Children’s income support policies are a mess. For years CPAG has argued that Working for Families is based on faulty thinking that belongs if anywhere in the past century. A more convoluted, discriminatory and illogical combination of confusing tax credits would be hard to imagine. Those who are doubly burdened with issues of poverty and child disability must fight for any extra meagre entitlements. Only some newborns are given the extra tax–funded support of Paid Parental Leave, while the very poorest babies who need extra help the most are given nothing.

Adding to that is the archaic and creaking benefit system that fails to offer families adequate support when they need it most and punishes them with sanctions in the name of welfare reform. The use of relationship status to punish women and their children has no place in any fair and just welfare system. Child Support changes have been a long time coming but don’t appear to offer any improvement. Not only are they very expensive to administer, they are having perverse effects in making some single mothers much worse off than before. We have got policies very wrong and it is no wonder that there are 205,000 children in families under the very, very low 50% poverty line.

These are not just academic matters for the policy wonks to tut-tut over from time to time. The impact of bad policy creates a systemic bias that reinforces entrapment in poverty. Policies fail our children and their young lives are blighted with long-term consequences both for them and for society. It does not have to be that way. We do choose to treat older citizens well, and have low rates of poverty as a result, but we choose to marginalise, judge and damage the lives of the weakest of our young with ill-judged policies.

Unfortunately, the most concerned and articulate in the children’s’ movement have never agreed about the messages that government should hear on child poverty. Consequently, government finds it easy to side-line them, even to the point when the term child poverty itself has dropped out of recent government statements.

For example, it does not appear in the Government briefing for the coming budget. Instead we read of more emphasis on jobs and growth to cure the problems of not child poverty but ‘families in need’

The Government’s economic programme continues to build a faster-growing economy with more jobs and rising incomes, and to support New Zealand families in need.

Worse still, the only other reference contains an ominous indication that all government intends to do is to shift money from one set of poor children to another:

As signalled previously, the Government is looking at ways to help families and children in material hardship and the Budget will contain some measures to address this issue. As a first step, the Government will look hard at the billions of dollars already spent on vulnerable families and children to determine whether this can be better spent.

There is no clear, unambiguous message to government that the poorest children continue to miss out and that they must be included in all tax-funded support for children. For example, when well-meaning children’s advocates call simplistically for an increase to the Family Tax Credit or worse hark back 50 years and demand a ‘universal child benefit’, the government can rightly sneer, as John Key did when he referred to such urgings as ‘barmy’.

The problem is that those who care passionately about child poverty disagree among themselves. Some find the intent of Working for Families to encourage paid work compelling regardless of whether or not it is well designed to achieve this end. Some think it is OK to rely on private charity to mop up the remaining problems when paid work does not deliver the expected outcomes.

Colleen Brown, a tireless advocate for disabled children and their families said last week at the launch of the CPAG disability report – It should not be this hard –children poverty and disability

[A]a social movement for change must be underpinned by a clearly articulated and agreed upon analysis and strategy for change if it is to succeed. Most importantly, the analysis will give a sense of right and justice to the cause, elements so necessary in sustaining the self-belief, fearsomeness, tenacity and sheer hard work throughout the campaign.

So let’s have a go at what we might be able to agree on and therefore our vision for where we want to be in the future and then insist with one voice that policies adapt incrementally in an agreed direction.

Here is a suggested set of principles that surely are uncontroversial.

- Principle of equal treatment for equal child need

- Principle of adequacy of weekly child payments and parental welfare benefits

- Principle of recognition of the unpaid work of mothering especially when child is young

- Principle of encouraging paid work where appropriate with needs/wellbeing of the child/children prioritised.

- Principle of relationship neutrality.

- Principle of simplicity

- Principle of transparency and openness

Based on Principle 1 backed up by being signatories to the UNCROC we should have no difficulty in supporting the right of all children to benefit from social security, especially those tax-funded measures that reduce poverty. The first step then is to join the iniquitous In Work Tax Credit to the FTC for the first child payment. This makes the first child maximum payment $152 weekly paid for all low income first children. This avoids any judgemental discrimination about who is worthy or not based on outmoded criteria of fixed weekly hours of work or benefit status and will reduce child poverty significantly. It also greatly improves outcomes judged on principles 1,2,3,6 and 7.

If some find that it offends Principle 4, then they need to answer the question: were hours of work increased because of the In Work Tax Credit? Perhaps a look at the latest Treasury ( 2014) evaluation of Working for Families may help answer that:

This paper examines the labour supply responses to the Working for Families (WfF) package of welfare reforms, which was fully implemented in 2008. The policy changes were implemented with the aim to encourage benefit recipients to participate in the labour market and to address income adequacy issues for families with children. …It is estimated that the introduction of the new policy increases labour supply of sole parents by an average of 0.62 hours per week, but decreases labour supply of married men and women by 0.10 and 0.50 hours per week, respectively.

Treasury don’t do the obvious which is to look at the net effect on hours worked. Many married women work less because they can afford to work less. They get the IWTC on the backs of their partner’s hours of work regardless of how many hours they personally work. Thus given the numbers of married and unmarried women, it is likely that overall work hours actually declined because of the IWTC ! So much for a work incentive or maybe ‘married’ women just aren’t expected to work ?

Notice that Treasury does not even begin to evaluate whether the objective of income adequacy was achieved. Perhaps that is because such an analysis would end up agreeing with the Ministry of Social Development’s damming indictment:

Working for Families had little if any impact on the poverty rates for children in workless households. (MSD 2010)

The government’s claims of emphasis on jobs and growth also deserve considerable scepticism. Offshoring, large scale use of third nations workers, and failure to develop local industry have contributed to a moribund economy that apart from offshore property investment and the Christchurch stimulus would be flatter than a corpse’s ECG.

This government has no economic credibility whatsoever, and its apparent better performance during the GFC was happenstance, not management. The desire to cut welfare right left and centre is symptomatic of their failure – thriving economies readily invest in decent social programs, recognising the downstream cost of failure.

Child poverty, is but one pathology of unemployment, and always a monetary phenomena and necessarily a govt. imposed crime against humanity.The currency is a simple public monopoly.The dollars to pay taxes, ultimately come from govt. spending or lending.Unemployment can only happen when a govt. fails to spend enough to cover the tax liabilities it imposes, and any desire to save financial assets that are created by the tax, and other govt. policy.Sa id another way, unemployment, is the evidence of over taxation.The govt. could provide a guaranteed job at a living wage to all those willing and able to work.For those who cannot work, for what ever reason should be given an income adequate to participate in society.This is not likely to happen,as it is politically advantageous to have a cohort of people available to blame for any govt. policy failure.The practice of austerity in N.Z. since the mid eighties as been a disaster for most, but a policy which has been championed by all economist to the delight of the 1%.Those who have or are critics of govt. policy concerning child poverty are captured by neo classical economics and therefore their analyzes from that perspective will be worthless.These failures represent the success of the 1% and their lackeys to convince us that there is no alternative.[TINA]

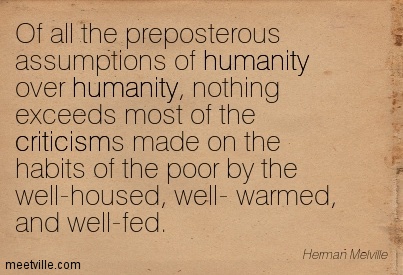

Conservative middle class and right wing finger wagging at the poor doesn’t solve child poverty. It just makes them feel better by justifying avoiding social responsibility,

Generally those same moralistic finger-waggers enjoyed free healthcare and education in our country,

Can anyone tell me why government withholds $450million a year from the children in poorest families by denying them the weekly child-related ‘ In Work Tax Credit ‘ that has a clear objective to reduce child poverty? Yes it is a trick question

Poverty entrapment ensures the low paid work and volunteerism sectors are sustained. Although the long term economic and social implications of poverty surely exceeds the cost of supporting families transition out of it.

Children from the poorest families are being denied support as a means of pushing their parents into jobs they either they don’t qualify or have the experience to apply for. Failure in this sense is disheartening and may lead to depression and anxiety.

The message is a dangerous one and detrimental to child development – that it is ok to care (and be remunerated) for caring for someone else’s child, but it is not ok to care for one’s own child while on a benefit.

The govt needs to inject more money into training and education. Although rejecting advise appears to be this govt’s modus operandi.

http://www.amnesty.org.nz/news/new-zealand-rejects-international-recommendations-address-inequality

I fully support what Susan says and writes about the dismal state of affairs for poor families, especially those with disabled children. There is more to all this, we face a radical, evil attack on welfare as a whole, based on the UK “model” for getting even sick and disabled into work, that is competed for by the fit and healthy. The pretense that it is all about “enablement” is a charade, a lie, it is about getting persons off benefits, no matter what, to save COSTS.

How much worse can things get, when the MSD secretly change the rules and processes, to “allow” disabled and sick to be heard during appeal hearings, on health grounds, all to favour MSD and WINZ and make it even harder for justice for the poorest to be applied:

https://nzsocialjusticeblog2013.files.wordpress.com/2015/03/the-m-a-b-hearing-process-how-msd-secretly-changed-it-to-further-disadvantage-clients-oficial-post-18-03-15.pdf

This document found via that link is not quite up to date, so go to “nzsocialjusticeblog2013” for the up to date version of that post and related info. There are many links to some really revealing information on that small blogsite, care to read it, you will learn what is going on.

Principles. ‘Mom and apple pie’. ‘We all agree…’

Wall paper over the omnishambles that is our present society in transition from the Industrial/factory/mindless drones age to something a lot more anarchic.

For example: “Principle of encouraging paid work where appropriate with needs/wellbeing of the child/children prioritised.”

Communities barely exist now. Grandma’s out at work. Child care ‘services’ gobble a very hefty belt of the miserable income.

Bootstrapping by reskilling is precarious, expensive, and pretty much not on for people out in the wops.

And the surrounding costs of living. Electricity. Transport. Over-priced food and few options.

Excluding cultures for people, female and male, who are trying to enter different work environments. Can be tough to leave the lower-paid employment environment. Can be done, of course, and the personal price is high. This is not America where a plumber can retrain as a surgeon and go back to his former community and be respected. This is Kill the Tall Poppies NZ.

And what does ‘encouraging’ actually mean in practice? Coaching? Helping with clothes and transport? Buddy support? ‘Encouraging’. So – so middle class, vague and floppity, really.

Raise the minimum wage and it will simply be trying to run after the train. It won’t crack the underlying problems.

Politicians come later. Much later. Why? Because they largely represent the middle of the bell curve. By their very nature they can legislate and consolidate but change is not their forte. Look elsewhere for the means whereby to begin resolving this challenging problem.

Thank you Andrea

you say

“And what does ‘encouraging’ actually mean in practice? Coaching? Helping with clothes and transport? Buddy support? ‘Encouraging’. So – so middle class, vague and floppity, really -”

I hate that word too, sorry for being sucked in to using it by trying too hard not to sound as if a good paid job is unimportant.

What I had in mind was a far more rational approach to additional earned income especially for those on benefits. The system is set up to provide huge disincentives.

Here is an example from WINZ

“If you’re not a sole parent you can get up to $80 a week (before tax) before your benefit payment is affected. If you have a partner, the $80 applies to your combined earnings”

When a couple can have only $80 between them before losing benefits almost dollar for dollar and that policy and the amount has not changed since the 1980s something is seriously wrong.

It provides a huge disincentive to earn extra and/or to declare a relationship- on both counts setting up a possible fraud charge.

And to bear in mind also, this talk about earning up to $80 a week on top of the benefit is a con also. The extra earned money is allowed on top of the main base benefit, but earning extra, even less than $80 a week, will usually affect certain supplements most beneficiaries depend on.

It may lead to a cut in the Accommodation Supplement, Temporary Additional Support and the likes.

As most on benefits also need these supplements, in many cases that extra income that is officially allowed, is then in reality not really allowed in practice, given the cuts in Supplements.

I am astonished that Labour do not raise this, when the government goes on about “allowing” beneficiaries to earn extra. But perhaps Labour’s spokespersons on welfare are a bit too out of touch with these realities?

It would be hard to overstate the importance of our failure to address this issue. The usual alternative to the jobseekers allowance is not a 40 hour well paid job as policy assumes but casualised and erratic hours of part time insecure work.

What are the policy analysts in Wellington doing? Too insecure to give the advice the government needs to hear?

Correct, Mike. Most New Zealanders don’t realise that simple fact.

That is why the government gets away with smoke and mirror and other tactics. People think, oh, these beneficiaries, they have it easy, they get the benefit and only need to work a few hours extra, to earn more, and be as well off as a working person.

So sadly too many think they beneficiaries do still get “special treatment”, which they do not, and have never really been, in real terms.

The first thing an incoming progressive government can do, on Day One, involves almost nil cost – but sets the agenda for said government: the Prime Minister must become Minister for Children.

All else will flow from that decision.

All legislation; all policies; all Budgets, will have to pass the desk of the Minister for Children, aka, the Prime Minister. As such, they must have first priority in all resources and funding.

If an incoming progressive government cannot achieve that first step, then they are not listening.

We may have to shout louder.

Comments are closed.