything, Steven Joyce’s response was,

“Nobody’s arguing that being a manufacturer isn’t challenging. In fact, in my history in business, every time you’re in business it’s challenging.

“But going around and trying to talk down the New Zealand economy and talk about a crisis in manufacturing, I don’t think is particularly helpful.”

See: Exporters tell inquiry of threat from high dollar

“There is no doubt that economic conditions in the post GFC- world are challenging for some firms. The role of Government is to do things that help make firms more competitive and that is what our Business Growth Agenda is all about.”

See: Opposition parties determined to manufacture a crisis

Or Minister for Primary Industries, Nathan Guy saying,

“Our trading disadvantage has meant that we need to do more with less, and to work smarter.”

See: Innovation in New Zealand’s Agribusiness sector

To which exporters responded with this,

“We’re told to get smarter and I find that irritating and insulting. I’m about as smart as they get in my little field. How the hell do these people get smarter? For a politician to tell somebody else to get smarter – he’s risking his life.”

See: Exporters tell inquiry of threat from high dollar

Not very helpful, Mr Joyce. Though Opposition Parties may appreciate that you are pushing your core constituents into their waiting arms.

That’s how you alienate your voter-base.

.

4. Sporting subsidies

.

The Rugby World Cup

- Prime Minister John Key today announced a $15 million grant for an upgrade of Christchurch’s AMI Stadium for the Rugby World Cup in 2011.

See: Govt announces $15m for AMI Stadium (30 April 2009)

- Dunedin Mayor Peter Chin says he is “chuffed” the Government will contribute up to $15 million to cover shortfalls in private sector funding for the $198 million Otago Stadium project.

See: Chin ‘chuffed’ at $15m for stadium

- The Government blew out a $10 million budget to host VIPs at the Rugby World Cup – even though just a handful of foreign leaders attended.

See: $5 million overspend on World Cup VIP budget

- An extra $5.5 million will be spent on the Rugby World Cup to make sure there’s not a repeat of the chaos that unfolded on the evening of the tournament’s opening ceremony.

- Including the $350m spent to upgrade stadiums and provide IRB-approved facilities around the country and millions more pumped into infrastructure and preparations, the bill for the tournament has easily surpassed the $400m mark.

See: World Cup ‘absolutely worth’ price tag

Yacht Races

The Major Events Development Fund will invest $1.5 million on each of two Volvo Ocean Race Auckland stopovers to be held in 2015 and 2018 following an announcement today by Economic Development Minister Steven Joyce

See: Govt to support 2015 & 2018 Volvo Ocean Race Auckland stopovers

.

Meanwhile, Health Minister Tony Ryall refuses to provide additional funding for specialised medicines for patients with rare disorders. See: Letter from Tony Ryall, 5 December 2012

The message is crystal clear; National will subsidise rugby games and yacht races. But don’t expect help if you discover you have a rare disease.

.

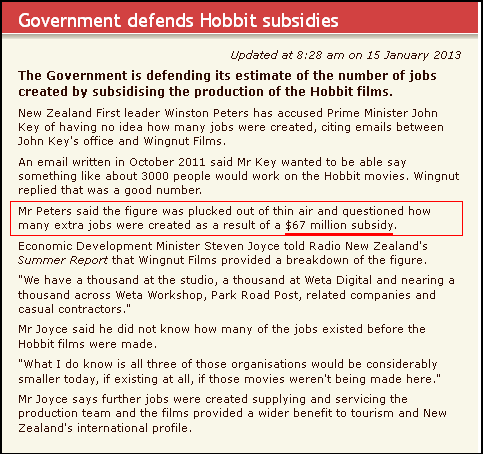

5. Warner Bros subsidy

.

After Jackson made public noises in October 2010 that ‘The Hobbit’ could be taken offshore, there was a kind of mass-hysteria that pervaded the country.

Warner Bros wide-boys jetted down to meet Dear Leader, who kindly supplied a taxpayer-funded chauffeured limousine to bring the Holloywood execs to Parliament.

Dear Leader said “no more subsidies”.

Nek minit; Warner Bros demanded, and got, an extra $15 million. (see: Govt defends Hobbit jobs claim)

All up, the New Zealand taxpayer coughed up $67 million to give to Warner Bros. (Who sez crime doesn’t pay? Gangsterism obviously turns a healthy profit now and then.)

.

.

The film obviously didn’t do too badly at the Box Office – $1 billion is not too shabby by anyone’s standards,

.

.

Can we have our money back now, please?

.

6. Broadband subsidy

.

Funny isn’t it. Pro-business lobby groups always complain about State intrusion into the market place… Except when subsidies are being handing out.

One wonders why, if the Free Market” is more efficient than the State, that $1.5 billion in taxes has to be paid to private telcos to do what that they should already be doing.

Perhaps this is why it took the State to build this country’s infra-structure over the last hundred years. Infra-structure such as electricity generation. (See related blogpost: Greed is good?)

Which National is now preparing to part-privatise.

Private companies will soon be owning what taxpayers built up over decades, and which private enterprise was loathe to build in the first place. (If you’re wondering whether I’m referring to state power companies or broadband – there doesn’t seem to be much difference.)

.

Meanwhile, back in the Real World!

.

.

Dear Leader says,

“Some argue that people on a benefit can’t work. But that’s not correct.”

Correct.

Because as Welfare Minister Paula Bennett stated candidly on Q+A on 29 April,

“There’s not a job for everyone that would want one right now, or else we wouldn’t have the unemployment figures that we do. “

See: TVNZ Q+A: Transcript of Paula Bennett interview

Correct.

Which means that National’s “reforms” to push 46,000 of welfare is not just a meaningless exercise (the jobs simply aren’t there) – but is actually a political smokescreen to hide their own incompetance at forming constructive policies for job creation.

Unfortunately, there are too many right wing halfwits and Middle Class low-information voters who readily buy into National’s smokescreen. It’s called prejudice, and means not having to think too deeply on issues,

.

.

Fortunately, it is the job of those on the Left to dispel these unpleasant notions for the Middle Classes. (National’s right wing groupies are a lost cause.)

Let’s start by posing the question; why is welfare for corporations supposedly a good thing – but welfare for someone who has just lost their job, supposedly bad?

That’s what we need to keep asking the Middle Classes.

Eventually, they’ll start paying attention.

.

.

*

.

Additional

Scoop: Where’s National’s ‘corporate welfare’ reform?

Fairfax media: Doubt stalls biofuels growth (14 March 2011)

The Press: Solid Energy ‘wasted millions’ on biofuels (31 Aug 2012)

Southland Times: Biodiesel loses subsidy, prices to rise (30 May 2012)

TVNZ: Prime Minister defends loan to MediaWorks (8 April 2011)

Radio NZ: Data reveals drop in manufacturing, building jobs (22 Feb 2013)

Previous related blogpost

Once upon a time there was a solo-mum

Doing ‘the business’ with John Key – Here’s How

Acknowledgements

Tim Jones of Coal Action Network Aotearoa

.

.

= fs =