The fact that the global stock market meltdown wasn’t the headline on any of our TV News shows last night speaks terrible volumes of our blind ignorance.

John Key however told reporters yesterday that he has had officials test the big banks and even if house prices fall 40% and we get 13% unemployment, the banks will be ok!

Thank god the rich are safe.

China’s stock market predictably melted down, this caused huge losses in Asia, which then chased huge losses in Europe which then hit America overnight. Watching the Dow Jones drop by almost 1100 points overnight was incredible.

With Australia getting hit hard yesterday (down 4%) and China getting hit even harder (down 8.5%) NZ gets hit twice because those are our two largest trading partners.

While John Key was promising NZ at the election that we were on the cusp of something special, the truth is that his rock star economy is choking on its own vomit. 305 000 NZ children living in poverty, Worker rights crushed, draconian welfare reforms designed to disqualify rather than help, privatisation of state houses that are freezing tenants to death, 5.9% unemployment and a property bubble in Auckland that is set to implode.

Beyond putting all our cows in a Beijing paddock, rebuilding from a natural disaster and helping fuel the property bubble with lazy immigration, this Government have done sweet FA to help build NZ, preferring to allow their blessed free market to stake out a Darwinian economic survival of the richest.

So are we entering a new economic meltdown on par with the Great Depression of the 1930s?

The unequal distribution of wealth and unregulated greed of modern capitalism, symbolized by the Great Recession of 2008, has fostered groups which challenge capitalism. This time it has come from trans-national movements like Al Qaeda, and anti-Globalization protestors rather than national ones. The recent rise of the BNP and UK Independence Party in England have increased as the effects of the Great Recession of 2008 have punished Britain’s finance sector (which now accounts for 20% of the country’s GDP) while $140 billion in bonuses for bankers who continue to write up questionable deals with the full backing of the taxpayer creates class resentment that can fuel extremism.

The differences between these two threats indicate how the definition of ‘crisis of capitalism’ has evolved in the shadow of the Great Depression. Fascism and Communism held pretentions to be the new global hegemony. Transnational challengers however, seek to modify or limit Globalized Capitalism rather than replace it.

As the planet struggles to reign in an industry that globally accounts for over $300 Trillion per year in the financial economy as opposed to the $8 Trillion created by the real economy, this obvious power imbalance gives some hint to the difficulty capitalism has to evolve beyond the influence of those wealthy enough to write the rules. Without the type of social pressure a W recession could enforce upon capitalism to evolve, neo-grasmcian counter hegemonic movements will have limited success for co-opting the leavers of power for internal change. The danger of wishing for the W recession is that the same fuel to create social change can be the same source of fuel for extremism.

The Great Recession of 2008 is a worse crises of capitalism than the Great Depression because the managed capitalism that was supposed to protect us from the cruel boom and bust mechanics have been replaced by the very deregulated wild west free market approach which led us to the 1929 collapse. The Great Recession is a failure of neo liberalism, but the additional problem for the Great Recession is that it is taking place within an environment that simply can not sustain the extra pressure consumer culture and unregulated growth has placed upon the biosphere.

The ‘solution’ to the Great Recession of the 2007-2008 has been printing money with zero interest, this has managed to kick the can down the road for America, it’s imploded Greece and the half a Trillion China poured into it’s economy have resulted in the obscene meltdown we are seeing now…

Fear China’s stock-market earthquake

Here’s the chilling thing. What’s going on in China is madly redolent of the 1929 Wall Street crash.Here’s why.

The 150% rise over a year in the Shanghai Composite Index to its mid-June peak was largely driven by investors borrowing to buy shares, or margin trading in the jargon, just as happened in the US during the Roaring Twenties.

And the subsequent self-reinforcing collapse has been driven by China’s indebted investors being forced to sell shares to meet their debts.

As for the economic significance of what is going on, well these very big stock markets in Shanghai and Shenzhen are no longer serving their core purpose of supplying equity capital to businesses – which will have a significant negative impact on Chinese growth.

The despicable injustice of the wealthy elites looking after their greed is best summed up here…

A crisis should never be wasted, the question will be who exploits it first? Tobin taxes, taking happiness into account, redesigning the very masculine dominated growth measurements and a developmental rather than neo liberal approach on the one hand or the increased consolidation of power into the hands of a corporate elite on the other.

The latter isn’t working and a TPPA ‘free trade’ deal with America is no solution.

This so called Rock Star economy has had a terrible impact on the poorest of us while National’s rich mates have prospered. Real Left solutions will be demanded by voters who can’t afford to be consumers any longer.

The middle classes voted for Key in 2014,despite the dirty politics, despite the mass surveillance lies, despite his office colluding with the SIS to smear the Leader of the Opposition months before the 2011 election because his policies have continued to push their house prices up and up and up.

What happens when the only reason they are voting National pops?

Key is probably making millions backing the collapse of world stock markets.

But, aksually, the reality is…a new flag will give us hope of a bright new future, as a low wage, serfdom economy….

…after all I was poor once from a poor family, so I know what it’s like on “struggle street” (and I certainly won’t be going back there in a hurry believe me).

If all else fails, I can always sell Moonbeam to the Chinese…..

JACK RAMAKA says:

AUGUST 25, 2015 AT 8:24 AM

Key is probably making millions backing the collapse of world stock markets.

It’s pure speculation that FJK’s dabbling in world misery. However, did you know?

If 1 = a

and 2 = b etc.

and you add up the letters/numbers in John Key’s name, it adds up to 88. If you look at 88 closely enough, it’s very similar to 666.

and if 1=a

and 2 =b

Also, there is a difference of 19 between b-a-n-k-e-r and another rhyming word of banker.

It’s all in the numbers….

Solid analysis imo. Be interesting to see what the FED does next. You can’t slash interest rates when you’re already at zero to “stimulate the economy”. More QE? Pension and insurance funds can’t take any more hits to their balance sheets. It all looks very ugly to me. I wonder if overseas investors in the Auckland property bubble will start selling up (perhaps to cover stockmarket margin calls). Also in US$ or EUR, the capital gains on Auckland houses suddenly doesn’t look so great (in fact I’d say in the last few months you’d be looking at a pretty big loss given the tanking NZD).

It is quite possible that the present instability in the stock market will make Auckland’s house prices go higher. If speculators are taking their money out of stocks and shares, buying our real estate instead looks sensible.

Also the argument that our falling dollar will make a difference may be wrong. China has been buying NZ$dollars direct from the Reserve Bank for some time now, so the question is “Is it better to have your money tied up as Yuan on the disastrous Chinese stock exchange, or have your money as NZ$ dollars buying Auckland houses?” At present it looks like a no brainer.

The part played by the Chinese Auckland banks needs attention too. If Chinese speculators come to Auckland with money to burn, put it in a Chinese Auckland bank and get their mortgages from that same bank, those mortgages will be created as NZ $dollars from nothing by the bank. I dont see how the Chinese bank or speculator loses from this. Effectively a relatively few yuan will have been multiplied up to an awful lot of NZ$dollars.

Sometime not far away the Auckland mortgage market will collapse. But not tomorrow.

Max Keiser has said for years that we need to raise interest rates but with crooks in the banks and on Wall St. and in govt.s – that will not happen. They are creating this economic collapse and it has been in the works for a very long time. Strap on your seat belts, it is going to be a bumpy ride.

Martyn, please provide a source for the bank bailout figures.

No source means the figures lack any authority.

There are a lot of links for that post, e.g.:

https://www.facebook.com/permalink.php?id=218602041595641&story_fbid=763303313792175

http://scottishindependence.com/2015/07/did-you-know-the-current-estimate-is-that-greece-needs-a-bailout-of-around-370-billion/

http://economics.stackexchange.com/questions/6394/large-banks-collapsing-verses-a-single-countries-economic-decline

Unfortunately none of them provide a verifiable source. But the clear consensus means it be true… [ducks] ;-).

All three links resolve to the same source, a blog post on a political party website which provides no information on who collated or how the survey or figures where obtained.

Even if I wanted to believe the figures, that is an unreliable source.

If the figures are credible Martyn should not have any problem citing the source of the study or survey. Nor is it up to readers to track them down,

To make it worse, Martyn simply ignored a request when asked after he gave the same figures on an earlier post.

Not a good look.

Top columnist predicted this in March so we are on track to the big one folks.

PAUL B. FARRELL GET EMAIL ALERTS

Opinion: Stock-market crash of 2016: The countdown begins

Published: Mar 1, 2015 10:36 a.m. ET

725 165 143 877

Dow will drop 50% as market replays 2008, 2000 and 1929

By

PAUL

B. FARRELL

COLUMNIST

Library of Congress

Crowd of people gather outside the New York Stock Exchange following the Crash of 1929.

It’s time to start the countdown to the crash of 2016. No, this is not a prediction of a minor correction. Plan on a 50% crash.

Most investors don’t want to hear the countdown, will tune out. Basic psychology. They’ll keep charging ahead with a bullish battle cry, about how the Nasdaq will keep climbing relentlessly to a new record above 5,048 … smiling as they remember reading that a whopping 73 companies are now in the Wall Street Journal’s Billion Dollar Start-up Club, with Uber ($41 billion), SpaceX ($12 billion) and Snapchat ($10 billion). Hearts race even faster reading in Bloomberg BusinessWeek that “China’s IPO Boom Mints Billionaires” and Jack Ma’s Alibaba fortune is now valued at $35.1 billion.

Yes, technology IPOs are in the lead, and with all that good news, it’s easy to understand why investors tune out, don’t want to hear the warnings, no countdown to the 2016 crash.

But the crash of 2016 really is coming. Dead ahead.

Maybe not till we get a bit closer to the presidential election cycle of 2016. But a crash is a sure bet, it’s guaranteed certain: Complete with echoes of the 2008 crash, which impacted on the GOP election results, triggering a $10 trillion loss of market cap … like the 1999 dot-com collapse, it’s post-millennium loss of $8 trillion market cap, plus a 30-month recession … moreover a lot like the 1929 crash and the long depression that followed.

Plus cycles theorists warn that we dodged a crash in 2012-2013, thanks to the Fed’s stimulus and cheap-money polities. Or rather delayed it, which adds more power to the next one.

Why not sooner, you ask? Why not in 2015? Yes, Mark Hulbert’s already warned that the “stock market risk is higher today than it was in the dot-com era.” Yes, a dip is possible. MarketWatch’s Sue Chang writes of a 10%-20% stock-market correction by July.

But we also know markets are typically up the third year of a presidency. So if no crash is in the cards this year, then why bother with warnings and a countdown? Why bother building up the 2016 elections with lots of dark early warning signs, and doom-and-gloom warnings for the next 18 months?

Why? Simple, behavioral economists have long been telling us that investors will either choose to stay in denial till it’s too late, never having learned the lessons of history when the market collapsed in 2008, 2000 or 1929, when they collectively lost trillions. Or we know some investors really do want to heed the warnings, so they can plan ahead, avoid big losses, and take advantage of opportunities later, at the bottom.

Deja vu 2008: Watch another presidential hopeful collapse!

Let’s compare 2016 with earlier crashes: 2008 to 2000 to 1929, knowing all bulls drop into bears eventually. Basic cycles theory. And this next one will trigger losses bigger than 2000 and 2008. So bet against the house at your peril.

Jeremy Grantham’s already on record predicting that “around the presidential election or soon after, the market bubble will burst, as bubbles always do, and will revert to its trend value, around half of its peak or worse.”

http://www.marketwatch.com/story/stock-market-crash-of-2016-the-countdown-begins-2015-02-25

Those figures have been floating around for a,year or two on many American blog and facebook posts.

This is the 3rd or forth time I have seen that picture.

You don’t have to be a clairvoyant to see that National will blame everything going wrong in NZ on what is happening overseas and of course the previous government but reassure us that they can be trusted to see us right.

Cue the National Party going into the turbocharged lying mode! and cue mass asset sales.

Either that or they’ll blame the Labour party – even though they haven’t been in govt for 6 years.

And don’t laugh – if they reckon worm farms are high risk health and safety occupations then these neo liberal subversives are capable of anything.

Most worm-farms were started under Labour.

Labour knew that this Health and Safety Business-Friendly law was going to be introduced by National down the track, so deliberately seed-funded worm farms years ago to make the National Party look like dicks.

Cullen said to Clarke “I have a cunning plan Helen, a plan so cunning, you can put a hook on it and call it a worm!”

Sneaky, forward looking scumbag Labour Party…..they deserve all the blame they get.

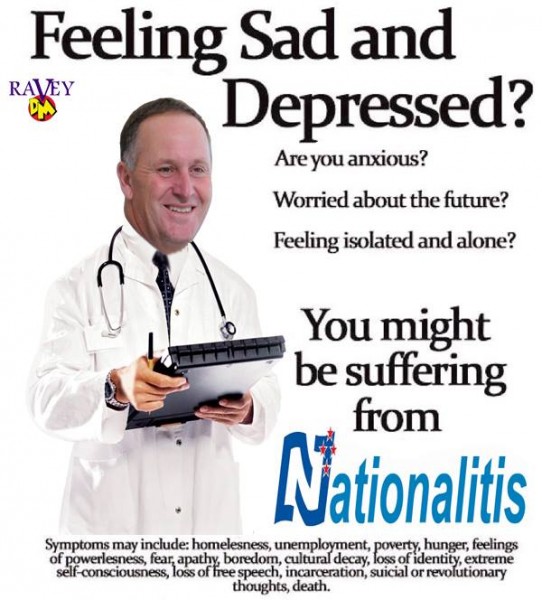

Crack up “Nationalitis” been coming for a while now but hang on America is working on Quantitative easing 4 now yeah that should really help the artificial bubble that’s about to pop go the weezle.

We NZ/Aotearoans have a massive country per head of population. Our country can grow anything in abundance. Our country has vast fresh water resources and equally vast ocean based resources i.e. fish and security. We have an highly educated and talented work force.

We are being plundered by the Banks .

All the Banks out ! Out now. Regulate money lenders ( Debt parasites ) into oblivion. Write off ALL mortgage debt. Create tax free havens in the rural towns coupled with free health and public transport to those towns to get our agrarian economy back on its feet and conduct a public inquiry into the relationships between current and historical politicians and their corporate banking whores .

If we did these things we could watch the Global financial crash with bemused detachment.

Our politicians sold us into this nightmare so they must pay to get us out. We must insist that our resources are returned to us and all monies from these ‘investments ‘ be returned to us also. There needs to be a public investigation into the portfolios of certain ‘business persons’ who profited most from the sell – off’s of our resources and infrastructure and any misappropriated monies would be held in trust to be eventually returned to us the NZ/Aotearoans under the proceeds of crimes act.

Or we could do nothing and ponder which is least painful. Gassing ones self in the BMW or hanging ones self from the balcony of the Parnell mansion ?

By crikey , CB – your talking my language here .

And the absolute rage of tens of thousands in our society over these subversive treasonous neo liberal rorters.

ALL mortgage debt? Even for those that have amassed a property portfolio through negative gearing? Uummmmm-think again!

Sorry that won’t work. I happen to know that BMW’s are so environmentally advanced when it comes to fuel emissions, that it’s almost impossible to asphixiate oneself in one. Ask a certain ‘prominent’ sports ‘journalist/celebrity’. It’s a non-starter so to speak.

Just some thoughts:

1. We’ve reached the end of growth particularly post WW11 growth because the planet has been trashed in the pursuit of wealth.

1a. Ocean fish stocks will have disappeared by 2050, the mighty Tuna has been hunted almost to extinction

1b. The World’s forests are exhausted and logged out.

1c. rare metals are becoming harder to find.

1d. Agricultural land has been exploited to the max and poisoned with chemicals in the Green Revolution.

1e. Even though easy to access oil has peaked in 2005 the oil price is depressed because other aspects to support growth in the biosphere are trashed out.

1f.Overpopulation continues to trash the planet with insatiable human needs and demands.

1g. The insatiable lust to grow and take risks has given us Deep Water Horizon and Fukushima.

1h. A sixth great mass extinction is now happening due to human caused climate change and may very well wipe out humanity too.

1i. Droughts, Wildfires, Floods in a heating up World are crippling economies.

The point: The stock markets and financial system and its free market bullshit are living in a fantasy land totally disconnected from ordinary people and the biosphere which no longer can support their delusions of grandeur.

The end is truly nigh for the post WW11 system it’s all downhill from here on we’ve permanently maxed out our credit card with nature and though she’d like to forgive us she simply is unable to do so. We have wrecked her.

Yes, and still the insanity continues, it won’t stop until we are all flat on our backs once this beautiful rug under our feet is totally ripped out and destroyed. Such is the insanity of this dominant lunatic culture. The tapestry of life hangs in the balance, ‘infinite growth’ is yanking out all the last threads.

But business as usual on RNZ today ripping up trees, plundering the land and water….4$$$. Grief is all that is left, and witnessing this tragedy in action. The lunatics running the show can’t see beyond plundering.

I liken Kiwis (NZ’ers) to our native kiwi, that was doing fine until the nasty predators came along…

And Radio Live are talking about facial tattoos today when the stock market is in meltdown – what has happened to NZ that we have become shallow bits of fluff – not caring a damn about our country and the mess it is in – the shocking thing is that there are many people in this country who do give a damn but they are not allowed a voice or are shut down in interviews. It fills me with despair how the media has become so effectively muffled. On any platform, written or on the airways these days, it has become boring drivel.

Key pulls Bodhi’s tail while Pike River sufferers weep: <a href="http://thestandard.org.nz/key-priorities-puppy-photo-op-not-pike-river-people/

A caring patriotic PM: Bodhi or Moonbeam – PM’s favourite diversion behind new flag?

We must first rid ourselves of the old corrupt monetary system before NESARA can be introduced:

https://pathwaytoascension.wordpress.com/2011/08/17/history-of-nesara/

Goodbye and good riddance to the Illuminati and their minions.

And Radio Live are chatting about facial tattoos today when the stock market world wide is in meltdown. How typical is that, we just sit back like sheep and take this sort of rubbish. I hardly ever listen to radio these days but thought today might be different, how wrong I was. Everything in NZ today in print media or TV/Radio is just rubbish, I have given up the Herald yonks ago and now the Listener cum life style magazine is on death watch, TV is hardly ever turned on. how boring NZ has become, we used to have wonderful in-depth political discussion panels, not idiots like Hooten and other under qualified people waffling on. It fills me with despair how dumbed down we have become. It’s a depressing state of affairs. Like I said on The Standard “my whinge for the day”.

Don’t worry my loyal sleepy hobbits, all is well, all is well, Daddy is in control of it all, he has the answers, go back to your sleep, all that is in meltdown is mum’s freshly bought ice-cream, which she forgot to put into the freezer after shopping.

Nighty, nighty, dear All

What happens when the only reason they voted National collapses?

It gets ugly.

And as we saw in Chris Trotters latest tow posts on TDB …the Great Depression was caused by a system similar to neo liberalism :

Lassez Fairre.

Same basing everything off credit , same concentrating wealth in the hands of the few , same impoverishment of the poor.

And what pulled Europe and Japan and later the USA out of it on average 6 months after they accepted it ?

John Maynard Keynes and his Keynesian theory of economics.

Which is what this country accepted and practiced from the 1930’s to 1984 …when it reverted back to essentially the same reckless system we had pre 1929.

And until we go back to a system like Keynesian economics – or some modern variant of it – we will continue to be tied in with and suffer the same fate as we did in October 1929.

Guaranteed.

Now let’s see what FJK and Blinglish can conjour up from their bag of magic tricks, to help the country ride out the financial storm that’s coming.

Plan B perhaps?

Plan B? What’s that? That’s the impression I got watching and listening to Blinglish in Parliament this afternoon! Nothing there to help buffer the economic tsunami when, NOT if it hits!

I’m picking up far more information about this financial market issue from alternative news site such as TDB and TS, than I am able to get from msm! Good one guys. Another good reason to support the alternative sites.

Plan Z……. zzzzzzzzzzzzzzzzzzzzz

Go to sleep Blinglish and FJK and it will all fix itself up by next election.

All hands off deck

Our Banks disappeared under dodgy circumstances.

National Bank of NZ sold to Lloyds and Bank of New Zealand to Fay Richwhite, many other NZ financial institutions bit the dust through suspect management.

Blinguish said today National has a plan, but when Winston pushed he wouldn’t say what that was.

We know what they have planned still to came.

Sell kiwi rail, Hospitals, ACC, and anything else these loose Bruce’s can get their greedy little hands on to keep afloat.

This all before they desert the sinking Planet Key astro cloud ship the criminals.

It’s a plan so cunning you can pin a tail on it, pull the tail…

….oops forgot the end of the sentence…

Never mind, we’ll just bribe the electorate with muddle-uncome and upper uncome tax cuts before the next election and sleepwalk into power again, minus the Conservatives, minus the Maori Partee and Minus Peter Budgie …jeez have forgotten his real name – that guy from Ohakia….

As for David Seymour…once we get John Banks in charge of ACT, then we’ll see some action on the right of the right….

If the long run, as Keynes put it, we’re all dead. And as he didn’t put it, eaten by worms. That the Gnats are noticing and terrified of the danger the worms represent shows how decayed and ‘ripe’ they have become. Herod feared the worms in his final days too.

Comments are closed.