.

.

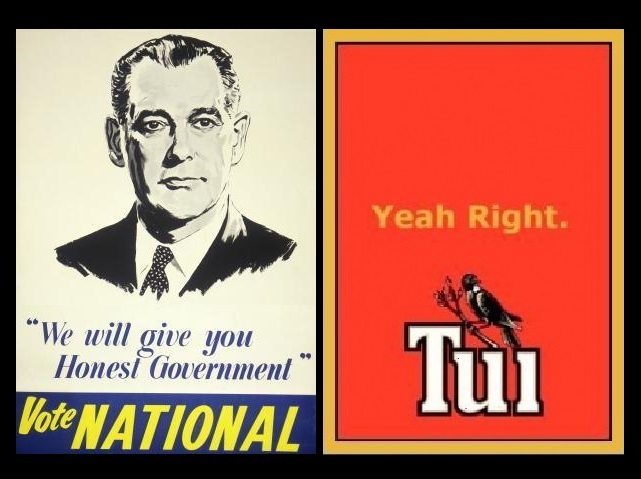

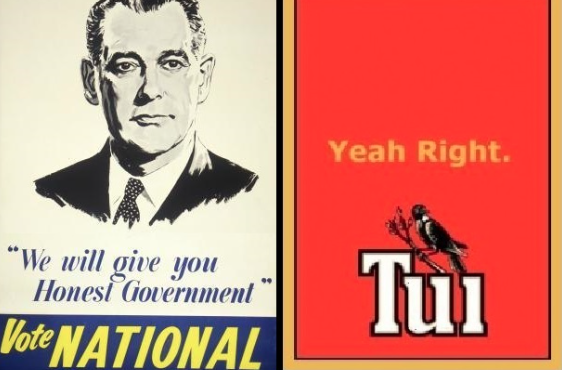

National Makes Good on 2008 Threat to Sell Kiwibank

NZ Post’s, announcement on 6 April that it intends to sell-down 45% of it’s subsidiary, Kiwibank, appears to make good on Bill English’s inadvertent threat in August 2008 that Kiwibank would “eventually be sold”.

English was secretly recorded by an un-named person during a 2008 National Party Conference, and encouraged to talk freely on the prospect of selling Kiwibank;

.

.

English subsequently complained; “I did not choose my words well“.

However, it now appears that English expressed his words honestly, disclosing a secret agenda to sell Kiwibank to someone he believed was a loyal National Party apparatchik.

Another secret recording, this time from National MP Lockwood Smith, also hinted at a secret agenda held by National;

“There’s some bloody dead fish you have to swallow, to get into government to do the kinds of things you want to do. Once we have gained the confidence of the people, we’ve got more chance of doing more things.

We may be able to do some things we believe we need to do, perhaps go through a discussion document process. You wouldn’t be able to do them straight off.”

Both English and Key issued public statements resiling from any intention to sell Kiwibank;

“It’s not my view. It’s not my private view. I simply used loose language – I made a statement I shouldn’t have.” – Bill English

“We would never make a change to that decision without a mandate.” – John Key

Again in 2008, Key resiled from any sale of Kiwibank;

“I’m ruling out selling Kiwibank at any point in the future.”

And again in 2010,

“National would not sell Kiwibank at any stage, ever. We have ruled it out.”

Making a Promise

On 25 February 2014, our esteemed Dear Leader, John Key, announced to the nation that National’s asset sales programme was over;

.

![“Just as we did before the last election we’re making our position on share sales clear to New Zealanders before we go to the polls later this year. We’ve achieved what we wanted with the share offers in energy companies and Air NZ. We’re now returning to a business-as-usual approach when it comes to [state-owned enterprises]. The truth is there aren’t a lot of other assets that would fit in the category where they would be either appealing to take to the market or of a size that would warrant a further programme, or they sit in the category that they are very large like Transpower but are monopoly assets so aren’t suited.”](https://fmacskasy.files.wordpress.com/2016/04/john-pinocchio-key-1.jpg)

.

Two years and nearly two months later, and Key’s promise- like so many other committments he has made – appears to have been watered-down to permit a de-facto partial-sale.

The intended purchasers would be two other SOEs, NZ Superannuation Funds (25%) and ACC Funds (20%);

.

.

Breaking the Promise

Even as NZ Post’s Directors were announcing the partial sale of their subsidiary, Kiwibank, Finance Minister Bill English was engaged in some well-rehearsed damage-control.

No doubt with considerable prompting by Party strategists and media-minders, English reassured the public that National would not allow the people’s bank to end up in private ownership, as the former Postbank did February 1989 when it was sold to the ANZ Bank.

English promised;

“Kiwibank will remain 100 per cent government-owned – that is a bottom-line. To ensure this occurs, the proposal includes a right of first refusal for the Government over any future sale of shares – which we would exercise.”

However, in reality there is no guarantee that either of the two SOEs will not on-sell to a Third Party. As in the past, English and Key could easily find ways and means to circumvent their committment to exercise a “right of first refusal” to buy-back the shares. “Bottom lines”, along with other inconvenient promises, rapidly end up discarded – as Key’s promise in 2008 not to raise GST showed us. Or his 2008 and 2010 promises never to sell Kiwibank.

National has already gone back on it’s word to end it’s privatisation agenda. First by the gradual sell-off of Housing NZ properties, and now the partial sale of Kiwibank.

To be blunt, National cannot be trusted to keep it’s word.

Key knew in advance!

Despite Key’s committment to end asset sales on 25 February 2014, it appears from Michael Cullen’s own statements that our esteemed Dear Leader was already aware at around the same time, that a partial asset-sale was being planned by NZ Post.

During a video-taped press-briefing by Fairfax media, Cullen admitted that he and Key had discussed the partial-sale of Kiwibank that year (2013/14).

@ -14.56

“So Brian [Roche] and I after discussion, and [I] think I remember correctly, I had a brief discussion with the Post Board, went to see the Prime Minister, to see whether there would be a kind of visceral reaction from the government, as our ultimate share holder, to that happening. That was not the case. Mr Key indicated he was very comfortable with that prospect and on that basis therefore we began to proceed...”

So when Key made his public promise on 25 February, 2014, that National’s asset sales programme was over – he was making that committment whilst knowing full well that the partial sale of Kiwibank was already underway.

Broken promises and secret agendas – this story has it all.

Who Pays? Loyal Kiwibank customers do!

There is a hidden cost to the partial-sale of Kiwibank.

As David Hargreaves from Interest.co.nz reported;

The move could see Kiwibank’s credit rating slip by one notch from the current A+ to A as NZ Post will likely not guarantee Kiwibank’s future obligations once the deal proceeds.

When a financial institution’s credit rating is reduced, it means (generally) that they become a greater risk of lending money to them. According to Investpedia;

“…While a borrower will strive to have the highest possible credit rating since it has a major impact on interest rates charged by lenders, the rating agencies must take a balanced and objective view of the borrower’s financial situation and capacity to service/repay the debt.

A credit rating not only determines whether or not a borrower will be approved for a loan, but also the interest rate at which the loan will need to be repaid.

… and a high interest rate is much more difficult to pay back.”

It is entirely likely that when a credit down-grade occurs (as happened to New Zealand under National in September 2011), the cost of borrowing funds will increase for the bank.

Which is precisely what Hargreaves reported;

Standard & Poor’s has indicated that following the announcement of the proposed transaction, Kiwibank’s long term issuer credit rating (A+) will be placed on credit watch negative pending the proposed termination of the standing guarantee provided by NZ Post. Should the guarantee be terminated, Standard & Poor’s has indicated it will result in a one notch downgrade to Kiwibank’s long term issuer credit rating (from A+ to A).

That cost will either have to be absorbed, reducing their profit margins and making it easier for Key and English to justify full privatisation – or will be passed on to the banks customers.

English will most likely not permit Kiwibank’s profit to fall as that would mean lower dividends paid into government coffers.

Which leaves Kiwibank’s Mum & Dad customers to foot the bill for the partial-sale.

The Agenda #1

The sale to ACC and NZ Super Fund is a clever ploy. On the face of it, Kiwibank remains in wholly State ownership, albeit shifting it’s shareholders around, from one SOE (NZ Post) to three (NZ Post, ACC, NZ Super Fund).A kind of multi-million dollar Musical Chairs.

At the same time, this would allow a healthy dividend payment (an amount yet to be disclosed) to be paid to the government. As Cullen said on 6 April;

“The proceeds would allow New Zealand Post to invest in its core parcels, packages and letters business and pay down debt. It is anticipated that a special dividend would also be paid to the Crown…”

This was confirmed a day later by Bill English speaking with Guyon Espiner, on Radio NZ’s Morning Report;

@ 2.10

Guyon Espiner: “Ok, let’s look at what happens to the $495 million that NZ Post gets from this sale. I understand it doesn’t go to generate any extra capital for Kiwibank, it goes to NZpost to pay down debt and invest in it’s parcel and mail business, right?”

Bill English: “That’s right, and then if there’s, subject to negotiations there may be special dividend passed back to this [inaudible] government.”

English said any dividend payable to the government would “likely be several hundred million“. This would prove a godsend to English who otherwise would be struggling to create another Budget surplus in his May budget.

The Agenda #2

National has not only increased it’s revenue, thereby alleviating a major headache for Bill English, but they have pulled the rug out from under the Greens who, three days earlier, had been calling for increased $100 million investment in Kiwibank. As Greens co-leader James Shaw stated in a recent policy announcement;

“Our plan will help Kiwibank lead a change in New Zealand banking, by giving it a clear public purpose that requires it to drive competition to generate better interest rates for New Zealanders.

We’ll help Kiwibank to grow faster by injecting $100 million of capital into the bank and let it retain more of its profits.

Strengthening Kiwibank so it can create competition in the banking sector is the smartest way to ensure all banks pass on the best interest rates to Kiwis.”

A deeply cynical person might suspect that after the defeat of John Key’s pet vanity-project (the recent flag referendum debacle) that National has decided to exact revenge against the many Labour and Green voters who voted to retain the current flag, by partial privatisation of a favourite state owned enterprise.

Does such cynicism border on paranoia? In an era of Dirty Politics; tax-havens with trillions hidden away; and increasingly corruption of state leaders, officials, organisations, and institutions – the demarcation between healthy scepticism and paranoid fantasies blur, merge, and are tomorrow’s headlines waiting to be made public.

Labour’s Response?

Labour and the Green Party both responded to Cullen’s announcement. As Stacy Kirk wrote for Fairfax Media on 6 April;

The response of opposition parties has been mixed, with the Greens calling it a step down the path of privatisation.

Labour leader Andrew Little said it was important Kiwibank stayed in public ownership.

“And this does that, there are some good conditions around it,” he said.

“This provides a way to get extra capital from these sovereign wealth funds, and hopefully for NZ Post to use the funds that they raise from the sale, to put more capital into Kiwibank.

Meanwhile, Labour Party state-owned enterprise spokesman David Parker said Cullen should be congratulated on the idea.

“Michael Cullen should be congratulated for securing a route to expand KiwiBank and keep it in public ownership, given the refusal of National to provide more capital for NZ Post or KiwiBank.

“Michael Cullen’s solution only works to ensure the bank will remain in public ownership if National promises that if ACC or the Super Fund sells its shares, then the government of the day would exercise its first right of refusal and buy them back.”

Labour’s response has not only been weak and naive – but it also appears that David Parker is not “up to speed” with the terms of the sale. It is extraordinary that both Labour’s SOE Spokesperson, David Parker, and Labour’s Leader, Andrew Little, believe that;

“This provides a way to get extra capital from these sovereign wealth funds… to put more capital into Kiwibank” and that “Michael Cullen should be congratulated for securing a route to expand KiwiBank”.

Nothing of the sort will happen.

Both Cullen and Bill English have been crystal-clear and surprisingly honest in stating that;

- “The proceeds would allow New Zealand Post to invest in its core parcels, packages and letters business and pay down debt.” “

- “It is anticipated that a special dividend would also be paid to the Crown.”

- Kiwibank will get nothing.

So where Parker and Little get their cozy ideas about “putting more capital into Kiwibank” is unclear.

Instead, Green Party co-leader, James Shaw, seemed more cognisant to National’s real agenda;

“The fact is the Government forced Kiwibank’s hand and today’s announcement will make it easier than it was before to move Kiwibank into private ownership.”

Labour needs to get it’s act together on this issue.

The future of the people’s bank depends on it.

As for the mainstream media, it is high time they became aware of the many promises made by both Key and English – and their subsequent breaking. Otherwise, they too are failing the public.

National, in the meantime, has carried out the perfect bank “heist”.

It only took eight years to accomplish.

.

.

.

References

Fairfax Media: NZ Post to sell 45 per cent of Kiwibank for $495m cash injection

NZ Herald: English – I didn’t choose my words well

TV3 News: National hit by more secret recordings

Fairfax Media: Facebook Video – NZ Post to sell 45 per cent of Kiwibank for $495m cash injection

NZ Herald: PM pledges not to sell Kiwibank after all

Faifax Media: Key – Why I should be the PM

Otago Daily Times: Key not ruling out Kiwibank sale in future

NZ Herald: PM – no more SOEs to sell after Genesis

Fairfax Media: Key ‘no GST rise’ video emerges

NZ Treasury: Income from State Asset Sales as at May 2014

Interest.co.nz: NZ Super Fund and ACC proposed as new minority shareholders in Kiwibank

Investopedia: Credit Rating

NZ Herald: S&P cuts NZ credit rating

Radio NZ: Bill English – Kiwibank will stay 100 percent New Zealand-owned

Green Party: Greens will repurpose Kiwibank and save Kiwis hundreds of millions

Additional

Fairfax media: Kiwibank tape catches English

Scoop Media: Bill English Talks On KiwiBank Being Sold (audio)

Other bloggers

No Right Turn: Plunder

The Daily Blog: KiwiBank another privatisation by stealth – Robbing Fred to bribe Dagg to pay John

The Dim Post: A fascinating precedent

The Standard: Kiwibank sale to NZ Super, ACC privatisation by stealth

Previous related blogposts

Westpac, Peter Dunne, & Edward Snowden

The Mendacities of Mr Key # 12: No More Asset Sales (Kind of)

.

.

.

.

.

= fs =

Lovely “Lefty” Mr Cullen, nicely doing the dirty work of the Key government. Look no further for a reason why for 9 years under Helen not one iota of Douglas structural deforms were rolled back. Does it all come down to, “Its OK for Labour to do the neo liberal thing nicely, far more nicely than those nasty Nats”? Its still doing the neo liberal thing though.

Excellent investigative reporting there Frank brilliant.

This shows how this ruthless agenda within this “Corporate key” clone is working to destroy our assets for making us future tenants of our own country as they did to Greece bit by slowly until gone.

Hang them high or bring back “Madam Guillotine” and cut their heads off its about that time before we are all left hanging folks.

We need some kiwi solutions to NZs economic woes.

Excellent background reporting as always, Frank. This is what is missing from our MSM!!

It seems that Bill English has been planning the sale (more like THEFT!!) our own bank for the last eight (longer??) years. New Zealanders will be a sorry bunch if we allow this to go ahead. It will eventually mean less competition, higher mortgages and higher bank account fees. Just like what happened before Kiwibank was set up.

This is thievery, pure and simple.

If this sale goes ahead, I’m looking at moving my account and mortgage to the Co-Operative Bank.

As usual, outstanding investigative reporting from you, Frank.

The way you look back through recent history to put current events into context is a gift!

Frank is an asset we are proud to have in our camp alright PRISS.

Sorry Frank, I hit the four star instead of the 5 star by accident in the rating. You are fast becoming one of my favourite bloggers here. The research, as always, is fantastic.

I need to add, when I site your work in conversation, it always help people see a wide truth.

“The Agenda #3

A deeply cynical person might suspect that after the defeat of John Key’s pet vanity-project (the recent flag referendum debacle) that National has decided to exact revenge against the many Labour and Green voters who voted to retain the current flag, by partial privatisation of a favourite state owned enterprise.

Does such cynicism border on paranoia? In an era of Dirty Politics; tax-havens with trillions hidden away; and increasingly corruption of state leaders, officials, organisations, and institutions – the demarcation between healthy scepticism and paranoid fantasies blur, merge, and are tomorrow’s headlines waiting to be made public.”

Already made it into conversation with people with a lot of head nodding. So again, thanks Frank.

What is going to happen is that we will sell Kiwibank to ourselves. The government will take the purchase price and pocket most of it then pass on a small amount to NZ Post which, in effect, is simply located in the same building. The nominal “ownership” of Kiwibank by New Zealand Post is just a convenient fiction. but what is sure is that none of the money will be used to rehydrate Kiwibank.

The hope on the Left that Kiwibank might one day grow to the point of competing fairly with the corporate Aussie trading banks consequentially recedes even further. One more victory for the Neos.

[…] blogpost was first published on The Daily Blog on 11 April […]

Any word from Jim Anderton on this? Either out loud or tersely to Michael Cullen…

Andrea, this is all I could find. Jim Anderton on Radiolive – http://www.radiolive.co.nz/KiwiBank-needs-capital-to-compete—Anderton/tabid/506/articleID/117977/Default.aspx

The comment was made on 6 April – the same day as the announcement. Anderton has some of his facts wrong – none of the sale proceeds will go to Kiwibank as capitalisation.

Also this on National Radio

http://www.radionz.co.nz/national/programmes/thepanel/audio/201796181/kiwibank from Radio New Zealand.

When you borrow borrow borrow and spend spend spend you eventually sell sell sell. Not his fault he was told to.

Just read this on Boingboing. Chilling stuff and why I would, if I were Superman, boot the banks out of Aotearoa/ NZ.

The Global Criminal Economy.

http://boingboing.net/2016/04/11/its-the-criminal-economy-st.html

No, seriously, you should read this.

Goldman Sachs told Key to wreck our economy and force us like Greece was, into complete submission, so Key has almost achieved his task.

Robbing Peter to pay Paul. Nothing achieved at all. Leave Kiwibank alone.

Great work again Frank.

re. Key… how the …. does he poll so high?

Comments are closed.