Liam Dann does a good job of explaining the positive and negative issues looming for the NZ economy and as dairy prices plunge again overnight alongside a large Wall st sell off and China Bank rumours begin, his case for the negative reading gets stronger…

Five reasons we’re in economic trouble

Dairy

The fall from record dairy commodity price highs has come harder and faster than anyone could have expected. Suddenly we’re seeing farmers having to shift their mind set from a record-beating payout of $8.40 to a $5.30 at best – and we don’t yet know if we’ve hit bottom.The dollar

It’s still too high and leaves the Reserve Bank snookered. The bank needs to keep lifting interest rates to head off a housing boom and keep a lid on consumer spending and the domestic economy.But efforts to do so attract currency investors and push our dollar higher, making life tough for exporters. Dairy price falls may prompt a pause but Reserve Bank Governor Graeme Wheeler seems full of resolve to stay on top of inflation.

China

As New Zealand’s largest trading partner, the continued slowdown in China’s growth rate has to be of some concern.But while that may be measured the biggest risk is a property or stock market crash in China. Any kind of uncontrolled financial turmoil in China would send shockwaves around the world with the biggest impact felt through Asia and Australia. How likely this is depends who you talk to. Certainly there has been evidence of a property bubble in big cities like Shanghai for some time.

US markets

They’re over-valued and due for a fall. The real US economic recovery has failed to keep pace with stock prices which have been inflated by an influx of investors who can’t expect any kind of serious interest rate returns from the banks. With the Federal Reserve keeping the official cash rate near zero, markets are still benefiting from artificial stimulus. As markets hit record high after record high some are getting nervous – particularly as we head in to October, a month most strongly associated with big market falls.The strategy

Where is it? What is New Zealand actually doing to create jobs and push wages up. As export earnings fall we are once again relying on the wrong end of the economy – property and consumer spending – to prop up GDP and see us through. If that’s the case we have only limited time before a drought or another global financial crisis stops in our tracks.

…nothing was solved with the 2007 Global Financial Meltdown. Instead of being punished, those who benefitted most from perverse financial instruments in a super deregulated market are back to their same dominance at the rigged nano second casino that is Wall st.

One of the great ironies of our time was watching the shining corporate white knights of hyper free market capitalism begging for public money to bail them out of their own bewildering greed at the height of the GFC.

The geopolitical micro climate generated by China and Australia being our largest trading partners has provided the environment for a Government to do the changes necessary for our economy to resist the global financial storms around us. National chose not to strengthen our social infrastructure and reinvest in our people, they chose to squander that reform time on borrowed tax cuts for the already wealthy…

…the true victims of this crushing rise in debt are those on welfare who are being cut off benefits to afford middle class entitlements.

Adding to these woes is the perception problem towards inequality we have in NZ. The richest 20% of us in NZ own 70% of the wealth, with 18% in the hands of the second richest quintile, and 10% in the hands of the middle quintile. Just 2 per cent is owned by people in the fourth quintile, while the bottom 20% of NZ owns nothing, but thanks to a mainstream media focused on ratings over public broadcasting, the majority of NZers have no idea of how extreme or inequality actually is.

What many NZers don’t seem to appreciate is that beyond the Christchurch rebuild, there isn’t actually any other economic plan and the speed of the downturn will be quick and steep…

New Zealand’s booming economy is at risk of a hard landing once temporary factors ramping up growth wear off, economists say.

Our economy is the envy of the world with an annual GDP growth rate of 3.3 per cent and unemployment of 5.6 per cent, both near the top in the OECD.

But the current rate of growth is unsustainable, a panel of some of New Zealand’s top economists told a briefing in Auckland today.

And they said many New Zealanders are not aware how much our economy is relying on one-off boosts like the Christchurch rebuild, or how quickly it could slow down when they come to an end.

…but NZers decided that a PM with no economic plan, deeply embroiled in dirty politics and mass surveillance lies was a better proposition than the Labour Party. Which when you consider the latest Cunliffe vs Robertson madness, starts sounding less shocking.

Thankfully for Labour, all of National’s black swans come home to roost in a 3rd term. The economic short term thinking becomes harder to hide, the heavy handedness of the welfare and student loan reforms come into effect and the full impact of Dirty Politics gets played out in the various legal checks and balances.

We may find out in 2015 how vacant and empty National’s aspiration really is.

“NZers decided that a PM with no economic plan, deeply embroiled in dirty politics and mass surveillance lies was a better proposition than the Labour Party”

This is the “crux of the biscuit” (thanks Frank Zappa) – when New Zealanders have had all revealed to them and STILL vote for Key/National where can you go from there. It’s not a “checkmate” for the Left so much as some strange “anti-checkmate” like “anti-matter” is to “matter”. We are now in a twilight zone with no linear path to travel along. More like suspended in a murky soupie substance like the victims of the alien honey trap in the Scottish indie film Under the Skin starring Scarlett Johansson.

Starting to feel like some Americans when country voted for Bush in 2004. Are my countrymen awake?

Great Article – totally agree. The problem is to shift into a high value knowledge economy and no commentator/political group seems to be able to work out how to transition there without massive blood shed. Labour was trying too get there, but there was too much penalization of the middle NZ and the perception of a rapid change in the status quo. Families aren’t willing to put their future on the line without any kind of buffer period of adjustment or a clear vision of the future and certainly not if Labour can’t even seem to trust themselves let alone ask people to vote for them. I too, thought they had a chance in the election but The Sovereign Wealth Fund and (Green) Carbon tax were never explained in clear terms for the average person and quite frankly NZ needs to see some progress on those before ‘trusting’ them and the policy. If Labour and Greens had cracked down on dirty politics and corruption issues in the election then they would have looked more trustworthy. If they had allowed a buffer period of a adjustment and campaigned 3 years before explaining their policy. If they actually used new media properly so that the average joe and MSM could just read about it on their website for example. These things all help. Otherwise it is just sound bytes on TV which the Greens seldom get and Labour wasted. No one will trust you if you behave like a rabble. Sorry this may be hard for Labour – I feel for David Cunliffe who performed credibly in the election and now seems like being smeared in a campaign. That’s why The Greens and Labour need to focus on corruption right now before it gets even stronger. There is no point having a message if you can’t get it out or it is corrupted by dirty politics. They need to join forces and attack the perportrators in court. Use the legal system. Cameron Slater and John Banks have come a cropper there. Even Winston Peters might be keen to tackle corruption it was his whistle blowing credentials, that won him all the votes Labour lost.

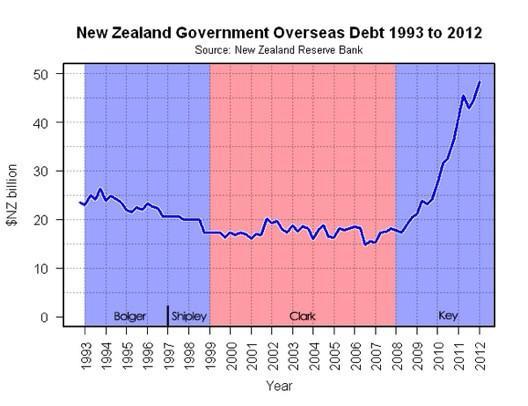

I still amazes me how surprised people are when I point out the vaunted ‘recovery’ has left NZ in debt to overseas nations to the tune of $86 Billion dollars. Their jaws drop, they flounder for explanations to justify why they voted for National, they find none. They believed the hype and were unaware of the facts.

Let’s make sure this term, as brief as I hope it is for Mr Key, we are able to disabuse the public of the misconceptions and outright lies that have been keeping them enthralled for the last six years. We are the anti-spin.

I think destroying the narrative that the Nats have run the economy well is the single most important thing to do. The debt statistic is essential to undermining the surplus line spun by the Nats.

Sadly though, with the corporate media acting as an amplifier for the Nat’s line about the surplus and a Labour Party hamstrung and captured by a right wing clique of neoliberal MPs, it is very hard for this message to get out big time.

Social media may be the solution as it was in Scotland.

Keep it simple. state NZ’s government debt, farming debt and private debt.

Exactly, Paul, I still don’t understand why that graph wasn’t all over the place during the election campaign. It’s clear, simple, stark and effective. Even the most diehard Nat supporter would find it embarrassing: it has “borrow and spend” written all over it.

Government debt their own doing 500 New Container Wagons Built in China Costing Kiwi’s $500K and 120 Kiwi Jobs at Hillside Workshops in Dunedin. Then there was another 40 New Locomotive’s Chinese made when A&G Price of Thames wanted the Job worth $150mil ! That’s a Lot of money which could have been pumped back into many other businesses around NZ supplying parts / materials and services all paying good wages and heaps of Tax ! Then there are the next 3000 New Container Wagons worth $300mil which they haven’t wanted to talk about or the poor state of the first 500 Chinese built ones which now appear are having several major problems requiring grossly under paid Chinese Workers to come out to work at Kiwi Rails Picton Workshop fixing their faults .

So with Lowering of NZD this should make it cheaper to manufacture these 3000 New Wagons and any other New Locomotive’s here in Gods Own ! This Lower NZD will also put more money into Tourist Operators , Exporters eg Farmers & Sawmillers / Logging Jobs and then there’s NZ Domestic Manufactures who have been Closing their Kiwi Plants to move off shore , they should be coming back ! But it’s going cost them a lot to rebuild & tool up ! Where as if NZ Governments had of keep a handle on this over the last 10 – 15 years they would have been still here , but expanded with Government insistence Win Win for all Larger Kiwi Made manufacturing which could be now supplying Globally from here based all around NZ in small Provincial Town’s ! Then there wouldn’t of had to be so much of a push into Huge Dairy Farm’s which are hard on the Environment I end my sermon !

“Our economy is the envy of the world with an annual GDP growth rate of 3.3 per cent and unemployment of 5.6 per cent, both near the top in the OECD.”

We shouldn’t be accepting statements like this. Firstly the ‘rock star’ economy has only been evident for about a year (just in time for the election) and the figures are meaningless. If new money is introduced into an economy from outside, of course employment rises, and so will GDP which is directly related.

Unemployment figures are misleading anyhow. The figure that really tells you what is going on is the total number of hours worked per year and I suspect it has fallen.

Also, having sold large chunks of our assets overseas, the cash received should also increase employment. Factoring these things in, the economy doesn’t look good at all. The real crunch comes when we stop borrowing and have to repay the interest without having increased real productivity. That cant be far away.

p.s Message to Greens. Voters don’t like the word Tax. So a name change might help for the Carbon Tax. If I was a strategist I would suggest calling it Carbon Credit:)

Likewise Labour need to get the word Kiwi in there for your Sovereign Wealth Fund. i.e. Kiwi Wealth Fund.

I hate marketing but it works!

It is worth bearing in mind that a lot of the borrowing was necessary to continue funding social programmes introduced by the Labour government and which benefit those most vulnerable in society.

Example please? Nothing to do with funding the tax cuts then?

That might be true – in part – Deejay, but billions more was borrowed to pay for two tax cuts in 2009 and 2010. And it certainly didn’t stop National from subsidising some industries to “preserve jobs” (Tiwai aluminium smelter, the so-called film “industry”, and a handful of others), but not others (http://fmacskasy.wordpress.com/2014/10/02/2014-ongoing-jobless-tally/) which shed thousands of jobs.

The money squandered on tax cuts could easily have used as;

* venture-capital for real job creation joint ventures with local businesses;

* re-training the thousands who lost their jobs in the GFC and Great Recession;

* and a mass house-building programme that would have addressed the critical housing shortage; looming housing price-bubble; boosted the local economy; put young New Zealanders into their first homes; and trained people for the building industry.

All things which a proactive government does at a time when State intervention is most required.

As things stand now, our economy is limping along, predicated on raw commodity exports and the re-build of a shattered city.

God help us if that’s all we have.

I see your points Frank and can’t disagree; however, our differing perspectives on how economies should work means we have divergent views on whether tax cuts create value or incur cost.

Funding the tax cuts were as much a part of taking the country through the GFC as funding WFF. Tax cuts create disposable income, which in turn increases savings or spending, both if which stimulate an economy. That the Govt. has received almost unanimous international recognition for their handling of NZ’s response to the GFC is recognition of that. The next step is to rebalance some of the inequalities, and a tax free threshold an adjustments to WFF would be a good start.

In which case it’s a shame it didn’t work.

Instead we got government cutbacks; mass sackings of state sector workers; and unemployment skyrocketing. So much for “stimulus”. And most the tax cuts went to high income earners who don’t tend to spend as much as low-income families, who spend everything.

By the way, ever wondered why tax cuts are considered a stimulus to the economy – but raising the minimum wage for the lowest wage earners is not?! Hmmmm…

Who might that be? The same capitalists who landed the global economy in the ka-ka in 2008?

I’m not sure you can argue the tax cuts didn’t work. Despite the tail end of the GFC, the NZ economy has been growing faster than most others in the OECD, and that isn’t all ChCh. And there is a big difference between tax cuts and raising the minimum wage. One is funded by Govt borrowing or reduced expenditure, the other by the very businesses we want to be employing more people. Personally I don’t think we will reduce inequality by hurting employers, but by getting people into work, and via the tax system making it more worthwhile for them to do so. I’m for having people at the tail of income levels pay zero tax, not those at the top pay less, but at the same time it is those at the top whose investment and spending create jobs, so I’m not that keen on killing the golden goose either.

But “we’re on the cusp of something great” aren’t we?

Excellent article Martyn. It’s also worth noting that near stagnant or below inflation real wage increases appear to be a systemic factor of the new global economy in the post crash world. Therefore, current inequality is only going to get worse. Here’s hoping that Labour can sort out there shit before National have too much time to frame the narrative.

Socialism for the rich, disaster capitalism for everyone else.

Interesting Post .

Here’s my take on it . But what do I know . Nothing That’s what .

The biggest threat to NZ’s people are the Banks . All of them . Then , the Insurers . All off them too . In there , in that nest of rats , the idea of having huge debt leveraged against the house that Kiwis will literally kill themselves for ( ‘ Mortgage ‘ . ORIGIN late Middle English: from Old French, literally ‘dead pledge’, ) is hatched .

Having absurd debt levels against ones home serves many uses for the likes of Jonky-Swine .

Power .

If your Banking friends are able to sell debt to Kiwis for homes and stuff , you have a great deal of power within local currency markets . You can also sway other politicians in their thinking , change legislation , create new laws and pretty much do what ever you like to anyone you don’t like at any time , anywhere .

Control .

If you have huge debt against poor wages , you have control of the Masses .

Personal wealth creation for your Privileged Few mates .

Well , there’s a surprise . Once inside that clique , that club , the Money Club , one can manipulate and sway the flow of money to suit ones self . You can make millions and millions and millions and no one will ever question your motives because you , as the crook , can easily cover your tracks with the laws and legislative changes you and your fellow crooks have laid down ahead of time . After all , they were the architects of the scam so they’re well ahead of the game . A bonus point for them is that they can appear extremely clever , brilliant and as one commenter here once said of jonky ; very intelligent .

@ Martyn . I wouldn’t be too afraid of the future if I were you . Sure , we’re going to go through a readjustment period of a few years of the OMG’s as personal debt is restructured through the IRD ( As an example , people will default on credit card debt . The banks write that debt off as a loss on their books then the real filth , the debt collection companies will purchase that debt off the banks and pursue the miscreants who failed in their moral obligations to pay for debt that retailers pretended was capital and more than likely bought off-shore as politely repackaged debt with usury interest added just for us . Meltdown . http://youtu.be/l4XfNiqwQDo )

While the Parasitises have sucked out the very marrow of our agricultural export earning sector , there is life in the old sheep , cow , pig , deer , goat , grain , seed , fruit , wine , and vegetable yet . Once the horrible wailings of the Latte Sippers has settled down to a low sobbing of an evening , those people will evacuate the cities and head to the hinterlands and literally dig in .

The one thing that I find amazing and dumbfounding is that no one . Not one single one of you , with all your fabulous minds and extraordinary resources has mentioned once , not once that I can see , the vital connection between our rural export earning infrastructure and our urban need for spending that same money earned . In there . In that anomaly , in there is the answer to our future . After all , it’s been the answer to our past . It’s what gave rise to our great little country but generations of swine have crippled that economy for their personal wealth creation and they borrowed billions to hide their tracks . Look it up .

And remember . Not one political party mentioned our export sector during the lead- up to the last debacle that was our election . The National Party talked money , jobs and tax breaks . The Labour Party talked money , jobs and tax increases . The Green Party talked about the environment , money , jobs and tax increases . The Conservatives , ACT , etc talked gibberish . No one said , ‘ We must invest in our agriculture . We must encourage people onto the land to become growers and agricultural developers in an holistic and sustainable way . ” No one said that . Despite a burgeoning global population needing to be fed , we wipe our farmers out with debt and market manipulations then replace them with Cowsploiters . Brilliant . Very Intelligent .

I swear to God , one small contingent of good people with some knowladge could arrange a deal between one large Indian town and us who’d literally swallow all our produce in one go , so why the fuck would we worry about China again ? Ask any Bankster ? They’ll tell you .

Jesus , we’re schmucks . Small town schmucks with a priceless commodity just ripe for the plucking / plundering .

So right CB, I have retired to the country to take up my family’s inter-generational skills of growing food. Done it before can do it again. In the past I had to export to make any money. These days local farmers markets will take everything I can produce. Cash . Minimal tax. Every local enterprise that has tried to export the horticultural wealth of Northland has been throttled by MAF. Those pricks are on the take.Export is a nightmare for the small grower . even for the small manuka honey producers forming an association to get a decent price so they’re not screwed over by Comvita ( part chinese owned)has had limited success. We are better off selling locally.

Yes the banks and this government, their agents, have a lot of power over many NZers.

The reason why many middle class NZers voted for Key’s government is because they are hoping CGT on their rental property will be their nest egg. These are scared people, massively in debt to the banks, whose economic plan relies on the housing bubble.

If that collapses, they have no plan b.

Right on – build resilience in our local communities for the uncertain future – and food will be a major part of building that resilience. Mangere was once a food bowl with adjacent labour force. Now it is houses and food production had to move to Pukekohe – away from the market and labour force. Guess what – they are now planning to build on Pukekohe soil – intelligent!

Many of those who voted for more of the same will be angry when their loved ones are hurt by lost jobs and no hope, but they will force us all to suffer because they were not clever enough to understand what is happening. Give a man a rope and hope he knows what it is for.

are many nz ‘thinkers’ aware of the world bank strategy to in-debt countries by loaning money that the bank cant even back – most of the citizens time and resources goes into serving debt, around 70% of tax now in nz goes to servicing debt 30 % for everything else, there are a lot of obvious implications of what that means, ultra rich using owned msm to convince middle class the lower class is the fault with economic issues for example.

muldoon deliberately started the process dumped it on labour, key has gone into hyper drive, next step? total ownership of all your stuff by ultra rich interests is the short version, if it doesnt make sense or ring any bells go over the moment of truth a few times till the light goes on, cross reference everything on google

its skipped up 25 billion or so since the election

http://www.nationaldebtclocks.org/debtclock/newzealand

Capitalism is on its last legs.

It cannot make us produce enough to meet its ballooning debt.

Its their debt not ours (working people) but they want us to work as slaves and repossess our assets to pay for it since our labour is the only value of substance.

So rather than pay our ‘share’ we can all repudiate their debt.

Organise to defend our assets and build communes where we live off our own labour.

Bye bye capitalism, hullo communers.

same applies to nz now

America is no longer a democracy — never mind the democratic republic envisioned by Founding Fathers.

Rather, it has taken a turn down elitist lane and become a country led by a small dominant class comprised of powerful members who exert total control over the general population — an oligarchy, said a new study jointly conducted by Princeton and Northwestern universitie

Read more: http://www.washingtontimes.com/news/2014/apr/21/americas-oligarchy-not-democracy-or-republic-unive/#ixzz3EwZRXyxx

Follow us: @washtimes on Twitter

Country Boy is right. NZ has lots of fertile land, much of it being wasted. Some of the richest land around Mangere, Howick, Tamaki, carefully sealed under concrete, tarmac, wharehouses car yards. Its proximity to urban markets, port, airport etc would have made it fantastic for growing and exporting high value food produce, flowers (by air) etc. As he says, no mention of any of these in pre election policies. Milk and wood production and with no added value, is just so dumb. Even a big multi national like Danone can make huge profits on its converted milk products while Fonterra makes hardly any. The usual complacent, greedy arrogant suspects…

“NZ has lots of fertile land”

“Lots” could be clearer . There is need of an audit of foreign ownership, and of the rate at which we are being sold off. I say “we” because without our land, we are nothing, we have nothing.

Excerpts from a recent article by Geoff Cumming:

* Close to 1 million ha in plantation forests alone is in foreign hands (either full ownership or management).

* In the wine industry, it is estimated that between 40 per cent of wine produced is ultimately owned by foreign companies.

* Back in 2003, the Overseas Investment Office (OIO) was comfortable with an estimate that 1 million ha of rural land was owned by foreigners.

* OIO records show that from 2001 to 2013, a total 1.6 million hectares of freehold land changed hands in transactions requiring overseas investment approval. That’s more than 10 per cent of the country’s estimated 14.5 million ha of productive rural land.

* In 2012 – after Key had claimed fewer than 1 per cent of farmland was overseas-owned – Rosenberg produced a “conservative” estimate that 3.2 per cent of farmland was in foreign hands. Adding forests, his estimate was an again conservative 8.7 per cent.

* If leasehold interests were included, it was possible that 10 per cent of farms alone were under foreign control, he concluded. Since then foreigners have been handed the keys to another 130,000 ha of freehold land and 90,000ha in leases. http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11309648

In our small land, keeping track of how much is under snatch-&-grab should be a priority. Instead, it is tossed in the ‘too hard basket’: “Tracking sales and establishing whether the purchaser is a New Zealander or not … potentially requires an infinite and complex monitoring regime,” chief executive Annelies McClure said in a statement.

fyi a typical scenario would be selling the idea of bio fuel – loaning $500,000 to start it, let it fail say how sad lets move on, pay shipley etc millions to administer its failure, repeat

All the things you are talking about here we were supposed to have been warned about when the GFC (I prefer to call it the CGF – Collapse of the Greedy F…..s rather than the Great Financial Crisis) hit us? I recall a lot of “we won’t let this happen again” and “we have learned our lessons” being spun to us, but obviously nothing has changed. The greedy are just as greedy as they ever were and always will be. When the next CGF hits – the perpetrators will have their Cayman Islands bank accounts well stocked in preparation, the rest of us will pay for it.

Great article as usual Martyn.

There’s are lot of investors out there using cheap loans, searching for high yield investments.

But our whole economy is seriously now becoming over leveraged and structurally being destabilised.

Asset and stocks values are now outstripping their income yield.

Just look at Auckland house prices?

We are in another asset bubble with another credit boom about to explode as the asset value increases to yet another boom & bust deflation that will turn out to be our next finally recognised real depression.

http://www.youtube.com/watch?v=qU6d466bQPY

STRONG STABLE GOVERNMENT

National = strong stable govt ? Bollocks .Anyone can look good if its all on borrowed money .

Any family , business , or country which pretends to be successful by clocking up the credit card is a sham .

20 b increased to 60b in 6 years is not good prudent financial management . Do we want to owe 90 b in 3 years time ?

70% of our tax to pay for the interest each week ?

10 b less govt revenue from lower log and dairy prices ?

The above graph was Cunliffes golden arrow in the TV leaders debates to shift votes from National to Labour by hitting the very core of Nationals brand -Sound financial management .

It was visually so simple and elegant , even kiwis with tiny 20 second attention spans could get it instantly.No complex statistics required and hard to defend .It sowed the seeds of doubt.

National people are financially conservative and most would not support a family , business ,or an administration which created a false sense of prosperity by reckless borrowing .

Labour only needed another 2-3% rise and 2-3% drop in National to change the Govt .This was a strong argument for change which could well have made a real difference to the elections outcome in favor of the left block.

Most ordinary kiwis accepted that National with their , accountants, business people bankers, economists,etc seemed the best qualified to run the economy and bring further Strong Stable Government .

But what most kiwis didn’t know was that Nationals “solid” performance was not based on increased productivity ,it was based on unsustainable and excessive borrowing.The nation needed to hear this .

In 30 seconds 2.4 million viewers would have got the message National had maxed out the credit card and we were in the shit “.Is that good management ? Hell no , Im voting Labour .

But tragically Cunliffes /Labour strategy team never used it.I think this was a tactical error of some magnitude .

or, The Stupid Economy, is it about?

“What many NZers don’t seem to appreciate is that beyond the Christchurch rebuild there isn’t actually any other economic plan and the speed of the downturn will be quick and steep ” The understatement of the year.

I don’t think they even realised that Chch is a factor in the “growth” of the NZ economy, or that whole milk powder is almost the sum total of NZ manufacturing. And they did not want to think about Auckland’s preposterous housing market being an issue either, so long as they had a house on the books.

I note Liam Dann, a big supporter of National also balanced out his pessimism with some shallow, hope for the best, glowing points as well.

I am reasonably convinced our economy will stall very shortly if not tank in the next 3 years because National have simply sat on their hands. We can go so far on bullshit and John Keys hollow reassurances!

Sure they sold off assets but that was a whole different agenda to further enrich the wealthy and as a stop-gap measure to prop up the economy. It was carefully and painstakingly researched and polled to be marketed in such a way as to appeal to greed first and ignorance second.

However you cannot underestimate the John Key factor and Nationals incredible ability to paint themselves out of the shit they have either created or ignored, with a marketing campaign extraordinaire of misinformation. Nor can you underestimate the sheer trusting stupidity of New Zealanders to believe any old line this lot throw at them.

Do you left-wing losers not realise you are nothing, have nothing, want everything, and have only senses of self entitlement. What the eff would you know about commerce, the nearest any of you getting close would be filling out a dole form. Some people are born to lead and achieve, others are losers who can’t even follow, the latter being your type.

“eff”? Funny! We’re big boys and girls, IGM, we can handle words like fuck, just as we can the rest of your mindless rant.

Here’s a thought. Why don’t you try making substantive points? You know, actually make some sort of sense or argument? Or is abuse all you can manage?

IGM – your rants are ridiculous. 😀

IGM says,

“Do you left-wing losers not realise you are nothing, have nothing, want everything, and have only senses of self entitlement. What the eff would you know about commerce”

IGM you are the problem not the solution here, with your rose coloured glasses looking at being saviours for what?

We are now in public debt to the tune of $86 billion now after you idiots took over and the crown debt was only 6 billion.

Trresury figures show,

6% of crown debt ratio to GDP in 2008

Now in 2013 26% with Key’s borrowing and now rising.

What a jerk, to say we will borrow big to show we know how to run commerce.

Sorry you look and sound like a total jerk get lost and ruin someone else’s country.

Yes, the national voters I have asked said they voted for ‘charisma’ and did not believe me when I informed them of the huge debt increase – or that our better GDP economic growth was due to an earthquake. Sadly many NZers are uninformed. And we won’t go into the short comings of GDP as a measure of growth.

Is that graph inflation adjusted. If not, it is beyond meaningless.

And debt is better expressed as a % of GDP not as a raw figure. Hypothetically debt under Bolger could have been 50% of GDP and Key’s 2% depending on actual GDP (or any other combination of). Gross reporting of these figures in this way is actually damaging to the cause and too easily defeated IMO.

We might be “rock star” but I don’t think our GDP has trebled in six years.

The problem we voters faced, was a Labour Party offer that was incoherent and adhoc…e.g Labour’s Capital gains Tax proposal…what a debacle. How could we confidently place our future in the hands of a group of sniping, factionalised individuals, publicly represented by an ill-informed and delusionally empowered ‘leader’.

I voted Greens & IMP Party Vote, seeking disruption…

Goddamn this beautiful country has some biggie troubles ahead…

County boy, write a book – I will buy it. Great stuff!

With the economy starting to tank, it may be a slim blessing that Labour lost the election.

Can you imagine Right Wingers blaming an incoming Labour-led government for falling international dairy prices?

1000% Frank wait as by xmas these idiots that have promoted spend big will vanish into the woodwork and NatZ will be soundly blamed for the ruin they have heaped on us all.

Great xmas present to a majority population suffering under this worthless Government.

Some may find this an interesting read…

http://www.monbiot.com/2014/10/02/the-kink-in-the-human-brain/

Comments are closed.