Ever been at the bank and they tried to upsize your loan or hassle you to bring your Kiwisaver to them? Ever been cold called to see if you want a credit card? Want life insurance with that??

If so, you have been on the receiving end of the insidious sales targets culture in the banking industry.

Before you start kicking into ‘those greedy banksters trying to get big sales bonuses’ rhetoric, let’s look behind the scenes, to the daily life of Barbara, a banking consultant at your local multi-national bank branch.

“Every morning we have a sales huddle, you are asked by the manager how many products you are going to sell today. These products range from life insurance to home loans, many are what some call debt products.”

These are sales targets.

“Throughout the day you are asked by the manager why you haven’t sold x number of this or that product. You have to make the target.”

But what if all morning Barbara has only seen an elderly couple, a family struggling on a benefit, and some students?

“It doesn’t matter. You are still pushed for why you haven’t sold products to those people.”

At the end of the day a ‘debrief’ meeting is held. Barbara and her colleagues are again asked why they only sold a certain number of products and what they will do differently the next day to improve. “The pressure is high – you feel humiliated – made to feel ‘what is wrong with you? Can’t you do your job?”

If things don’t improve, the consultant is up for performance management and ultimately disciplinary action.

The targets are often the same regardless of location or demographics so Paraparaumu could have the same targets as Auckland CBD.

“You feel so unethical. Sometimes you know these people can’t afford to take on the debt and the product is not right for them but if you can’t meet target your job is on the line.”

Unfortunately, stories like Barbara’s are commonplace in the banking industry.

The subject of sale targets and associated incentives/disincentives is under close scrutiny following the Wells Fargo scandal in the States. US Bank Wells Fargo CEO John Stumpf was forced to resign after it was exposed that thousands of Wells-Fargo employees had been creating false accounts. Why? The pressure to meet impossible sales targets was unbearable and staff felt it was the only option.

“At my branch it was the norm to disregard the customers’ needs and only focus on the sales,’ said former Wells Fargo worker Cassaundra Plummer. “My manager pushed me to only talk about the positives of products and to avoid discussing fees and the things that were negative. He would say things like “you don’t have to tell them all of this, that’s why we give them the paperwork.” I would respond saying “but no one ever reads the paperwork,” and he would say “exactly”.”

After these practices were made public, Wells Fargo have removed sales targets entirely.

Closer to home, Stephen Sedgwick was commissioned to investigate sales culture in the Australian banks. The Sedgwick Report, which was released last week, is clear that there needs to be an overhaul of the sales targets culture and presented 21 recommendations for banks to move away from this culture and towards one of service first, not sales. The Australian banks committed to these recommendations.

However their New Zealand counterparts ANZ, Westpac, BNZ and ASB have been less equivocal of their commitment to change the sales culture, despite being part of the same companies. It is critical we use the opportunity of the Sedgwick report to push the banks here to remove sales targets, and with it the insidious culture that is currently pushing bank staff and their communities to the brink.

In Barbara’s words: “I can’t sleep, I am on anti-depressants and I’m taking my stress out on my family. This is not the job I signed up for. I want to give people good financial advice and assistance not force products on them they can’t afford.”

Yes SS Joyce & Goldman Sachs are both working together to bankrupt NZ as they did to Greece, as Goldman Sachs already have their ex employees inside our NZ Treasury now and have since 2009!!!!!!!!

We must rid them in September election before they destroy NZ.

Thanks Tali,

Yes SS Joyce & Goldman Sachs are both working together to bankrupt NZ as they did to Greece, as Goldman Sachs already have their ex employees inside our NZ Treasury now and have since 2009!!!!!!!!

If Barbara doesn’t like working in sales then she should consider getting another job.

A bank is just like any other business – it sells products and needs sales people to do that.

ethics

noun

1. moral principles that govern a person’s behaviour or the conducting of an activity.

There you go, Andrew. No need to thank me, I’m here to help.

You still haven’t told me what their unethical behaviour is. Please give an example.

If you have some specific examples maybe you should go to the banking ombudsman with a complaint.

(Personally I find the banks here are very good and offer an excellent service. But then I am an investor, not a borrower…)

That’s a direct quote from the above article… the one I’m assuming you did read.

Pushing products and services onto people who quite obviously cannot afford them is unethical. As a manager, pressuring your staff to act in this way under the implied threat of dismissal for non-performance, is also unethical.

Please don’t ask me to draw you a picture in crayon explaining why.

Caveat Emptor

It’s their life and it’s their choice to make.

Andrew:

There you go – making assumptions again and those throw-away soundbites passing for wisdom.

Investor you may be. Business builder you clearly aren’t.

Is ‘hold your nose for quick profits’ your wealth-making strategy by any chance?

Another job – something like becoming a narrow-minded right-wing parrot like yourself Andrew?

No other ‘business’ creates its ‘product’ (money) out of thin air and charges interest on it. No other ‘business’ is as unethical as banking.

Banking is a scam. And it’s destroying the habitability of the Earth. But since bankers have a stranglehold on western societies, western nations will be driven into fighting yet another war to protect the western banking system one last time before it all caves in.

The article isn’t about Barbara you dolt

I had a client who worked at one of the big banks. He was a business development manager aka sales. The guy was clearly hard working and successful, but every year they put up his targets and he knew that soon he would not achieve them, so it was time to leave. The bank was about to lose a talented worker because of unachievable targets for selling debt. Thinking it through, the people left are the ones who are target-driven and have no moral standards of right and wrong to overcome. That bodes ill for the future of our financial system which teeters on the banking sector and the debt it produces.

At the other end of the scale, a high street bank teller left her job because she couldn’t cope with the sales targets. She was hard working and loved her job, which involved serving customers. She just couldn’t sell. Another good worker tossed on the scrap heap.

When the economy falls over there won’t anyone to sell anything to. The banks won’t need sales people and will be stuffed…

” However their New Zealand counterparts ANZ, Westpac, BNZ and ASB have been less equivocal of their commitment to change the sales culture, despite being part of the same companies. It is critical we use the opportunity of the Sedgwick report to push the banks here to remove sales targets, and with it the insidious culture that is currently pushing bank staff and their communities to the brink. ”

………………………………………………………………………………………..

Interesting.

Is it because NZ is regarded as more out of the way much like the Wild West final frontier and these arsehole managers feel they can get away with it?

Or is it that banking staff do not have adequate Trade Union protection , – if at all ?

Or could it be that many of these bank managers are foreigners and only here for a few years to do their management ‘ apprenticeships’ before they are then shipped back to their country of origin , – much as is the Australian practice of sending junior managers here for those very same reasons?

Well, to be honest, it used to be a damned lot worse in the mid to late 2000s (say 2005 and shortly after, prior to the GFC). I was asked about whether I knew this or that “service” of the banks I used all the time, and whether I would be interested.

Nowadays this is only happening occasionally.

While this may well be the case, that bank managers meet with their staff before starting their work every day, to encourage them to sell products and services that the customers may not even need, it does not seem to be acted upon by each staff member all the time.

I suspect that some front line staff are encouraged more than others, to do this, those that are employed to actually sit down and talk with customers, those consultants, I mean.

At the counter, I only get asked sometimes, how my day is, bla, bla, bla, and they try in some branches, to make me use their deposit box, if I want to deposit money, rather than do it at the counter.

The strategy is clear, they want to get people use machines if it is trivial and day to day business, and not involve persons that cost the banks in wages and salaries.

There is actually no money being earned by banks in transaction services and the likes, they earn in interest and offering special banking products, through fees and so.

So they do of course try everything to expand in those services.

The trend will continue and make bank workers more redundant or obsolete, as machines and computers will do most work, only if a customer has a special need for a new product or service, and wants to sign up to such, will there be a person to person interaction.

We see similar trends in retail, with supermarkets now having automated checkouts, as they all want to replace man- or woman-power with machines, who are cheaper in the long run, and who cause no “issues”, like wage disputes and sick leave.

Our world though is become less and less humane with all this technological change, many jobs will go, which will also dis-empower individual workers, fighting for the jobs that may be left, and the few unstable and low paid jobs that will be introduced in other areas for other functions.

The Banksters are a law unto themselves. They have lost any form of humanity and now look reptilian in the way they conduct business. The profits are rediculous and all about moving money up the heirarchy to the banks bosses and owners.

Ba hahaha a a a !

The poor diddums. Anti depressants because her conscience has ris.

Try living in the fucking streets. She’d be shovelling antidepressants down her maw like cornflakes if, that is, she could afford the Dr’s visit. Fabulous though that she came forward. Sorry. I let my cynicism get in the way there for a moment.

The ONLY way to deal with the foreign banks is to purge them out of NZ/ Aotearoa and wipe off the debt they swindled us into.

Then, focus on our local crooks. Write off mortgage debt, pile on speculative property taxes, ban loan sharking, re nationalise our stuff and things and conduct a public inquiry, the likes not yet seen here but is coming, to specifically look in to where our export earned, after-farm-gate money has gone. No, not just the historical tax funds used to build what were once our assets and amenities, the assets and amenities they sold, AKA laundered. Those other funds that were drafted into who’s pockets brokered by what bank/banks/politicians/privateers? Billions and billions of foreign and local bankster laundered money is missing. Who’s got that? How did they get it? Where is it now? Mercury Island? Gibbs estate? Can Fay and/or Richwhite help enlighten us? Pig Muldoon wasn’t so dead he could explain why he was in Switzerland and no doubt checking the balance of the numbered account he held there. What about holyoak? Roger the scum bag douglas? And there are many more. Mike Moore. There you go.

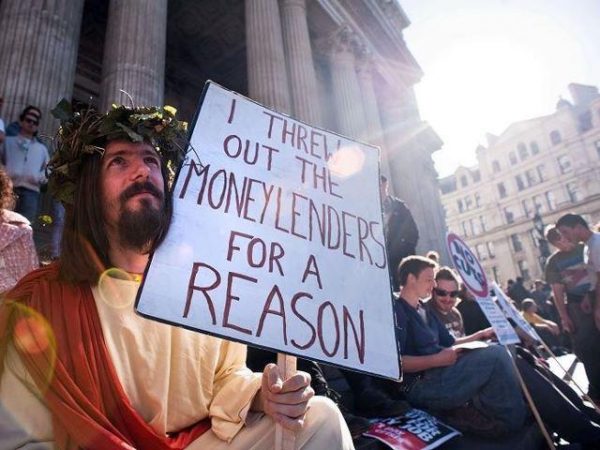

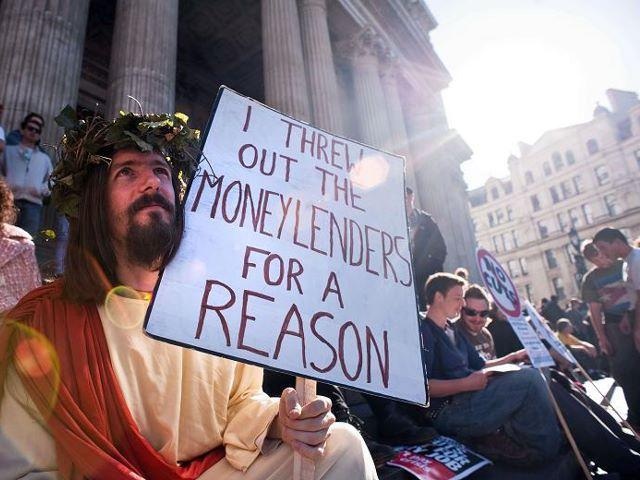

Power selling debt. AKA they steal the time we have to live our lives. Time spent working to pay for $-time stolen from us by cunning criminals in fancy buildings. Jesus wept. No doubt literally.

Great Post @ Tali Williams. Brave you, I say.

Another pearler .

President Andrew Jackson was one such man as you are talking about , and he set out to ( and succeeded to ) break the hold of foreign financial interests in the USA , and hence they printed their own cash.

Andrew Jackson Takes on the Bank of the US – VOA Learning English

learningenglish.voanews.com/a/1749399.html

And it wasn’t until the treacherous President Woodrow Wilson signed the Federal Reserve Act of 1913 that the USA went into permanent debt to European interests by having to pay interest on every dollar they borrowed. And essentially ended up being in bondage to the House of Rothschild.

Did Woodrow Wilson REGRET Handing AMERICA to the … – YouTube

you tube▶ 6:54

https://www.youtube.com/watch?v=7sr2DspCZig

Apparently a lot of our offshore profits go offshore because of banking.

About time we bought in a robin hood tax and also some sort of transaction tax on money transfers – we just have too much money going in and out of NZ that is untaxed.

https://www.theguardian.com/business/2011/nov/03/bill-nighy-robin-hood-tax-g20

“The support has been gained not just from Nicholas Sarkozy and Angela Merkel, but also the money men Warren Buffet and Bill Gates – who was sceptical initially – and now the Archbishop of Canterbury.

“It is very popular because no one is going to have to pay any more tax directly. The value of the derivatives market is now somewhere between $605 and $620tn [£377 and £387tn] – the world economy is only $60tn – and the $620tn is currently untaxed. The 50 pence tax on every £1,000 is all that is being asked for.”

He says there are ways to protect the public from the tax being passed down to the consumer.”

Yep SAVENZ,

The likes of Goldman Sachs are on life support with Nactional as theryare generating so much need for their “borrowed funds” NZ will go the same way as Greece sooner than we know.

Matter of time.

Greece found this out the hard way and so will new due to those egg-heads who cant see the green (money) for the trees.

I don’t know, if Gates is so worried about such things he could just have his companies pay their taxes without avoidance…

https://www.theguardian.com/commentisfree/2014/jan/06/bill-gates-preaches-fighting-poverty-hypocrite-microsoft-tax

and Buffett who would seem to be ‘not very good with investing’….yeah right…..

“Warren Buffett earned $11.6 million in 2015 and paid taxes of $1.8 million. However, his net worth is $64.7 billion. That means in 2015, the world’s greatest investor only produced income of 0.018% of his assets.”

https://millennialmoola.com/2016/10/12/warren-buffett-is-the-greatest-tax-dodger-of-all-time/

i took matters further last week i decided to join the local credit union stuff the banks

i need a simple banking facility with out the over head bullshit and with online banking i dont need the branches.

this is reason nz is heading for the mother of all crashes our houses hold debt is staggering and one day its going to blow up .shock will turn to anger as the former middle class realize the scale of there debts and the personal bankruptcy that follows we live in dangerous times.

Don’t hold your breath Darth.

The NZ household debt has remained roughly constant for the decade or so and the cost of servicing it has dropped dramatically.

http://www.rbnz.govt.nz/statistics/key-graphs/key-graph-household-debt

The last time we saw dramatic rises in household debt was during the Clark era when both debt and the cost of servicing it skyrocketed.

New Zealand has traditionally had much higher interest rates than the OECD average, and is going to head there again soon:

https://data.oecd.org/interest/short-term-interest-rates-forecast.htm

https://data.oecd.org/interest/long-term-interest-rates-forecast.htm#indicator-chart

Look at the long term forecast, it is on the way up, as interest rates are going up in the US, and will also do so in other places, forcing them up here also. Add the due shortage of available credit, given the demand for investment capital here, and that will also urge banks to increase interest.

Nice work. It’s the exact same story in other industries, though. I know of IT companies where migrant labour is exploited in the extreme, employees are made to buy Apple products with their own money in order to impress wealthy clients and portray the company in a certain light – all on below minimum wage. Where workers are hounded hourly by bosses, and verbally abused in the extreme in open space offices if they don’t make targets. The reality is these people won’t stop unless forced.

The most absurd offers of insurance I got were those by a bank, asking me to insure myself from not being able to pay back a loan I took from them. Obviously they failed to ask for such insurance when the loan and credit was agreed on, but once they realised a “risk”, they phoned me repeatedly, asking me to consider the benefit of insuring myself from not being able to repay the debt.

I thought, what idiots and BS artists, what risk was there for me, there was none, the risk was all on their side, and they wanted me to pay for insurance to minimise their own risk.

That is how far they go, these banksters.

What TRIVIA Tali . I mean it’s valid but you’ve missed the giant elephant in the room.

The REAL true insidiousness of what banks do is practice FRAUD.

Most people believe that when you take out a “loan”, banks are “lending” you money.

But this is an illusion. In actual fact your signature conjures up “funds” at the time (electronic digits entered into their books- no less) that did not exist before.

Then you pay them with your labour.(ie working for years to repay them)

On top they charge interest.

Wrap your head around that. The truth is so simple that people can’t believe it.

Put simply- Banks “lend” nothing. They bring nothing to the table. But you pay with your energy spent for years. That is con artistry majeure !

Interestingly there was an article recently in the Herald written by Don Brash expressly to deny this very fact. ( because people are starting to wake up)

I only read newspapers to catch up with the latest bullshit & lies.

Another thing: They make Interest rates go low, people feel confident to take out mortgages …..then, later down the track the interest rates are inflated resulting in mortgagee sales. So banks are also in the business of stealing properties.

And then there are national debts – these are odious & evil, because the masses have (eg) “austerity measures” imposed on them and enslaved for life in misery (- as well as future generations..to pay for loans that are so astronomical with their fraudulent interest added on that they can NEVER EVER be paid off but forever increase, (loans that they had no benefit from.)

Governments are really just agents for the major international moneylenders.(Rothschilds).

This is the naked Truth.

As an aside, banking staff (eg the woman you mention )are not even aware of the true nature of the banking system or who they are working for.

Comments are closed.