So the first horseman of the economic apocalypse will be Mighty River Power. If you think you are paying a lot for the mismanaged electricity sector now, our current price gouging will seem like a gentle hand massage compared to our energy generation being owned by 49% of the private sector with all the narrow vision of next quarter profitability.

Bingo drinking every time Key says ‘Mum and Dad investors’ this month could cause the greatest loss of life from alcohol poisoning ever recorded.

The insult of asking us all to pay for assets that our Grandmothers, grandfathers, mothers, fathers, brothers and sisters have already paid for becomes an obscenity when you consider that the wealthy will be the only ones who can afford the $1000 share threshold.

The wealthy in NZ have been given hundreds of millions in tax cuts and they will use those tax cuts to buy our once public assets. Adding further insult, those wealthy enough to buy the shares will also be given a bonus bribe if they hold onto them until after the next election so as to not embarrass National in 2014 with mass overseas ownership.

We have effectively subsidized the 1% into ripping off our own assets. Now I know what Maori feel like every day in this country.

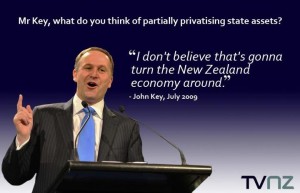

What of our money trader Prime Minister’s claims of gold and rainbows about to fall from the sky in the wake of the asset sale program? All the billions Mr Key promises we will make are a nonsense.

Compare if you will all the money John Key claimed the TPPA would generate for NZ. Professor Jane Kelsey was scathing of how Key plucked his claim of billions and billions out of thin air in a press release put out yesterday…

‘Governments often wheel out fantastic projections of an El Dorado to rescue agreements that are withering under intense scrutiny. But $3.5 billion was almost double the figures in previous studies on the TPPA, which themselves used implausible assumptions on the upside and ignored all the potential costs’, according to Professor Kelsey.

‘As the next round of negotiations begin in Singapore today, it is time to debunk his claims’.

An Official Information Act request revealed the Prime Minister was citing an unpublished econometric study in November 2012 by the Washington-based Peterson Institute for International Economics that updated earlier versions published by the East West Centre.

Professor Kelsey says ‘the assumptions that underpin the report’s computerised modelling belong on an alien planet’.

It assumes that all eleven countries – including the US – will agree to comprehensive liberalisation, including zero tariffs and all ‘non tariff barriers’ will be removed. Workers who lose their jobs will simply move on to new ones. The entire deal will be tied up by 2013 and approved by national parliaments and implemented immediately – and by Korea and Japan from 2015.

The report ignores any real world downsides – losing part or all of the $5 billion savings from Pharmac over 12 years, the stifling of innovation through extreme US monopoly rights over intellectual property, the economic and social costs of light-handed regulation, legal fees and compensation awards from investment arbitration suits brought by US firms, to name a few.

…Key’s claim of billions from the TPPA are as hollow and fake as his claim of 7 billion from the asset sales program yet the latest Roy Morgan Poll has National at 47.5% and Labour at 30.5%.

Who said attacking Maori protestors on Waitangi Day and bashing beneficiaries doesn’t work politically?

Despite Key running NZ in the interests of the rich, by the rich and for the rich, New Zealanders still adore him and believe his vacant aspiration will see them prosper.

With a million dollar sales campaign about to start, few mainstream media outlets will want critical analysis of the sale when eyeing up the advertising candy about to be dished out to their industry.

National’s trick is that they are supported by small business when their political agenda only helps big business. To keep small business voters on side, National appeal to the darker angels of the small business psyche with their welfare bashing and Maori bashing. Even though National do nothing to help the economic position of most of their voting block, National do promote their voters petty bigotries, and that keeps their voters focus off who is actually benefitting from this asset theft.

Key is a dodgy car salesman who is conning NZ into handing our sacred cows over for a handful of magical beans.

Sleepy Hobbits reap what they sow.

Both TPPA and asset sales will ultimately cost this country billions. That much is clear.

Once the Government has blown through the billions the asset sales will surely bring, then what? The reliable revenue stream these same assets brought will be 49% lower. Unless they somehow manage to invest the proceeds into something even more profitable than what they have sold, it is going to put future governments into an even deeper hole than it is now. They want to “invest” in hospitals I gather: this might come as news to some people, but hospitals COST money, they don’t make it.

As for the TPPA, it is such an obvious total scam, with NZers as the dupes, that it boggles the mind. National voters have a lot to answer for.

Interesting…

Key, English, and Ryall haven’t mentioned “mum and dad” investors in the last 48 hours. (Unless I’ve missed it.) Listening to RNZ and watching TV3 News – no “mums and dads”.

On RNZ this morning (5 March), English confirmed they were looking at majority New Zealand ownership of ALL MRP shares – not just the 49% being floated,

“The Government aims to have up to 90% of Mighty River Power retained in New Zealand hands, between the Government’s 51% share and domestic investors.”

http://www.radionz.co.nz/news/political/129610/investment-nous-urged-by-english

As for floating on the Aussie stock exchange… so much for targetting Kiwi investors forst.

Though really, it’s kinda understandable. With even more New Zealanders fleeing this wretched country to better opportunities in Australia – that’s where many “mums and dads” investors now live.

But nah. Even that’s not true. According to a RNZ report, the Aussie float will target institutional investors and not individual New Zealanders living across the ditch.

QFT

Thing is, I think the majority of people realise this. Unfortunately, it seems a lot of them aren’t voting because they no difference between the two major parties.

When he is not behaving like a car salesman he reverts to his classroom smart-alec behaviour as we see in Parliament.

When a question requiring some gravitas is asked of him he leaps to his feet, spurts some inane quip, and then bounces back in his seat like a schoolboy waiting for the giggles from the lower decile intellects around him.

http://www.stuff.co.nz/national/politics/8371776/Today-in-politics-Tuesday-5-March-2013

Theres a poll that allows you to rate the govts plan to partially sell Mighty River.

Its running 70% in favour

This video had foresight.

http://www.youtube.com/watch?v=FBtum5D1e2I

The pre-registration process does seem more keen on making sure you’re not buying shares for someone in America than making sure you’re a New Zealander. Is this part of some deal we have with the Americans? I don’t recall having to sign anything saying I wasn’t buying shares for New Zealanders when I lived in the USA. Or is it just Key sucking up to Washington, as usual?

Comments are closed.