If Prime Minister John Key has money available for tax cuts then cutting GST must be the first priority.

GST is a nasty tax on low-income families.

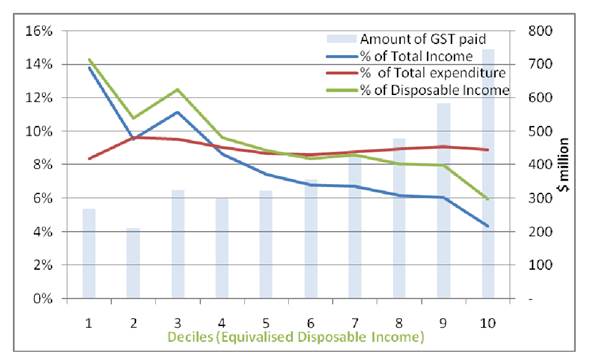

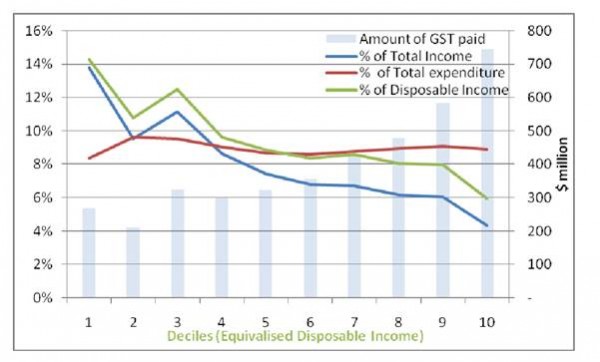

People in the lowest-income 10% of New Zealanders pay 14% of their income on GST while the top 10% of income earners pay less than 5% of their income on GST.

The following graph shows just how vicious and unfair GST is as it cuts into low-income families.

Last week MANA Movement showed how unfair and unbalanced our tax system is with a worker on the minimum wage paying a 10 times higher tax rate than the Prime Minister.

Minimum wage worker 28% tax

Prime Minister 2.8% tax

The minimum wage worker on 40 hours per week earns $29,640 and pays $4,207 in income tax and $4,149.60 in GST giving a total tax of $8,356.60 or 28% of income.

On the other hand the Prime Minister earns $428,000 from his PM’s salary along with this year’s $5,000,000 increase in his wealth (according to NBR’s rich list) which gives him a total income of $5,428,000. On this total income he pays just $132,160 in income tax and approximately $21,400 in GST giving a total tax of $153,560 or 2.8% of income.

Low and middle income families are doing all the heavy lifting for the economy and need a break.

Cleaners, fast-food workers, hospitality workers and security guards are all heavily subsidising the lifestyles of the Prime Minister and his superrich mates.

What we need is an overhaul the tax system and as well as abolishing GST altogether we need:

· A robust capital gains tax paid at the same rate as the person’s income tax

· A financial transactions tax on currency speculation to replace

· Higher tax on higher incomes

· An inheritance tax on estates over $500,000. (National abolished inheritance tax in the early 1990s allowing wealthy family dynasties to flourish at the expense of everyone else.

Flat tax, my ass. Another neo-liberal lie. Fairer tax, this is what this was sold it to us as. Those cretins knew it was a tax on the middle class and the poor.

Oh and make sure you Labour don’t buckle on CGT of at least 25% – the wimpy one of 15% won’t be a splash in the ocean. Well apart from all the whining from the right. Or, all those tears for having to pay a fair share rather than bludging off the rest of us.

This would make a huge difference for the underclass and working poor.Could mean bread and milk in the fridge for the end of the week. As for the 10% they might have to downgrade to the non leather seat option for the new commordore or beemer. Ah well never mind.

Yes the next government should just drop GST back down to 12.5 or lower. The National governments insistence on putting GST up undid the small positive stimulus from cutting higher income taxes.

The incoming government should balance their ambition of raising taxes on the wealthy with the need to actually get elected and stimulate the economy first however. Getting to full employment should be a priority and the positive political capital can then be used to tax wealth. Focusing on more taxs could cost the left the initiative and undermine the gains to be made from lowering the unemployment rate. That would be a real shame to see.

I like the idea of removing GST, and in the interim of reducing it down gradually, as it’s not a fair tax. However, this still won’t on it’s own stop wealthier people from tax evading unless there is policy to stop this much much more, plus it won’t stop companies still charging a lot for consumer items, unless there is a price freeze in place, which will be super hard to regulate at the moment.

Removing GST immediately also won’t help with funding the wide range of progressive policies Mana plans. In my view it needs a lot more work by the party to make it costed out more carefully because Labour won’t buy it and there is no guarantee at all it won’t put us under more debt as a nation. I prefer for now to tax larger earners more and putting in place regulation to stop them from getting away with avoiding paying tax, plus a giving a living wage and living benefit. A Hone Heke/Robin Hood tax would also help with this but it won’t cover such progressive measures on its own, and Labour unfortunately won’t buy those things either. So, we are stuck with GST for now unfortunately, but we can make it much much more easily. Dropping it back to 12.5% for now could be manageable though, if other taxes are in place…

Key’s first priority should be his resignation and sentencing.

But removing GST would bolster society and the economy as some of the volatile ‘hot money’ attracted by unrealistic exchange rates and lax trust regulations flees in the wake of Key’s incarceration.

Ensuring that the benefits of removing GST are not just soaked up by unsrupulous retailers will be a non-trivial preparatory step. Hope you’ve got a process in mind John.

I agree, cutting GST is an immediate must as it is an unfair tax, IMHO There should be a tax free threshold and most income taxes can drop too.

What I cant really understand is why Our government borrows NZ$ from overseas banks, and taxes us to pay it back plus interest on top.

yeah sure everyone else is doing it, but surely I’m not the only idiot that can see the lunacy.

We should instead create debt free NZ$ to be spent by the government instead of borrow/taxing to do so. eeek inflation i hear… If you borrow then the money has been created and is in circulation anyway so there is no real net change, also i keep hearing over the last year our $ is too high more of it in circulation should help with that too 😀

All of this is further compounded by our personal debt to offshore banks, why because we have few local banks anymore, this is one “service” we should never have let overseas interests dominate so fiercely.

While on the fiscal sector, I am GUTTED that our AWHI Credit union is forced to give up due to astronomical compliance costs.

Among other reasons I am voting IM Party because out of all the politicians in New Zealand I WANT YOU JOHN MINTO IN PARLIAMENT and you are right there on the list!!!!!

I could explain alot more but already risking TLDR as is 😛

[…] – See more at: https://thedailyblog.co.nz/2014/09/04/cutting-gst-must-be-first-priority/#sthash.ug0myJDz.dpuf […]

Comments are closed.