My blog on comparing Superannuation with the pittance paid out to the vulnerable via the neoliberal welfare state provoked the usual ‘don’t be mean to boomers, we worked hard’ mantra from our beloved boomer comrades.

Some even suggested that I was falling for a right wing scam to privatise or lower Superannuation, which if you read my column on Superannuation, seems ridiculous.

Cameron Slater went as far as to suggest that because the word ‘riot’ was in the headline, then I must be pushing for violent revolution.

Being lectured by a hate speech merchant like Cameron Slater for figuratively using the word ‘riot’ in a blog is like being lectured by Donal Trump on gender equality and nuclear disarmament.

Beyond the anger of the intergenerational theft and its impact on the political landscape that continues to prop up a corrupt Government to keep the property bubble inflated, what do we do?

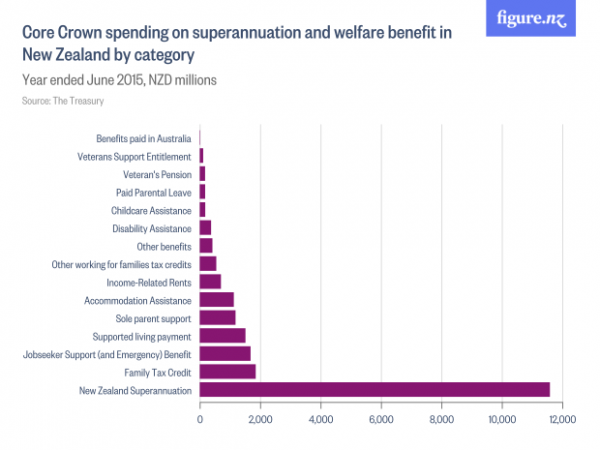

I don’t look at this chart…

…and think, ‘we need to cut back on Super’. Let’s be clear about that first of all. I don’t believe for one second that Super should be cut, I would in fact argue that it might need to go up.

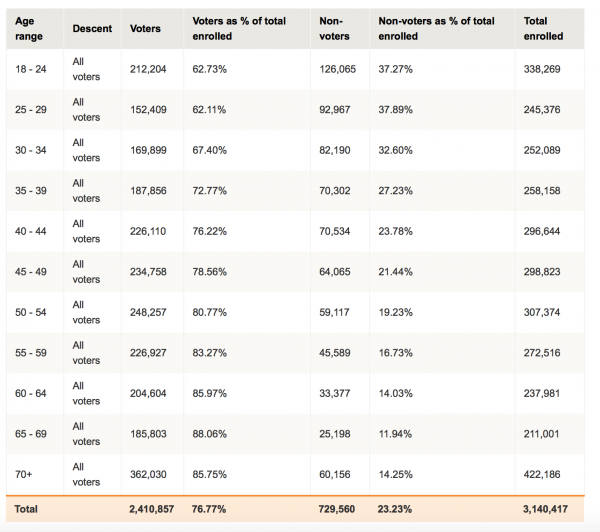

My issue is that we look after the voting old while gutting everyone else and that this leads to a terrible political imbalance where the old land owning class determine all domestic policy. This chart from the 2014 election is terrifying…

The solution? Not to gut the benefits for the old, but to give everyone else the same level of state subsidised support that those who are benefitting most from enjoy.

How do we do that?

It’s obvious.

A Universal Basic Income.

If everyone received a set income from the Government they would all have skin in the game. This would radically change the elections because people under 39 would then see a reason to participate.

We know the future of work is going to see many job loses, we know a UBI would solve many of those social tensions from those job losses. We have a Labour Party and Green Party that have tepidly acknowledged UBI but won’t implement it and even Gareth Morgan from TOP who argued for a UBI in his book ‘The Big Kahuna’ seems too frightened and politically timid to implement it.

For all those beneficiaries who have to grovel on their bellies at WINZ and MoD each month to get the pittance to pay for their day to day costs, no longer would they have to tolerate ‘Carol from WINZ’ destroying their self esteem. No more would they worry that Tolley is throwing them off welfare and forcing them to do menial jobs that might be counter productive for them, and no more would we see the young avoid the ballot box.

How could we afford this? A Financial Transaction Tax, a Robin Hood Tax and legalisation of cannabis would provide all the money to do this and as well respected economist Keith Rankin points out, we could implement an immediate UBI right now.

We need to give everyone within Society the harvest Boomers have enjoyed if that social contract is to mean anything. This is the strength of our democracy, not its weakness and we need to expand this franchise and autonomy of citizenship if this democracy is to withstand the turmoil of our future.

Stefan Molyneux made what I think is the best argument against UBI here:

https://www.youtube.com/watch?v=QxUzTW5dM4o

There haven’t been as many supportive murmurings (actually virtually none!) about people with disabilities/illness and UBI as I would have hoped. I believe that if UBI were brought in the first thing that would happen is that anyone without medical insurance (that was actually paying out what they should) will be screwed.

I don’t think pumping money into the economy causes deflation in specifically medical insurance, would that drag down the whole sector? Or will it be localised?

My read on pumping money into the economy causes inflation. Happy to be corrected.

YES MARTYN A BASIC UNIVERSAL INCOME IS A MUST.

RE-BALANCE THE WEALTH OF THE NATION AGAIN, AND PLACE PURCHASING POWER BACK WITH THE MASSES IS THE BEST WAY TO GO.

“….Carol from WINZ….’ what does that comment mean…. is that your prejudice and bigotory on display again.

Does spending so much time and energy looking at the failings (real or imagined) of others allow you to avoid confronting your own.

Kia ora, glad you noticed ‘Carol from WINZ”. It was my first ride with the term and I liked it. I’ve been wanting to put a face to the Neoliberal Welfare State and ‘Carol from WINZ’ sums up the agony and frustration so many beneficiaries feel when dealing with WINZ, CYFs, Corrections, Parole, Housing NZ. It could be ‘Carol from MoD’, or ‘Carol from Corrections’. Carol is a symbol of the repressive face of bureaucracy that beneficiaries endure. I hope to finish off the core of the piece over the weekend. My concern is less about protecting the neoliberal welfare state and their punitive policies, my focus is more on the lives these departments ruin.

Spin….

If yo had insight you might notice your male privilege, have you ever had a job…..

Job oportunities are limited for many people, especially women, many women prefer to work, even in jobs where non-achieving ‘men’ adopt smug, condescending, arrogant, bigoted, stereotype, attitudes towards them.

Many winz employees do their best despite the abuse they are the target of by non-achievers, with 3 rate degrees in nothing, like you, and of course the abuse from foul mouthed from entitled aggressive no-hopers.

I have never worked at winz but I was a benificaiary for a short time, sure some winz workers were unpleasant but most really were pretty decent, despite the constant lack of respect they live with.

‘Carol’ is likely to find herself stuck in low-level front line roles overtaken by those whose only qualification is having a limp penis.

We live in a world where having a work ethic and being prepared to do public service jobs, sweat for a living or do menial work is sneered at, while being a lifetime beneficiary is praised and admired, in a superior fake way.

It’s not those of us who work in jobs you look down on who are the problem, it’s those who contribute nothing – except self-agradising smug talk.

I bet you spit on cleaners when you use a public toilet as well, you need people to look down on to cover up your own limitations …

Keep sneering and keep supporting the poor in staying poor, without them your would have to confront your own lack of relevance.

Dunning-Kruger…….

We don’t look after ANYONE in receipt of a mite from the government.

Most people in receipt of the ‘lesser amounts’ have the opportunities to make an income at some time in the future. They may not be great but, unless they’ve passed the great glass wall of 45 years OLD, they’ve a glimmer of hope.

The oldies, boomers, post-boomers of the sixties coming toward the seventies, and other, have very little chance of that – even though many are bringing up grandkids, or volunteering in some capacity.

The economy steams ahead, with paper values of property raising rents, rates, utilities. Fake wealth supporting avaricious ambition.

Some people get pay increases, and local government hikes the overheads, as do the utilities providers. Our overheads.

Oldies are on their fixed incomes from now forward. Below adult minimum wage – and they pay out market rates for their rates/rents, utitlities – unless they enter into a Faustian bargain to hand over their property in exchange for income.

Meanwhile – the government can’t manage the local economy, so prices become ridiculous for anyone earning less than what? Seventy, eighty thousand a year?

The worth of savings for retirement become no more than a stingy salary for one year. Genteel poverty. Hidden go without.

Oldies vote. They were raised that way. They get damn’ all as a consequence of that adherence to old ways. Many voted Labour until the Fourth Labour Government’s social upheaval.

Right now 12% don’t vote – and that number could rise. Even the faithful oldies could say, ‘Enough! This is useless!’

This whole faux ‘democracy’ and voting, successive governments’ total inability to do the work they are elected to do, isn’t going to be resolved by indignation or divisiveness. Or the pitiful triennial sop to Cerberus that is ‘elections’.

People made the system. Surely they can devise a better one – not tinker with the real ‘oldie’ – our electoral process and who it benefits.

First of all I am a baby boomer who did work hard (20 years as a shearer among other hard labour jobs) but that isn’t actually an argument to justify giving us “oldies” a better run than the kids. There is something really sick about a society having a retirement commissioner stating that double the dole isn’t enough for “oldies” to continue to live the good life while kids go to school without coats and hungry.

But really, my take is that ostentatious consumption such as winter holidays in the tropics is not a human right nor is it good investment in the future. To expect that lifestyle in retirement is both alienating the “oldies” from society and condemning our kids and grandkids to warming world.

As Philipsen points out in “Little Big Number” if all we measure or give priority to is GDP we get a very skewed view of the world and a very skewed view of the possible or sensible policy choices. We need stop using GDP to claim that we are doing well. With climate change growth is not a good thing, redistribution is.

We can afford to keep both our children and our aged but our aged need to be responsible and not think “after us the deluge”. We,as “oldies”, need to think that we can’t chew through our children’s inheritance, we need to decide it is a good day to move over. Ka pū te ruha, ka hao te rangatahi.

You are correct about redistribution through tobin and robin hood taxes, but we can also use a progressive income tax, which also has the virtue of controlling inflation through bracken creep. By moving away from rewarding foreign savers by controlling inflation through interest rates to using progressive income tax and bracket creep we would allow the NZ government to have much more fiscal choice

Comments are closed.