Debt

Launched on Friday 1 March, 2013, the ‘TheDailyBlog.co.nz’ unites New Zealand’s leading left/centre-left commentators and progressive opinion shapers to provide the other side of the story on today’s news, media and political agendas.

Website customised by MILNZ.co.nz

Website customised by MILNZ.co.nz

© Copyright 2021 TheDailyBlog.co.nz. All rights reserved.

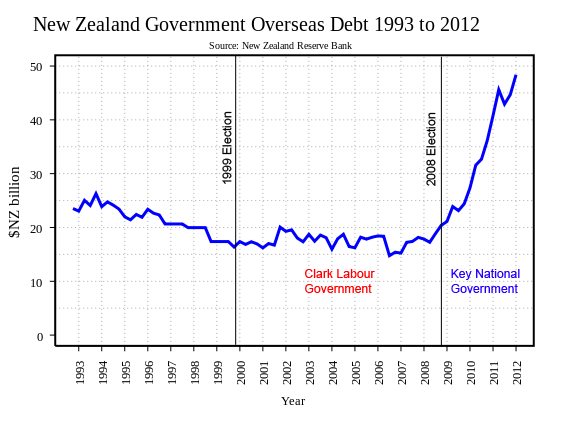

What I cannot understand about our huge escalation of debt, is where is it?

What has been done with all this money?

There is so much money unaccounted for.

So much, that the govt could have put every NZer into a mortgage-free home, and still had plenty left over to squander!!!

It just doesn’t make any sense, I mean, where is everything they spent our money on? I cannot see it anywhere.

They certainly didn’t spend it on anything visible to the eye, (other than flash new cars for themselves), which leaves me believing that over $50bn has been squandered in a criminal act by our govt – and used for what?!

Opinion and belief.

emissions trading, earthquake rebuilding, leaking homes are a few extra expenses I guess were probably not budgeted for. But in reality, I think the cost of running the country from week to week cost more than NZ was earning. You still have to pay the wages of policemen and keep the hospital doors open even if you are not earning what you thought you might. So to make up the difference, out comes the big credit card…..

@Schwin:

Our taxes and EQC insurance are supposed to cover those expenses you mentioned.

And lets not forget the ACC levies, and the GST, and fuel and tobacco and alcohol taxes also cover this lot.

This govt has taken, taken, and then taken some more, and still managed to accumulate this horrendous debt.

The use of this extra $50bn is nowhere to be seen!

Opinion.

As a conservative, I am dismayed by the notion of “living in an unsustainable fashion beyond one’s means.” (And I sympathize with Greens on the concept of sustainability, although I may disagree with how to achieve it.

Still, things could be worse. The Japanese government’s level of debt is pushing 200%, while in NZ it is comparatively low, at around 38%.

Oh dear… Certain rightwing National/ACT sycophants won’t like this at all. Expect them here shortly, with their misleading and inaccurate BS…

😀

By the way, a few reasons why our debt skyrocketed from 2008 onwards…

1. The Global Financial Crisis, which reduced corporate turnover and export receipts, thereby lowering the company tax take;

2. Two tax cuts (2009 and 2010) reduced government revenue, thereby necessitating borrowing more from offshore (http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10724665) to make up the difference. In essence, we borrowed from other peoples’ saving to put more money in our (mostly top incomer earners) pockets.

Using Parliament Library information, the Greens have estimated that this involved borrowing an extra couple of billion each year (http://www.scoop.co.nz/stories/PA1205/S00223/govts-2010-tax-cuts-costing-2-billion-and-counting.htm)

3. National could have kept Debt down by investing in job creation. Key’s cycleway project was promised to create 4,500 new jobs (http://www.parliament.nz/en-nz/pb/business/qoa/49HansQ_20090324_00000001/1-government-proposals%E2%80%94cycleway-and-nine-day-working-fortnight) – it failed spectacularly. (http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10692801)

Instead, job creation was largely left to “the market”, which itself was having to engage in mass redundancies for businesses to survive the economic downturn.

This meant more expenditure on unemployed which went from 3.4% in 2007 to 7.2% by 2012.

Ironically, part of our current economic “boom” is predicated on the Christchurch re-build – evidence that had National engaged in a mass housing construction programme in 2009, after it held it’s mostly ineffectual “Jobs Summit”(http://www.stuff.co.nz/national/politics/2524893/Jobs-summit-fails-to-deliver), we would have;

A. Maintained higher employment,

B. Paid out less in welfare,

C. Persuaded more New Zealanders to stay home and not go to Australia to find work,

D. Addressed the current housing crisis we now have.

As usual, National’s short-sightedness; irresponsible 2008 election year tax-cut bribes; and misguided reliance on market forces (http://tvnz.co.nz/national-news/christchurch-rental-crisis-best-left-market-govt-4785067) resulted in New Zealand borrowing more than we really needed to.

[…] Graphic courtesy of The Daily Blog […]

All the horse shit from the National Party’s overworked PR machine cannot hide this horror story although somewhere I’m sure Key will blame the previous government or some other fantasy story.

How the fuck does our partisan “Business” community in NZ think National know what they are doing? The only Rock Star I can see in this graph is the one on a heroin high! I note consumer confidence down for the third time running, no surprises.

On the positive side if this was tracking a Saturn 5 to the moon then English and Key would be congratulated, its an almost perfect trajectory. Sadly they are not at NASA, they are running or should I say ruining NZ, so they should be summarily dismissed.

To go with government debt household debt has sky-rocketed thanks largely to the housing addiction. I have no idea what the total private debt is of NZ or how it compares to 6 years ago.

However there is a good article by Bryan Gaynor today in the NZ Herald regarding share market investments. Simply put we are too reliant on houses, dairy and China and need to diversify.

Gaynor writes;

“At the end of 1986 domestic householders owned $81 billion worth of residential property and had bank and non-bank loans of just $10.2 billion according to Reserve Bank statistics.

By December 2013 total housing value had surged to an estimated $720 billion and household bank and non-bank loans to $202.4 billion. The latter figure excludes student loans of $13.6 billion”

No matter how you look at it that housing bubble is casting a nasty shadow over NZ. This is not exportable investment, it doesn’t produce anything we can sell to the world except houses to overseas investors for a tax free gain, houses that should have gone to people who live and work here.

Currently apart from a rush to build more houses (turning a lot of state housing areas upside down in the process) to satisfy the investors, National have no answer!

Comments are closed.