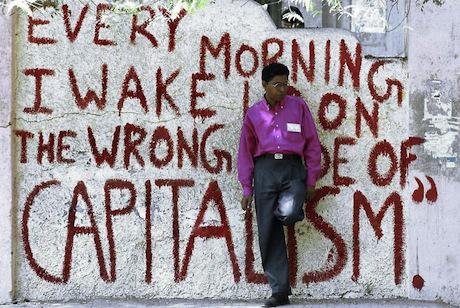

In the world of economics there are no crises, no gender issues, no growing inequality, no precariat hanging on in a fragile labour market by their toenails. No families ‘choosing’ to be cold and sick so they can pay the rent, no mothers sent to jail for infringing 19th century rules, no children spluttering up sputum from 3rd world diseases because our housing is so bad ,no inconvenient hungry students with enormous debt .

Thus it was this week on Monday at the 13th annual economists breakfast at the Heritage hotel in Auckland. Economists after economist pontificated on whether interest rates and exchange rates are going up or down and why and the virtues of quantitative easing that didn’t happen soon enough, apparently, except in the US. Never a mention of fiscal policy, except the bad effects of increase in GST in Japan undoing their monetary policy easing. There were no insights into the Chinese sharemarket crash that hit the headlines a few hours later with shocks now reverberating around the world. Shocks are random or exogenous in the workings of the economists’ models, of passing interest, rather than a systemic and inevitable outcome of a flawed neoliberal market system.

And, of course, there was no mention by the economists of high rates of poverty, , casualisation, low pay and uncertain hours, rampant speculative activity in real estate and growing inequality, even though the IMF and the OECD are regularly warning of the dangers.

As after the collapse of the sharemarket in 1987, the economy and economists are badly prepared for the knock on effects in property markets both here and abroad. When the inevitable downturn produces higher unemployment, more foodbank demand, foreclosures and widespread mental illness, who asks or cares whether the economic system works for low and middle income people and their children?

Actually, it is not working for them now, when times are relatively benign. One of the more tragic stories of this week is the NZ Herald expose of how young families are faring in the world of work . The incomes of many parents are not enough to pay their mortgage or rent so mothers must go back to work even when they have babies or toddlers under three. The article explains how after childcare costs and various losses such as repayment of student loans and loss of working for families, housing and childcare subsidies, families can actually be worse off.

What these cases show is the flaw in the popular mantra that paid work is (always) the way out of poverty. Ironically the answer is usually seen in demanding yet more and more taxpayer money for childcare and out of school care to ‘make work pay’. Some are arguing for longer and more generous paid parental leave, also funded by the taxpayer. So paid work has to be is made to be the way out of poverty by the state chucking a huge amount of money at it. Otherwise neoliberals might have to rethink the mantra?

Here is the tragic bit. Listen to what the mothers are saying:

“The more I earn, the less Working for Families [tax credits] we get and our childcare subsidy is also decreased, therefore I’d be going back to work for diddly squat and also giving up precious time with my children,” wrote Danielle Fletcher from Gisborne.

…even if Mrs Jones could gross $50,000 a year from fulltime nursing, the Herald estimates her family would end up less than $70 a week better off – and, she says, “I would lose time with my tiny, gorgeous baby who is only 2 months old”.

Their very young children would probably be saying “Please, please don’t leave me long hours at daycare it is not good for either of us”

Here is the underlying problem. The value of a mother’s unpaid care of young children in the home is invisible. But what looked costless, is made visible when she goes back to paid work and must pay huge fees for the outsourced child care each week.

If the taxpayer must subsidise the care of her children for her paid work to be viable then paid work has been oversold. It feeds the idea that taxpayers must pay more to make her work pay because work is such a good thing. But she also gives up the breastfeeding and the enjoyment and crucially important bonding with her baby for the bondage of a stressful paid job with a pile of added costs. To add insult to injury, even with expensive subsidies, her paid work doesn’t actually make the family much better-off after all.

Does New Zealand really need the labour of women with very young children so desperately that it justifies expensive subsidies for someone else to look after her children for such long hours? What if we paid her some of those childcare subsidies so she could feel she could stay around for her children until they were at least three? That would make the best interests of baby or toddler more central. If she needs childcare she can use some of that money to outsource the care but will do it only if it is sensible and viable.

In the meantime, this week, Labour’s paid parental leave extensions are being argued in parliament. Funded by the taxpayer to the tune of $500 million, 6 months of paid parental leave recognises the needs of young babies for mothering, but only for under one half of all new borns. Even Treasury has long argued that this payment is not a good tool for addressing income adequacy for all families with newborns. Parents of babies who miss out or get the very limited parental tax credit if they are lucky are just as worthy of having their caregiving role recognised with a payment.

So what about taking all the payments made to mothers on account of their babies – paid parental leave, parental tax credit, in work tax credit and childcare subsidies and make it a decent payment to all mothers for at least the first year of the child’s life? Small steps back from the neoliberal abyss but worth taking.

No, I can’t go along with that.

There needs to be a clear distinction between those who are demonstrating that they understand the fundamentals of looking after themselves and their dependants by doing their best to (financially) face up to the consequences of their own actions, and those who may choose to try to make a career out of having kids.

Paid parental ‘leave’….leave from employment. ‘In work’ tax credit… In work. self explainitory. Parental ‘tax credit’….it would be nice to think of the recipient for this handout as being a net tax payer receiving a refund in the form of a credit. And as for childcare subsidies…are these any more than a mechanism for setting the cost of childcare?

A “handout”?

You call financial assistance to families raising children (the next generation of citizens and taxpayers), “hand outs”?

So what do you call tax cuts for the rich, Mike@NZ?

How about the $12 billion we hand out unconditionally to those over 65, no questions asked about whether they have been feckless all their lives.

Good point. The only fair system for superannuation schemes is to pay money out on a pro rata basis according to their level of previous contributions.

No, that’s not fair. Because it ignores all the unpaid work done (primarily) by women. All that childcare, and all that care for aged relatives at the end of their lives. It’s unpaid.

It also means the differential between average incomes for men and women is continued into old age. Men will get more because they earn more and do less unpaid work. Women will get less because they earn less and do more unpaid work.

Yet in retirement women don’t necessarily need less to survive.

A Universal payment to all, not based on gender but equal for all is fair.

Typical socialists…always a slave to the mighty dollar!

It also looks like you have answered Susan St John’s comment/question perfectly, although I think it is a bit harsh of Ms St John to refer to those women who have it their life’s work to busy themselves with voluntary, lower paid, domestic and child raising work as “feckless.”

Quite right Mike.

“Feckless” is more appropriate to the likes of you…

Oh yes, here we go with the personal insults.

Very mature Mr Bark, very mature

Mike

you dont do irony?

So the rich get more, and those who couldn’t afford any level of contribution – they get nothing?

That’s quite a dark, grim world you’re suggesting, Mike@NZ.

The irony of course, is that the society which nurtured you was never quite so crude. New provided you with services irrespective of your ability to pay (once upon a time).

Ok, well if you don’t like that idea, then let’s go full circle back to Susan St John’s reference to the present system of handing out 12 billion to those over 65, no questions asked about whether they have been feckless all their lives.

We’ll just have to agree that I won’t complain about the ‘feckless’ and helpless getting money out after putting nothing in, while you must refrain from comment when the financially well-to-do draw a pension after a lifetime of contribution even though they really don’t need it.

I don’t believe I’ve ever suggested such a thing.

I fully believe in Universal Super, with progressive taxation, CGT, and FTT, to claw back state transfers to those who don’t require it.

As was pointed out today on TV1’s Q+A, and by others many times in the past, targetting superannuation;

(a) costs more to deliver because it involves a bureacracy to manage it,

and

(b) can be avoided by skilful manipulation of assets and incomes and accounting tricks (eg; family trusts).

With over $6 billion in taxes evaded by the rich and corporates (http://www.stuff.co.nz/national/politics/9037885/Welfare-debt-tackled-more-than-tax-fraud) it is no surprise how targetting can be an expensive waste of time.

Perhaps if you focused on sensible (and fair) taxation policies rather than indulge in neo-liberal fantasies, you might be taken a bit more seriously.

…and a lot less rudely! 🙂

Tax cuts are not a handout Frank as you are being handed nothing from the government, just being allowed to hold on to your own money. I realise it is a hard concept for a left winger full of entitlement to understand.

Use this analogy Frank, a burglar that comes into your house a steals half your property is not being generous by giving you some of your items back, he or she is still taking from you.

Hopefully this simple explanation should get through to you.

No, Stephen, it’s theft from society which then suffers less spent on education, health, housing, and now, it seems, a poorly funded CYPF.

Your burglar analogy is therefore rubbish.

Yeah, most of his analogies are rubbish Frank.

The other one the right wing dodecahedrons like is “The Little Red hen”.

I guess kids’ books are more their style… (Yawn)

“I realise it is a hard concept for a left winger full of entitlement to understand.”

Spoken like a true Self entitled right winger….. Bigotry based on rank transference seems to be a basic building block of the tory narrative.. The level of stupidity required to give credence to such drivel is difficult to fathom for those of us who prefer real world realities….

I assume you understand, and support the lardge percentage of the 4billion dollars handed over to the top earners going overseas to bolster the already large investments held by these people…. None of that money is ever going to “trickle down” through the Nz economy, or attract any tax, gst or otherwise… The tax cuts were an act of economic sabotage that have hamstrung the whole economy, and will continue to do so for as long as they exist…..

If a wage earner receives $40000 per year he pays approx. $13000 income tax. If he earns $150000 he pays approx. $33000 income tax. There is no logic to that, only a mathematical equation that magically shows an entitlement to the state of one third of a wage earners income. No burden of proof, no evidence of the higher earner somehow costing more for the state to maintain. Just a ‘you earn more so you owe more’ mentality.

I think that in the case of income tax (and rates on property for that matter) the real sense of entitlement mentality comes from the state and those who make a living exploiting it.

The taxes pay for all the services that you enjoy Mike@NZ: transport, education, medical care. A report from the Serious Fraud Office highlighted the fact that $19 BILLION dollars of tax revenue go unpaid every YEAR in NZ. The corporations and the people on the rich list are bludging from the salary and wage earners, not the beneficiaries.

That may be your opinion Tuan, but my point is where is the justification for demanding $13000 out of the wages of Mr $40000 but insisting that Mr $150000 ‘owes’ $33000 (actually that figure should be more like $50000, I miscalculated). He is still only one person, still uses only one persons share of the services you describe, but is expected to pay 3 times as much.

The sad irony is that Mr $150000 probably drives a more ‘earth friendly’ car, buys his own health insurance, pays considerably more than most for his family’s education and saves for his own retirement, yet is still referred to as greedy and is expected to pay ‘his share.’

On this reasoning the only “fair” tax would be a poll tax, ie everyone pays exactly the same amount. Good luck with that.

Yep, you’re on to it. It would also stop the practice of punishing success.

“Punishing success”?! *facepalm*

Parroting cliches hardly wins your argument, Mike@NZ.

Mr or Mrs $150000 is more reliant on the Government services (Police, Health, Roads, Education etc) to provide the environment where they are able to extract that amount for themselves. If its good enough for God to set a percentage for his followers then Governments should have the same ability. Up to 33% PAYE is higher than 10% but if all the people in a country were honest then Government expenditure could be substantially reduced.

How do you figure that Mr $150000 is more reliant on government services?

Gods percentage for his followers is the same percentage for all his followers, ie, a flat tax, which is my point.

A “flat tax”?

No thank you, Mike@NZ. Such a thing is unfair on those who earn the least, and increases the wealth and privilege of the riches 10%.

You wrote about “punishing success” – a flat tax punishes poverty.

The flat tax concept is ACT policy. There is good reason why that failed Party attracted only 16,689 (0.69%) Party Vote in last year’s elections. It is the Party for rich old white men, and screw everyone else.

So what’s your role with ACT?

I have no role, and have never had a role, directly or indirectly, in any political party.

…what’s that fishy smell?

Yes, I do refer to it as a handout.

What would you rather I refer to it as Mr Macskasy….income earned?

Susan, thank you for your erudite piece. We are all in this together, this appalling mess that is the result of successive governments embracing neo-liberalism and stomping on the poorest.

Mike how many people do you seriously think are making a career out of having kids? come on please give me a figure.

Some years ago a minister of finance said there were women out there who had 10 kids by 10 fathers. The reality was there was apparently 1 woman in this situation. Talk about a beat-up.

What you and the Hoskings, Henry and talkback hosts continually put forward appears to be that only the well off should have children. These kids will as Frank says all become taxpayers one day.

NB :

The rock I mentioned was about 3.5 meters tall and about as wide in a rough Isosceles triangle weighing several tonnes.

The mansion …as it were…was designated as a residence for entertaining business colleagues, and as such…was a tax write off.

Food for thought on just how much we let these neo liberals get away with their bogus theories and claims about how we should pay these characters exorbitant salary’s ‘because its in keeping with overseas trends’…

Well we’ve since had 2008 …and those self same self appointed pirates nearly sank the global economy…

I think its time we did indeed have an inquiry as tho the rorting that’s been going on since 1984 , quite frankly.

Mike

Do you think paid parental leave is justified because it is leave from employment? Are the in work tax credit and the parental tax credit justified because they only go to parents in work? So if she is at home on paid parental leave and the in work tax credit courtesy of the tax payer that is fine even if she never goes back to her paid work. 15,000 other babies get get no extra payment of any kind. Dont all babies need a mother for these early months, or do you want to punish the worst off babies because in your judgement the parents are :making a career out of having kids”.

1) In my opinion Paid Parental Leave cannot be justified in any circumstances. It is not the taxpayers job to pay to raise other people’s children, especially the children of those in paid employment.

2) Tax credits are as the name implies, a tax credit. They are a refund of monies earned by and paid by the taxpayer. That said, the whole system is a dogs breakfast of politically motivated voter bribes and they all should all go anyway as the risk of fraud and exploitation is too high as evidenced by your example.

3) Do all babies really need a mother at home full time? My wife took a break from the workforce to raise all of our children to 7 years old and we are all for it, but if a mum at home full time is the best thing, we would be seeing evidence of (your example of) 15000 babies and the children of the worse off absolutely excelling at school and in the workforce from the experience of being raised by a stay at home mum. Maybe it is more about access to resources, parent/child engagement and educational and personal achievements of the parents than about purely financial means.

” Here is the underlying problem. ” you say @ Susan St John and go on to explain . Reading the above puts me in a murderous frame of mind.

This is my idea of the underlying problem.

Thersa gutting openly lied to us when selling Telecom to two American telco’s at a fire sale price . The liars who defend their profits from other swindles which saw OUR assets sold off for their profit and in the absence of our assets, we suffer.

As that money, peanuts in real terms swerved drunkenly, through various cunning plans hatched to see alan gibbs, michael fay , david richwhite, ron brierly etc etc etc become ludicrously wealthy, our off-shore receivers of stolen goods become ever more wealthy on a day to day basis .

Here’s the real “ underlying problem “ @ Susan St John.

We allowed them to do it to us, we allow them to continue doing it to us and we seem powerless to stop them.

A question I would like to ask is how come no well educated , well healed , well informed person has come forward with a solution to our hypnotic state exemplified by our complete compliance and eager yielding to a few sociopaths who’ve made off with our stuff and things ?

Never mind the bullshittery of trying to work around things . Take the fuckers OUT ! And before all you quisling cops and other snoops and obeyers of the orders of your crypto-fascist masters get all faux concerned about my anti social remarks remember this . You are there for US ! NOT THEM ! You should be on our side . Come on over to US and help us sort this fucking nightmare out.

Our ‘ government ‘ needs to be dissolved , an inquiry needs to be conducted, and charges need to be laid .

That’s where the focus need to be brought to bear. Not continuously pointing to the problem. We know what the problem is ; that a cadre of swine have swindled you and I out of our stuff and things and have created monsters out of our wonderful other humans. The focus should be on how to drag their arses out of our parliament buildings and get our shit back.

Lets talk about that? And for Gods sake, bring the cops, the SIS , SAS etc over to the fold. Or they will fuck your shit up and they are not your enemy.

Yes….back in the early 1990’s …I was working as a painter..in the South Island, Queenstown no less…and along with the head cheese of Mace, there was Richewhite…

I pulled up in my van and his wife says…look at it !! look at it !!..in reference to my 12 month old son…my wife wasn’t impressed… she also had a about a 4 meter rock in the front garden shifted by increments of about 75 millimeters shifted about 8-9 times…

Now…that didn’t worry me too much…but they had antique furniture dating back to the 16th century inside…which belonged in a museum not in that bloody great tax write off… they also had German made lavatory’s worth $9000.00…to which I felt dutifully obliged throw my cigarette butts into…

I recall also his wife saying as the place was full of builders activity on the phone ” we should have gone to Fiji instead”…nice for some in that freezing place while we worked on low wages…

The floors were centrally heated schist …a local rock from that area…the mansion…which would have fit 2-3 the average size suburban bungalow’s inside them…had meters of cedar wood Venetian blinds – all of which had to polyurethaned…

But what really got me as I was struggling to support my wife and child in a rented Queenstown sleep-out on a painters wages…was one time when Richewhite senior said to a mob of young teenagers /20 somethings who were obviously his sons and sons mates:

”Lets go down and buy McDonalds…”

To which they all laughed. That gave it away .

They took the joke.

To not get hamburgers …but to buy the local McDonalds franchise.

This was during the early 1990’s….and not long after the Employment Contracts Act was lobbied by the then Business Roundtable and endorsed by the neo liberal politicians of Bolgers Govt…

And you ask me why I despise neo liberals so much.

Let that sink in a bit.

Don’t worry yourself too much Countryboy, if it’s State ownership and control you’re after, at least we still have Kiwirail.

Which might not be in the parlous state it is now, Mike@NZ, had it not been sold to Fay & Richwhite in the first place. They gutted the asset and then sold it off.

The buyer probably deserves a mention as well. Yep….file that one in the ‘total economic incompetence’ pigeon hole, right next to the ‘seriously stupid ways to spend other people’s money’ slot.

Or in your case – and the case of your fellow neo liberal mates – the lies that need to be told in order to cover up the stealing , rorting and raping of a country accompanied by the theft of other peoples money.

There….that seems more balanced now , doesn’t it , arsehole.

Unlike Frank and many other good folk on this blog you will find I am a tad less polite and a little more blunt about things at times.

And I don’t truck snide bastards like you at all when you can tell they’re just trash talkers.

True that!

Well said Mr Pungawerewere. 🙂

There is almost no recognition in any subsidy for childcare of the huge contribution that many women like me who worked in family-owned businesses have made and continue to make to our economy. A lot of this work is done in smaller areas where there is no childcare, or on farms where the children are taken with the worker on the job. I raised four children while running the office of a busy rural business and no childcare assistance nor housework assistance. Childcare help would have been invaluable at busy times. There must be mums like me still doing this in similare places. My youngest child spent 4 years being taken to work or sitting in the car while I did the banking or deliveries and collection of parts for the workshop. Hard work for me but didn’t do him any harm.

Raising children is real work.

Child rearing isn’t a kind of spare time hobby to fill in time when we’re not trashing the planet in honour of capitalism.

If we didn’t have children there would be no human future and no economy.

In my opinion parents and children today deserve to have time together to be a family and babies are best at home with loving family not contributing to the GDP at a child care centre.

What ever it takes to give mothers and fathers the chance to be at home with their children I’m all for it.

How mean spirited we have become if we would rather force a young mother out to serve burgers or answer phones in a call centre than be with her young children.

Thank you Susan St John for your sensible analysis of the current arrangements and your suggestions.

Yes. Oh for the good old days before Roger Douglas when families needed one income earner (usually the father) whilst the other partner (usually the mother) could raise the kids. Now the kids have to raise themselves while both parents work their guts out just to get by. Some progress huh?

This kind of comment goes down like a pile of sick on this site. Most are unrealistic idiots of the left. Lacking basic economic understanding.

I suggest you check out Scandinavian countries and see how it all actually works and don’t come back at me with the oil thing, the point is they have systems of redistribution of wealth (regardless of how much wealth) among their populace and come in constantly as the happiest nations in the world.

Mothers and children are well supported there. And guess what, with all that state support they have very small families.

Ryan; well, that comment from you was illuminating – in a Dark Side of the Moon Kind of Way.

Considering that Labour left the country in a better state than National currently has it, it’s kinda hard to know what you base your assumption on.

Or are you just going by religious faith?

Right-wing economics 101: You do all the work: I get the money and the credit.

Guess what J Ryan: You have just passed your first economics paper. What a man!

Another right wing moron .

Push the ignore button until they are reprogrammed to spit out sensible things rather than what a small minority of demented neo liberals want them to say.

These models the far right keep sending here to this blog seem to be the defective ones before they cast them out to the tip.

So tell us, J Ryan; illuminate us, please…

Do you think a government should promise tax cuts during an election campaign; when a recession is looming; implement those tax cuts; and then borrow billions to make up for the revenue shortfall?

What are your thoughts on that?

Thank you Susan St John for your sensible analysis of the current arrangements and some good suggestions around improving it.

Raising children is definitely work. Vital work, after all without it there would be no human future or economy.

Childrearing isn’t a kind of hobby to fill in time when we’re not out trashing the planet for the glory of capitalism.

How mean spirited we have become to deprive a young baby of being at home with loving family so they can go to childcare and contribute to the GDP while their mother works flipping burgers or answering phones in a call centre.

Our young parents and their children deserve better than that.

Janice, nobody has ever said that a mother cannot stay at home full time with her children. That has always been a lifestyle choice.

There are however those who for one reason or another have found themselves in different or difficult circumstances yet still insist that they deserve the same freedom of choice as of right and it is apparently the taxpayers job to provide. Yes, of course raising children is difficult, it is vital and socially beneficial, but it also requires careful planning, huge sacrifices and a fair helping of luck.

The taxpayer is doing enough already. They have children of their own to raise.

Well, Mike@NZ, the “taxpayer” can either help to raise children in our “village” either at the beginning, in infancy – or most certainly they may pay later on, with $100,000 prison cells; CYPS intervention; community support organisations; etc.

But one way or another, if things go wrong, we will end up paying.

Which end do you think we should focus on?

That’s an interesting generalisation Mr Macskasy. So by your logic, if I dont, as a taxpayer, pay to raise my own children and those of the less umm, less umm, less…well, you know, they will all end up in jail.

Interesting.

So you think it’s “interesting”, Mike@NZ? Considering that CYPF has been in the news lately and considering that we have some of the worst statistic in the world when it comes to raising children, I put it to you it’s vastly more than “interesting”.

It takes a staggering amount of blindness not to understand that if we don’t invest in our children now, that the outcomes later will be less than ideal. Many families can raise their children very well. But too many families cannot, and the consequences are disastrous for the rest of the country.

I asked you a perfectly good question – which end do you want to pay? At infancy, or later on down the track with wasted opportunities; unrealised talent; and worsening statistics.

It is this kind of head-in-the-sand attitude that I despair at.

And I answered your ‘perfectly good question’ when I reminded you that myself, and every other taxpayer, are already paying to raise our own children plus paying at both ends…plus everywhere in between.

By the way, don’t bother to try and use the threat of pay up or the kids will end up in jail…that already happens and apparently that’s my fault too for not caring and paying enough.

Well…

It IS isn’t it.

Child rearing is work. It isn’t some kind of hobby to fill the spare hours when we’re not out trashing the planet in honour of capitalism

Caring for our young is the most vital work as without it there will be no human future let alone any kind of economy to worry about.

How mean spirited we have become that we would rather a small child spent their days in day care contributing to the GDP than in the care of loving family at home. It seems we’d rather have a young mum flipping burgers or answering phones in a call centre than rearing and caring for her children in those important early years.

And why do we feel this way? Apparently because vast numbers of women … “choose to try and make a career out of having kids” ….. I feel so sickened by this kind of talk and it is now our daily fare especially from the media.

Thank you, Susan St John, for your sane, timely and helpful comments on this important topic.

I would have thought that a solution to the questions about what is a tax cut and what is a subsidy; why a pension is OK and child support is not, would be resolved by a simple guaranteed minimum income. In fact if we reach the point where most work is automated and theree are more ‘unemployed’, I dont see any alternative.

Incidently, Susan, an important issue is missing from the discussion:- years ago when production was much lower and there was only one bread earner for a family of typically four, that family unit could afford to buy a house.

Now with higher automation and two (or more) income earners that unit can no longer afford to buy a house. Why?

The reason (which females will hate) is this. Q>> “When there is a shortage of available housing, as now, how much is required to pay a mortgage on a house?”. A>>”Since you absolutely must have a home, the answer is “How much have you got?”

In otherwords the more a family unit’s income rises the higher the mortgage”. A wife’s wage income is totally lost in mortgage payments. That is only true when there is a housing shortage but you will notice that the government is doing nothing to fix that problem.

Dorothy

Leaving a child alone is not allowed did you also leave them in the car outside the pub?

The world is a lot different now but children are still our most valuable asset

Our major issue in NZ is that we are so selfish we do not understand that.

Waste of time publishing realistic comments on this site. You are dealing with people that live a delusion of basic economics, suffer from envy and think the world owes them a living. If that dude woke up on the wrong side, how about waking up on the other side. There are two sides to a bed you know.

^^^^^ Moron Alert !!! ^^^^^

Stay calm ladies and gentlemen and remain in your seats. Help is on its way . Please do not adjust or loosen your safety belts until we announce the problem has past.

“Waste of time publishing realistic comments on this site.”

So why do you keep doing it? 🙂

I am glad to be called a liberal left wing person. Liberal = open to new behaviour and opinions and willing to discard traditional values – also respecting individual rights and freedoms.

This term ” neo-liberal ” is misleading and confusing to most and I wonder if that is intended ? It trashes the good meaning of ” liberal ” just by association.

Their are those narrow minded greedy corporate types who I love to expose and critique whenever I can but I believe that we get a bit lost in all these terms and labels. I refuse to use the term neo-liberal to describe (?) those psychopathic upper 1 % or whomever because I like the word LIBERAL and feel we are trashing this good term and what it means to many of us left wing liberals. Maybe this makes no sense to most but I think we are getting lost in all these terms and labels.

There are good folks and their are bad folks, and there are liberals and conservatives and good folks and bad folks within each of those two camps. I consider myself a bit conservative in some areas but I still feel that we do no good to the great term and meaning of the word LIBERAL by using it in the context ( Neo-Liberal ? ) with those idiot corporate psychopaths.

Someone has to stand up for the great word and meaning of the word – Liberal in its true context. I like the word and I feel ambivalent towards this term – neo-liberal.

The problem here in NZ is we have been asset stripped by Roger Douglas and his cronies, like Alan Gibbs, Sir Michael Fay & David Richwhite, Sir Ron Brierley, the Fletcher Family etc. and the NZ public do not even realise they have been hoodwinked, our ancestors pakeha and maori built this country together and it has been asset stripped in one generation.

However we continue to hero worship these people. Fuzzy logic I call it.

Now we hero worship the likes of John Key & Ritchie McCaw, I liken NZ to a Cult Following where we are always looking for the next guru to follow.

It is the Sheep Mentality here in NZ whereby we follow the leader, we have a maliable press who preach the Governments Doctrine which we all judiciously follow.

https://www.youtube.com/watch?v=RBJlU4xIxBk

doctor guy standing talking about basic income

[…] When the inevitable downturn produces higher unemployment, more foodbank demand, foreclosures and widespread mental illness, who asks or cares whether the economic system works for low and middle income people and their children?” See more at: https://thedailyblog.co.nz/2015/08/29/another-week-of-neoliberal-economics/?utm_content=bufferba525&a… […]

just a word to thank Susan St John for another great think piece & for being one academic who goes public on her reseachesPower to your elbow Susan

Comments are closed.