The pressures from not allowing the 2007 Great Recession to cleanse the corrupt behaviour that caused it has built and built and built.

We are seeing the perverse impact of printing trillions in global bubble stocks and assets and the warning signs that a global backlash is due to rupture the financial markets are wrangling louder than ever.

The conditions are set for a flash collapse, what will be the trigger? A political shock? China? War?

Will Black Tuesday October 29th of 1929 come back and bite Wall Street this year?

Apple collapsing almost 2.3% in extended trading post their uninspiring results at a time when the stock market is looking to burst is grim on the eve of Black Friday.

Another global economic shockwave will be devastating for NZ.

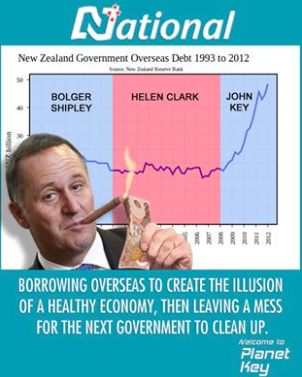

Beyond putting all our cows in a Beijing paddock, rebuilding from a natural disaster and helping fuel the property bubble with lazy immigration, this Government have done sweet FA to help build NZ, preferring to allow their blessed free market to stake out a Darwinian economic survival of the richest.

560 suicides a year, 41 000 homeless, 300 000 kids in poverty, huge domestic violence issues, sky rocketing incarceration rates and the latest i-phone – this is the broken New Zealand that neoliberalism has given us.

The unequal distribution of wealth and unregulated greed of modern capitalism, symbolized by the Great Recession of 2008, has fostered movements which challenge free market capitalism. Brexit, Sanders and Trumpism is the political manifestation of these angry pressures.

The ‘solution’ to the Great Recession of the 2007-2008 has been printing money with zero interest, which has managed to kick the can down the road for America and the half a Trillion China poured into it’s economy has resulted in the pressure’s we are seeing now…

Fear China’s stock-market earthquake

Here’s the chilling thing. What’s going on in China is madly redolent of the 1929 Wall Street crash.Here’s why.

The 150% rise over a year in the Shanghai Composite Index to its mid-June peak was largely driven by investors borrowing to buy shares, or margin trading in the jargon, just as happened in the US during the Roaring Twenties.

And the subsequent self-reinforcing collapse has been driven by China’s indebted investors being forced to sell shares to meet their debts.

As for the economic significance of what is going on, well these very big stock markets in Shanghai and Shenzhen are no longer serving their core purpose of supplying equity capital to businesses – which will have a significant negative impact on Chinese growth.

…the despicable injustice of the wealthy elites looking after their greed is best summed up here…

…and the consolidation of power into the hands of a corporate elite is embodied within the TPPA…

…this so called Rock Star economy has had a terrible impact on the poorest of us while National’s rich mates have prospered. Real political solutions will be demanded by voters who can’t afford to be consumers any longer.

The middle classes voted for Key in 2014, despite the dirty politics, despite the mass surveillance lies, despite his office colluding with the SIS to smear the Leader of the Opposition months before the 2011 election because his policies have continued to push their house prices up and up and up.

What happens when the only reason they are voting National pops and does the Left have the answers and policy ready when it does?

I hope the crash comes before the election, not after it

me also…then Clinton would be gone

The rich always survive in these economic meltdowns… they know how to hide money.

Its always the innocent man or woman in the street who suffer because of the greed and arrogance of others, they loose their home and savings.

Nothing has been learned from 2007-2008 when we came close to the edge of the cliff.

John Key and his government will survive any crash because according to them they are perfect economic managers and kiwis have lost their common sense and political acumen and cant spot fraud and corruption when its right in front of them.

I wouldn’t bet that it would help the left, though I might agree. NZers of today are in a word, spoiled – if the economy pops, they’ll eat the bait that says it’s the poor’s fault.

You wouldn’t want to be in government when it pops the squealing is going to be loud and our half trillion dollars of debt I just can’t imagine what it’s going to be like. I have done everything i can from a personnel level got rid of all debt payed off the mortgage increase saveings Moved money out of the banking system there is only so much you can do, I can see a lot of anger from those who sooner or latter are going to loose everything home KiwiSaver the lot I wouldnt be saying we told you so either its going to be volatile

The IMF has a clean balance sheet in which to roll up all that debt a la 2008. And then the global Great Depression.

Whilst I agree with your general narrative I do not think there will be a market collapse in October because it is almost certain that TPTB will keep the zombie markets alive until after the ‘election’.

I suspect TPTB will print enough phony money via the Federal Reserve to keep the Dow around 18,000 (the level it has been propped up to for the past 6 months) at least until mid-November. Ditto BoJ, ECB, BoE, BoC etc. for other markets. And it would be bad for Christmas retail sales to have a market crash in the peak shopping period. That leaves the end of the year as the earliest opportunity for TPTB to orchestrate a crash.

Longer term none of it will help, of course, because oil, the fundamental resource for all industrial societies, continues to trade at below the level required for most oil companies to be profitable. Brent oil is US$50.30 at the moment, and Shell and BP (and others) are slowly going broke.

http://crudeoilpeak.info/royal-dutch-shells-upstream-earnings-peaked-2008-now-in-the-red

On the other hand, the international price of oil cannot be allowed to rise significantly because high oil prices would rupture the global economy, as happened in 2008. Direct subsidies to energy companies (in addition to historically absurd interest rates) may be the last resort of governments desperate to prop up the system a little longer. Subsidies, bailouts and yet another war. Tried and tested methods that work in the short term and make everything that matters worse.

The progress trap is moving towards its final, inevitable conclusion, with no way forward or back, just off the cliff via overpopulation, overconsumption, resource depletion and environmental collapse.

Needless to say, none of the social issues you have highlighted are of any interest to TPTB, and won’t be until they foment revolution. The point of revolt is still a few years into the future, mainly because most people are completely clueless about everything that matters (or are in denial) and still believe governments act in the best interests of the populace.

I think the derivatives market will crash bringing wall street down with it.

Yes true that, we are in la la land now simply living “above our means” our older generation who lived though two world wars and the major first depression and who listened?????

We were warned but to no avail.

The whole point about warnings is that most people ignore them.

Studies have been done with respect to fire alarms: if an authority figure tells everyone to ignore the alarm because “it’s a false alarm”, then the vast majority of people do ignore it; on the other hand, if an authority figure tells everyone to “evacuate the building immediately”, they do.

Thus we see the background to the ‘perfect storm’ that is on the horizon and is getting bigger by the day: authority figures, such as John Key or media talking heads, insist that NZ is ‘headed for a brighter future’ in which everyone will get rich simply by living in NZ, and that talk of ‘difficulties’ is just scaremongering: people believe the bullshit because they have an intense desire for the phony narrative to be true. Add to that the intense desire of people who have a vested interest in keeping Ponzi schemes running for a long as possible and you soon realise there is no hope for this society. Collapse is inevitable: it’s just the timing of collapse that cannot be accurately determined (though proper analysis of energy resources and environmental degradations provide a reasonably good guideline).

We are subjected to idiotic narratives about NZ having stupendous reserves of coal, oil and gas just awaiting the right moment for development, idiotic narratives about global warming being a myth because ‘it was warmer in the Medieval Period’, idiotic narratives about debts and deficits not mattering, idiotic narratives about house prices always rising, idiotic narratives about solving transport problems with electric cars and electric trucks, idiotic narratives about colonising Mars, and such idiotic narratives will continue until meltdown occurs: anything other than face reality.

‘If you don’t deal with reality, reality will deal with you.’ -Dr Colin Campbell, co-founder of ASPO.

I love all the hype about going to Mars. Gives people a feeling of who cares planet earth is f@#ked, we’re going to Mars. Rumours of McDonald’s speculating property on Mars already.

Yep i agree but the deritives crash is a certainty as all currency goes through Japan to buy the derivatives and as soon as the currency goes the wrong way its all over. Banks will closeup shop for days. Thats it folks no more money…

Sounds like the Natz are trying to drive Transpower into bankruptcy.

Transpower nett profit after tax was $113 million and the Govt bilked it of $166 million in dividends.

The average interest rate on Transpower’s $3.3 billion of borrowing is 7.2%, costing them over $225 million in interest last year.

Looks like Pumpkin Patch has gone under. Another Kiwi company bites the dust – too much borrowing!! So what’s the Natz doing, more borrowing to pretend they know how to run a business when all they know is to run a business into the ground!

NZ economy peaked in 2014/2015. Been in decline since. Between now & the end of 2018-the crash. Especially with the biggest bank in NZ mortgages the ANZ stating twice this year, the shit is about to hit the fan!

i dont think any government will be able to stop a housing melt down.the housing market is out of control and john keys government has gambled with the whole economy.what is the answer to 10s thousands mum and dad soon to be bankrupts who used the roof over there heads as ATM machines fantasy wealth gone but the debt remains consumerism will die with the housing market and with it new Zealands dependency on the fire economy

Superb post. Never knew this, appreciate it for letting me know.

Comments are closed.