A right wing blogger has made a fool of themselves trying to dispute figures first revealed by me in the Dailyblog about how a huge gap had grown up between the number on benefits and the number being recorded as unemployed or jobless in the household labour force survey. She was replying to a column by my colleague Matt McCarten in the Herald on Sunday.

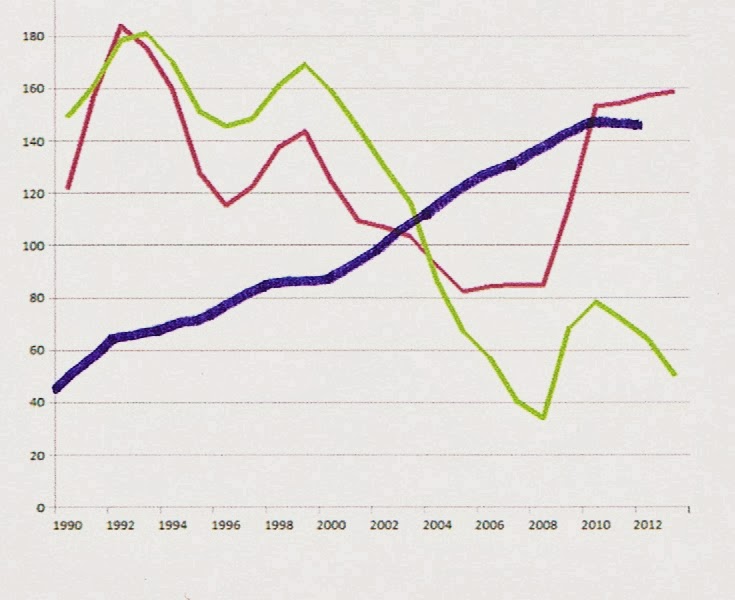

She did a crudely hand-drawn graph allegedly showing that if you combined the numbers on the unemployment benefit with the number on the sickness and invalid benefit you get a completely different picture. Well that is true with a hand drawn picture. However, if you actually use the official numbers from the Department of Statistics website and use an excel spreadsheet to draw the graph the picture is a little different (actually a lot different!).

Here is her graph.

She commented:

The purple line represents the number unemployed; the green line the number of people on the unemployment benefit. But what does it look like if I add the line representing people receiving a sickness or invalid benefit?There it is. The blueish line. (Apologies for the crude scan and manually added line but I don’t want to spend any more time trying to make this point than I have to.)The sickness and invalid benefits have increasingly become de facto unemployment benefits. The OECD refers to this phenomena as “medicalisation” of labour market problems. Being long-term unemployed can and does make people ill. It’s a problem all developed countries are grappling with.Treen however claims:There was also no significant increase in other working age benefits like sickness, invalid or sole parent benefits to account for the missing number of those receiving the unemployment benefit. I’ll leave you to draw your own conclusions as to why he would say that.

What you will first notice is she is not actually using the number I referred which combined invalid, sickness and DPB. The much larger number on the DPB has increased only modestly since 1990 which influences the combined number. However, I thought it would be useful to look at the number on sickness, invalid and unemployed combined and see how that number compared to the broader jobless number. It is true that these numbers have been increasing faster than unemployment over time. This is true for all advanced capitalist economies and the reasons are complex. But, even when we combine the benefit numbers, the huge gap between the number on benefits and numbers measured as jobless remains. Here is my graph using officials statistics and the graphing skills of excel rather than a crude drawing.

I wrote the following as a comment on her blog.

Hi Lindsay,Thanks for trying to rebut my graph. I have redone it for the combined benefit numbers (Unemployed, sickness and invalid together). It shows a somewhat less dramatic but still dramatic gap opening up between numbers on benefits and the broader jobless number. The jobless number goes from being regularly 20-50,000 above the combined benefit number to being 50,000 below the number. Here is your graph when done properly. https://dl.dropboxusercontent.com/u/ 18076151/Combined%20benefit% 20grap.png

I wonder if she will print my comment. I hope so. I like debating facts with right wingers.

I like watching right wingers try to justify how one hour of work a week is a valid qualifier to be included amongst the numbers of employed people.

ONE HOUR OF WORK A WEEK IS NOT EMPLOYMENT

Ummm… why would right wingers need to justify this when it is an internationally recognised method of determining employment status and not some neo-liberal plot to try and rig statistics.

If we take nations that hard core leftists like to bang on about such as Sweden and Finland you will find they use the same statistical techniques and also higher unemployment rates than New Zealand. Why do you think that is?

Ummm… you’re not making sense, Gosman.

Not surprising.

And by the way, I notice you don’t actually address what Mike has said – you’re simply trying to argue it away with irrelevancies.

Why do you think that is?

I responded to something Freedom posted in case you didn’t notice.

I responded to your bullshit, in case you hadn’t noticed.

It’s what I do in the morning; coffee; two gingernuts; and check out what rightwing bullshitry is around… 😉

The point is that Mike has indeed made a devastating response to rightwing , self-professed “expert”, Lindsay Mitchell and her nonsensical “graphs”.

The fact that Lindsay has not responded means she can’t or won’t.

And as ‘Freedom’ expressed so eloquently; working one hour a week is not employment.

By the way, Gosman, do you know that the former Soviet/Eastern European bloc had zero unemployment? True.

Why do you think that is?

Because they hid the true level of unemployment in pretend make work jobs for jobs sake or via distortions in the economy so grevious they were unsustainable in the long run. That a good enough answer for you Frank. Now please address the data I addressed to you regarding the structural deficit inherited from Labour by National in 2008.

ok gosman, I momentarily forgot what a pedant you are.

I will rephrase it, especially for you:

I like watching pig-ignorant corporate loving sycophnats will no understanding of the difficulties facing hundreds of thousands of new Zealanders and tens of millions more around the world, when they try to justify how one hour of work a week is a valid qualifier to be included amongst the numbers of employed people.

ONE HOUR OF WORK A WEEK IS NOT EMPLOYMENT

happier now?

LMAO!! 😀

Gosman should have focused on my response…!!

No. The definition of paid employment is used the world over by both left wing and right wing governments. It is a politically neutral definition. If you object to that blame society in general and not just one part of it.

Sorry, Gosman, that doesn’t wash. You could use that “rationale” to justify just about anything. In effect you’re using the status quo to validate your own opinion.

Not very intellectually rigorous.

How about you address the issue according to it’s own merits (or lack of).

So what if it’s “used the world over”? We used to have strong unions “the world over”, but that doesn’t stop you from opposing trade unions.

What is so frequently ignored in the debates around the increases in people on the Invalids/sickness benefits since the 1990s is that it coincides with the closing of the institutions which finished around the mid-90s. So you therefore had a large group of people who were previously locked away and not receiving a benefit (but were costing the taxpayer a hell of a lot more per week than a benefit but that doesn’t matter because it wasn’t a benefit statistic was it?) and when they were let loose even those who went to supported accommodation became benefit statistics. And trust me, institutionalised people have little chance of making it in the employment market.

No institutions hasn’t stopped people having mental/intellectual/physical disabilities, so there’s always going to be a group of people who have no choice but to be on Invalids/sickness benefits. Of course, Paula could have the institutions reopened- that would help her statistics. But in 1990 it was costing $1000/week to keep someone in a mental institution. Do you as a taxpayer want to fork out whatever that is in todays dollars?

This is getting very silly.

My blog is http://www.lindsaymitchellblogspot.co.nz

I published your second graph, along with your comment, on February 5. 2 days ago.

My posts are ocassionally duplicated at Breaking Views but that is not my blog.

My graph which I explained was crude because I wasn’t prepared to put in the time on Excel, uses the statistics from here:

http://statistical-report-2012.msd.govt.nz/Overall+trends+in+the+use+of+financial+assistance/Numbers+receiving+assistance

It never claimed to a add a line showing a combination of UB,SB and IB. I wrote, “But what does it look like if I add the line representing people receiving a sickness or invalid benefit? ”

Then you say:

“What you will first notice is she is not actually using the number I referred which combined invalid, sickness and DPB. ”

If I had, the line would be HIGHER than the jobless total. I was hesitant to mix the two issues – disability and single parenthood – despite both having historically masked the true level of unemployment.

At September 31, 2013, 304,394 working age (18-64) people were receiving a benefit.

http://www.msd.govt.nz/about-msd-and-our-work/publications-resources/statistics/benefit/post-sep-2013/all-main-benefits/september-2013-quarter.html

Yet you continue:

“…even when we combine the benefit numbers, the huge gap between the number on benefits and numbers measured as jobless remains.”

In fact if “we combine the benefit numbers” the resulting line would be around 40,000 higher than the jobless line.

Why not further use the “graphing skills of excel” to add in the DPB? Or I can if you’d like. Bit of a waste of time though.

We will only go around in circles.

In summary Mike there are not 100,000 jobless or unemployed people being denied state assistance to which they are entitled.

Because the DPB is not the same as being unemployed, Lindsay.

Or are you resorting to the hoary old chestnut that solo-mothers (but not solo-fathers – they are rarely mentioned by rightwingers whilst critical of solo-mums) do not work?

And in anticipation of your response that you could add in the DPB numbers because National has combined the unemployed category with that of the DPB – sorry, but as I said to Gosman above, that don’t wash.

You can’t justify one action simply because the government made it so. In fact, the very point of this is government policy is the way that solo-parents, invalids, and sickness beneficiaries have been lumped together with the Unemployed.

The implication, of course, is that solo-parents, invalids, and sickness beneficiaries are work-shy and should be working.

One thing wrong with that.

There aren’t enough jobs for the 160,000-plus Unemployed, not to mention a couple of hundred thousand other beneficiaries.

Yeah, it’s that simple.

And Mike has done a pretty good job in illustrating the current situation.

@ Lindsay,

The link to your blog spot doesn’t work because you forgot the full stop after your name. Sloppy like your graph?

I actually think we are looking at the numbers in different ways. You are looking at absolute numbers in the different categories. I am looking at a realtionship between them.

However let us take the low point of the number recorded in a June year as being unemployed – 2005 with 82,200. Since then this number has double to 157,300 in the June year 2012. We would expect the number of beneficiaries to double in a similar way if everyone was getting access appropriately.

The number receiving the unemploymemnt benefit has declined from 66,822 to 64,056. The combined number of unemployed, invalid, and sickness benefits has increaed by only 13% to 211,604.

Now you are correct that that number is above the HLFS measure of the number who are unemployed. But neither number accurately records the number of unemployed people in the country. Most people on sickness and invalid benefits are actually sick or invalid. ACC has contributed by preventing people accessing entitlements through them. Institutionalisation of the sick and disabled has grown out of favour. The aging of the workforce and increased age of national super contributes. In many ways the improved survival rates of modern health care leads to more people living lives with disabilities rather than dying.

My argument is that the only way you can have a doubling of the HLFS measure of unemployment (as inaccurate as it may be) and a freezing of the number on unemployment benefits is by denying entitlement. Including the Sick and invalid numbers doesn’t change that reality since 2005.

1/ Looking back short-term (over the GFC), many of the unemployed/jobless are not qualifying for the unemployment benefit because they have assets and savings, financially supportive partners or parents and/or aren’t unemployed for long enough. That’s not a “denial of entitlement” but does call into question whether paying taxes to support a social security system shouldn’t guarantee entitlement regardless (though you might argue for targeting those most in need).

2/ Looking back long-term (20+years), the unemployed/jobless have been increasingly supported by benefits other than the unemployment benefit. The typical pathway from unemployment benefit is first to the sickness benefit and then to the invalid benefit. Also many teenagers started on the unemployment benefit and moved to the DPB where they often remain for a many years.

3/ Additionally unemployed/jobless numbers have recently (last 2-3 years) been inflated by new work-testing requirements. Work and Income requires greater numbers of beneficiaries to be available and looking for part or fulltime work.

We are going to continue to disagree.

Lindsay,

So, in effect, Mike Treen was correct. Jobless numbers are greater than we have been led to believe.

Current entitlement rules (on top of National’s demonisation of unemployed, solo-mums, invalids, etc) are ad hoc and unfair.

For example, take these two situations;

Household #1 has two people flatting together. They are not in a relationship with each other. Both work. Both pay taxes. Both contribute toward their $400 p/w rent.

One get’s made redundant, and qualifies for the unemployment benefit (approx $216 p/w), plus an accomodation allowance to help pay a portion of his/her rent.

Household #2 next door has a de facto/married/civil unionised couple. Both work. Both pay taxes. Both contribute toward their $400 p/w mortgage.

One get’s made redundant – but does not qualify for the unemployment benefit or accomodation allowance, because s/he is in a relationship.

The “fairness” of this situation escapes me.

One more reason, as Mike pointed out, there are more jobless than registered unemployed. Tax paying New Zealanders are denied social welfare benefits simply because of their relationship status.

In effect, it is a discouragement to be in a relationship if you lose your job.

On top of which, you are considered “employed” if you work for one hour (or more), with or without pay.

If that doesn’t drive down “official unemployment stats, I don’t know what will.

Rubbish.

Numbers of welfare (generally) fell during the 2000-2008 period.

As for “many teenagers started on the unemployment benefit and moved to the DPB where they often remain for a many years” – evidence, please?

And you know as well as I do that teenage pregnancy rates have been falling, not increasing.

“In the early 1970s, 70 out of every 1,000 teenagers had a child in any year. By the mid-1980s the figure had fallen to 30 per 1,000. Subsequently, it varied between 30 and 35 per 1,000 until 1997. There has been a general downward trend in the last five years, and in 2002 the fertility rate for teenagers was at a historical low of 25.6 per 1,000.”

http://www.stats.govt.nz/browse_for_stats/population/births/teenage-fertility-in-nz.aspx

In fact, up until the Global Financial Crisis (which is the excuse this government uses when convenient), the number of solo-parents on the DPB was actually falling,

“Between September 2013 and September 2012:

The number of recipients of Sole Parent Support decreased by 7,268, or 8 percent.”

https://www.msd.govt.nz/about-msd-and-our-work/publications-resources/statistics/benefit/post-sep-2013/sole-parent-support/september-2013-quarter.html#Keyfacts1

That makes no sense.

Registered unemployed and HLSF numbers have been falling since 7.3% in the September 2012 quarter, as up to 33,000 gave up looking for jobs that simply did not exist. (And HLFS figures have been shown to under-state unemployment in this country.)

http://www.radionz.co.nz/news/business/127470/unemployment-rate-falls-as-more-give-up-job-hunt

If, however, you’re referring to greater “unemployed/jobless” numbers because WINZ (ie, the government) requires greater numbers of beneficiaries to be available and looking for part or fulltime work” – then you’re simply pointing out the obvious. National’s “reforms” are shifting categories of welfare, but doing precious little to actually shift them into jobs.

I believe it’s commonly referred to as re-organising the deck chairs on the Titanic?

As such, Lindsay, by not critiquing National’s manipulation of WINZ benefit categories, you’re actually part of the system that perpetuates the myth of low unemployment.

I think even you understand this simple reality, despite your protestations otherwise. It would take a quantum shift in your thinking to accept this.

Thanks for pointing out the inconsistency between the entitlement of single people and partnered people, Frank. We clearly haven’t left the 19th century on this one, yet.

The other bit that seriously stinks is the meanness covered by ‘not qualifying for the unemployment benefit because they have assets and savings’.

If you’ve been in work and scraped together ‘assets and savings’ then you’ve been paying taxes. (A virtuous ‘hardworking kiwi battler’) Why must you be doubly punished – loss of earnings AND loss of assets – to qualify for the unemployment assistance which is little more than a pittance and band-aid ‘training seminars’ on how to write a cv and ‘job search’?

When is Ms Bennett going to really reform the system so it actually becomes a working public service?

+1 Andrea.

My partner works at WINZ and he feels embarressed having to teach people 20 or 30 years older than help how to write up a CV or job search. He knows that they know, and they know he’s embarressed, but they are polite and understanding.

“2/ Looking back long-term (20+years), the unemployed/jobless have been increasingly supported by benefits other than the unemployment benefit. The typical pathway from unemployment benefit is first to the sickness benefit and then to the invalid benefit. Also many teenagers started on the unemployment benefit and moved to the DPB where they often remain for a many years.”

Typical for Lyndsay Mitchell – one of the many “stats twisters” there are. And she is so repetitive, using the small percentage of beneficiaries that may “fit” the present government’s propaganda “image” of the “career beneficiary”, to make us believe it is a wide spread problem.

So the dole is supposed to lead to sickness benefits and then invalid’s benefits, now (after the reforms) I suppose from “jobseekers” on benefits (with deferred work expectation due to health reasons) to a “career” on the Living Support benefit.

What a load of rubbish, and for every movement between certain benefits, there are plenty of good reasons behind them. We have so many work in marginal employment, that does not pay a living, so naturally, there is a lot of moving of in and out of work for a fair number of people. And yes, many are truly sick and disabled, although some UNUM Provident bought “scientists” wrote reports that claim most just suffer from “illness belief”.

The days of full time, secure employment for all, that also pays for a decent living, they have been over for decades. Now the HUNT is on for those marginal groups that do “cost” society, and sick and disabled are pressured to look for jobs that many healthy struggle to get. And it is all “dressed up” as “helping” people, while indeed the path that was followed in the UK is being followed, to “cull” sick and disabled off benefits, to save costs, and little else:

http://accforum.org/forums/index.php?/topic/15188-medical-and-work-capability-assessments-based-on-the-bps-model-aimed-at-disentiteling-affected-from-welfare-benefits-and-acc-compo/

A source, I am sure, Lyndsay knows as well, to tell us what a Professor Mansel Aylward stands for, who “advised” Paula Bennett, WINZ, MSD and GP conferences here and in Australia on the “health benefits of work” (aka “work will set you free” motto). Have a read of Black Triangle’s publications:

http://blacktrianglecampaign.org/2012/09/09/professor-mansel-aylward-my-what-a-very-tangled/

And what many in the public, nor in the mainstream media here do not know, there were “experts” called to “advise” Paula Bennett and MSD on the welfare reforms, sitting on the Health and Disability Panel, who acted also as “salespersons” for organisations that now won contracts to run trials on getting mentally ill into work. What about conflicts of interest?

Helen Lockett from Workwise is one of them:

http://nz.linkedin.com/pub/helen-lockett/25/1b/86b

http://www.scoop.co.nz/stories/GE1305/S00096/employment-and-mental-health.htm

http://www.workwise.org.nz/news

And the President Elect of the Australasia Faculty of Occupational and Environmental Medicine (AFOEM, as part of the RACP), Dr David Beaumont, was also working for ATOS, advised MSD and ACC here in NZ, and he is now having major key influence in indoctrinating medical professionals of Aylward’s bizarre “science”:

http://nz.linkedin.com/pub/david-beaumont/2a/780/943

Beaumont also runs his own business here in NZ, profiting from getting sick and disabled into work. What about conflicts of interest, I ask again?

http://www.pathwaystowork.co.nz/contact-us

Both the above (and others with vested interests) sat on the Health and Disability Panel advising on the welfare reforms:

http://accforum.org/forums/index.php?/topic/15264-welfare-reform-the-health-and-disability-panel-msd-the-truth-behind-the-agenda/

Here is what the RACP and AFOEM now stand for, after the infiltration by ideologues propagating Aylward’s theoris:

http://www.racp.org.nz/page/afoem-health-benefits-of-work

http://www.racp.org.nz/page/racp-faculties/australasian-faculty-of-occupational-and-environmental-medicine/realising-the-health-benefits-of-work/latest-news/

Simon Collins revealed who won out of first contracts that MSD offered to get sole parents and mentally ill into open employment (like “commodities” for hefty fees):

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11190002

(see lists down the bottom)

Employment statistics really, like REALLY, need to be taken with a grain of salt. After all, increases in Government largess can ultimately ONLY be financed by increased NET tax revenue. This is the only statistic that matters. For example public workers (e.g. teachers, police, most doctors etc) are net DRAINS on tax revenue. Yes, they do pay taxes, but ALL of their income comes from tax revenue in the first place collected from the net productive members of the economy (e.g. farmers, manufacturers, mining). I’m not remotely advocating that we need to get rid of public workers to increase our tax base… I am merely pointing out that “employment” doesn’t equate with tax revenue or GDP growth – these being the only way to fund any increases in government spending. I would also like to point out there are now many more “discouraged workers” – these are people who can and are willing to work, but have simply given up looking for a job (due a lack of supply) – e.g. two income families converting to a single income family. They are not included as “unemployed” because they are not drawing a benefit (the entirety and then some of the US’s “job growth” since the GFC can be ascribed to these people – factually the US has LOST 8 million odd TAX PAYING jobs since 2008, and they ain’t coming back and they ain’t paying taxes).

So, effectively what we have here is an exercise in lies, damned lies and statistics, in which the vague definition of ‘jobless’ and the wide range of ways in which people on different benefits can either fall into the ill-defined category of ‘jobless’, or not, makes it possible but not really justifiable to paint a propaganda picture of huge numbers of people being deprived of social welfare benefits they’re entitled to.

I guess there is possibly some case to be made in here about possible unfairness in requiring households, rather than individuals, to qualify for unemployment benefit, but that was a feature of unemployment benefit at least as far back as when I unsuccessfully attempted to portray my girlfriend as a ‘flatmate’ back in 1980, and presumably much further back – it’s hardly some recent, devious Tory plot. Same with the issue of not qualifying if you have assets or aren’t unemployed very long.

True, in some ways, Milt. The Nats are simply more overt in their demonisation of those out of work.

Labour, it should be noted, never reinstated Ruth Richardson’s benefit cuts in 1991 – a move which was partly responsible for the recessionary impact on the economy (and which helped push unemployment to 11.2% (minimum) by late 1991.

On the nail.

And yet, (I’m assuming) you were both tax-payers. It is a discriminatory policy based on nothing except a relationship status.

This, I believe, is where a UBI/negative tax makes more sense. A universal payment would eliminate the bureacracy; do away with arbitrary (and often crazy) rules; and simplify the matter once and for all.

After all, as Jacinda Ardern quite rightly pointed out in Parliament, we already have a form of UBI with our superannuation system.

The only downside is the unemployment created by doing away with most of the WINZ bureacracy. Some folk would dismiss that concern out of hand, but, well, they are people with families to support as well…

In the meantime, it’s up to Labour, the Greens, and the rest of us to resist and fight back against government vilification of the unemployed and other jobless. Silence on the issue, as they say, implies consent…

Indeed, Nitrium. A Radio NZ report revealed that 33,000 people dropped out of the unemployment stats at the same time the HLFS dropped from 7.3% (Sept 2012) of the workforce to 6.9% (Feb 2013).

Add to that the “mickey mouse” definition of an employed person working one hour (or more) per week – even if unpaid – and it becomes apparent that real unemployment is much, much higher than we’ve been led to believe.

Even the 2013 Census – which shows unemployment at 7.1% – is suspect, as it also employs the definition of a one-hour minimum to be considered employed. (http://www.stats.govt.nz/Census/2013-census/profile-and-summary-reports/quickstats-about-national-highlights/work.aspx)

Theoretically, unemployment could be zero if every unemployed person worked one hour per week, either paid or unpaid voluntary.

Nil unemployment.

The government would save billions in welfare.

That would be followed by further tax cuts.

And poverty would reach Third World proportions, with entire families sleeping in alleyways and under bridges. (Kind of like the United States.)

The only question is when the rioting would start…

I know about this crap first hand. I was on a sickness benefit, renamed to a “Jobseeker” benefit, why this is, who knows, it’s not as if those of us with medical certs actually have to actively seek employment. But after a recent review in which I had to admit I had a girlfriend I was means tested based on my girlfriends income. Talk about nuts. She’s only 25c above minimum wage and she’s expected to cover both our expenses?! And I don’t see why this is the case, we are not legally married. I’m an individual and I have my own expenses, as does she. Just another way to bring down the number of people on the benefit, eh? Regardless of the human cost. I now have to choose between my relationship, or rejoining a workforce I’m not sure I’m prepared to join, given my feelings towards the current economic climate. State coercion much? Might as well send me to the gulag.

There are probably many like you in yuour position, D Veneema.

Case in point; during the height of the GFC/recession (and I wish I had taken note of the details), TV1 or TV3 News interviewed a couple. If memory serves, they were living in Tauranga and the guy was involved in some kind of IT job.

They were a typical middle class/upper middle class couple.

He had lost his job, but was unable to access the Unemployment Benefit because his wife was still working. So they were having to survive on one wage, whilst still paying their mortgage, food, rates, power, phone, etc.

What struck me was that this middle class, professional, well educated person had no idea how the WINZ system and rules operated and he referred to the inequity that whilst both he and his wife had both been paying taxes – he was deprived of welfare assistance when he needed it the most.

The middle class – in this instance – came up hard against an unfair situation faced by thousands of other workers who had been made redundant. His entire response was a mixture of disbelief, surprise, and indignation that this should happen to him.

New Zealanders, generally, have no idea what surviving on social welfare is like, and many have false impressions of the “welfare life style”; new cars, SKY tv, etc.

If you ask those same people how much the dole pays, they have no idea.

And if you ask them if they know any families surviving on welfare, they generally insist they do. But I doubt it. Their knowledge comes from assumed experiences based on parroted anecdotes (like one person admitted on this blogsite), dramatised tv and movie stories, and not much else.

Perhaps this is something that an incoming government might address in some ways; bringing home the reality of survival on welfare to New Zealanders.

In the meantime…

In up-coming unemployment stats, I’ll be focusing on the Jobless and under-employed numbers, as well as the more restrictive “unem ployed” stats from the HLFS.

For example,

…he referred to the inequity that whilst both he and his wife had both been paying taxes – he was deprived of welfare assistance when he needed it the most.

He seems to have mistaken the unemployment benefit for some sort of unemployment insurance. It’s not. It’s a social welfare benefit intended to see that losing your job doesn’t result in you having to resort to crime or begging to make a living – it’s not intended to ensure that you maintain whatever lifestyle you were enjoying while employed. In this case, he didn’t ‘need’ welfare assistance, he ‘needed’ income insurance.

D Venema: yeah, the moment they can flag you as being in a ‘de facto’ marriage (which they’ll interpret very generously in WINZ’s favour), you’re fucked – that’s one thing that’s been consistent in their policy for decades.

Unfortunately, I can’t recall the full details of the story, so can’t comment on how threatened his financial circumstances were, due to the drop in income.

However, it still doesn’t negate the obvious that all tax-payers contribute (to varying degrees) to the Welfare System – but not all can access it. That determination isn’t based so much as “need” as personal relationship circumstances.

It seems incredibly arbitrary and unfair, and people only wake up to this reality when their own circumstances are impacted. (Which is usual for most human affairs.)

From the Social Security Act 1964, “Interpretation”, section 3:

“Income Test 1 means that the applicable rate of benefit shall be reduced—

(a) by 30 cents for every $1 of the total income of the beneficiary and his or her spouse or partner which is more than $100 a week but not more than $200 a week; and

(b) by 70 cents for every $1 of that income which is more than $200 a week

Income Test 2 means that the applicable rate of benefit shall be reduced—

(a) by 15 cents for every $1 of the total income of the beneficiary and his or her spouse or partner which is more than $100 a week but not more than $200 a week; and

(b) by 35 cents for every $1 of that income which is more than $200 a week

Income Test 3 means that the applicable rate of benefit must be reduced by 70 cents for every $1 of total income of the beneficiary and his or her spouse or partner which is more than,—

(a) if the rate of benefit is a rate of New Zealand superannuation stated in clause 2 of Schedule 1 of the New Zealand Superannuation and Retirement Income Act 2001, $100 a week; or

(b) in any other case, $80 a week

Income Test 4 means that the applicable rate of benefit shall be reduced by 35 cents for every $1 of the total income of the beneficiary and his or her spouse or partner which is more than $80 a week”

Also take note of the work test obligations if a spouse may be finacially dependent on the “jobseeker” applying for a benefit from WINZ:

“88G

Jobseeker support: obligations of spouse or partner of person granted it

From the time that payment of the jobseeker support commences, the spouse or partner of a person granted jobseeker support,—

(a) if the benefit is granted at a work-test couple rate, must comply with a requirement under section 60Q; and

(b) if he or she is a person to whom section 60RA applies, must comply with his or her social obligations under section 60RA(3); and

(c) if he or she is a work-tested spouse or partner, must comply with the work test.”

Own comment:

That is why WINZ is now so keen on doing “home visits” to sole parents, trying to find the slightest traces of evidence of persons living in de-facto relationships, to put yet more pressure on beneficiaries, to hunt them, to chase and harass them, all to ultimately save more costs. This “de-facto relationship” scenario is a line that is hard to be drawn, as some move in and out of relationships, or are just friends who live together for time being.

But when it comes to WINZ, they will swiftly stop benefit payments if there is any indication of persons living in a relationship. Yet they have the audacity of saying they want to check on sole parents to see they are “well”, and perhaps need some further “support”. Propaganda has found a totally new tune under this government.

Try living off a benefit while being a couple though, the rates are lower than those for two individuals, and individuals struggle beyond belief in many situations.

…all tax-payers contribute (to varying degrees) to the Welfare System – but not all can access it.

Well, they can’t if they don’t qualify for it, no. The government won’t pay me superannuation or an invalid’s benefit despite the fact that I pay taxes – doesn’t mean I can’t access them, I can access them the moment I meet the criteria for accessing them.

But when it comes to WINZ, they will swiftly stop benefit payments if there is any indication of persons living in a relationship

That’s because governments have this thing against fraud – they make it illegal and everything.

“the moment I meet the criteria for accessing them.”

So long as the government of the day doesn’t shift the goalposts. There could be quite a time gap between your coming into need and your meeting the criteria for accessing them.

And, while you wait, you’ll be steadily sinking.

Are you quite sure it’s about governments being against fraud? Or are they merely reflecting the ignorance and bias of their voting base?

If people were treated as ‘individuals’ instead of ‘couples’ – just as they are for taxation purposes – then the ‘fraud’ issue departs. Along with the snoops from WINZ.

[…] Right wing blogger makes fool of herself, Mike Treen on The Daily Blog rips right-wing blogger, Lindsay Mitchell, to bits for her cavalier […]

Comments are closed.