YOU CAN ALWAYS TELL when an ideology is dying – it starts lying.

In its early years a world-changing ideology relies on facts. It points to our lived experience of reality and asks: “Does this still work for you?” It has no need to falsify or distort: to the contrary, the more truth it speaks the more persuasive it becomes.

This was Neoliberalism in the late-1970s and 80s. The western world was on an inflationary treadmill. Prices were rising relentlessly and wages were following them up – but always with a little lag – with the result that, year by year, the actual purchasing power of people’s wages and salaries was falling.

As if this steady erosion of people’s incomes wasn’t bad enough, unemployment and inflation seemed to be linked. The newspapers called the combination of stagnating employment growth and runaway inflation “stagflation”. It was, they said, proof positive that the hitherto highly successful post-war policy of full employment – based on the economic theories of John Maynard Keynes – was failing.

According to Keynes, the State could keep everyone in work by spending large sums on goods and services calculated to soak up excess labour and stimulate demand. This expenditure was funded out of progressive taxation and from money the State would effectively borrow from itself .

Keynesianism’s critics argued that “excessive” government spending, by expanding the money supply, was simply sending too many dollars in pursuit of too few goods – the classic definition of inflation. Even worse, in its effort to create jobs, the State was “crowding out” productive investment in the private sector, leading to business-failures and job losses. In short, by attempting to create jobs, the State was, paradoxically, destroying them.

The Neoliberals’ prescription was simple, and to most people it sounded like plain common-sense. To rein-in inflation and reduce unemployment all a government had to do was: stop printing money; cut state spending; and give the private sector its head.

As the economy adjusted itself to this new “economic rationalism”, warned the Neoliberals, people would, unfortunately, be required to endure a little short-term pain. But they would definitely gain in the long-term. The private-sector was inherently more efficient than the State and was, therefore, ideally placed to guarantee all those who wanted them real jobs, at good wages, without inflation.

AS WELL ALL NOW KNOW, there was a little more to the Neoliberal prescription than that. And one man, the Polish economist, Michal Kalecki, had seen it all coming thirty-five years before it actually happened.

In an article entitled “The Political Aspects of Full Employment”, published in The Political Quarterly of October 1943, Kalecki wrote:

“The maintenance of full employment would cause social and political changes which would give a new impetus to the opposition of the business leaders. Indeed, under a regime of permanent full employment, the ‘sack’ would cease to play its role as a ‘disciplinary’ measure. The social position of the boss would be undermined, and the self-assurance and class-consciousness of the working class would grow. Strikes for wage increases and improvements in conditions of work would create political tension. It is true that profits would be higher under a regime of full employment than they are on the average under laissez-faire, and even the rise in wage rates resulting from the stronger bargaining power of the workers is less likely to reduce profits than to increase prices, and thus adversely affects only the rentier interests. But ‘discipline in the factories’ and ‘political stability’ are more appreciated than profits by business leaders. Their class instinct tells them that lasting full employment is unsound from their point of view, and that unemployment is an integral part of the ‘normal’ capitalist system.”

The loss of “discipline in the factories” – that was the real reason employers were so determined to rid themselves of Keynesianism. Under its full-employment policies there may have been some short-term gains (if you can call thirty years of unprecedented prosperity and growth “short term”) but in the long-term Keynesianism posed a deadly threat.

If allowed to go unchecked the power and confidence the State’s interventions had secured for working people would inevitably see it move beyond the provision of education, health and welfare services and into sectors of the economy where its enterprises would be competing directly with those of the private sector. To a limited extent this had already happened in the energy and transportation sectors. What would be next? Manufacturing? Retail? Finance?

For capitalists, the impetus which Keynesian full-employment policies gave to post-war social-democracy was frightening. In a sellers’ market for labour, trade unions had become a dangerous locus of economic, social and political power. The influence this afforded them in the political parties to which they were aligned was, by the early 1970s, seriously eroding the power of the top one percent of income earners. If the economic and social logic of full-employment advanced even a little bit further, the position of the capitalist elites would become untenable.

Something had to be done – and that something was Neoliberalism.

WITH THE PASSAGE of thirty years, it has become very clear (even to those who initially bought into Neoliberalism’s 1980s sales-pitch) that its promises of long-term gain were just another variant of “There’ll be pie in the sky when you die.”

The promised pain, on the other hand, has been all-too-real. A vast gulf of wealth and power now yawns between the beneficiaries of the Neoliberal “revolution” and its victims. The average working-class New Zealander is more indebted, earns less in real terms, feels more vulnerable in the workplace and is less secure economically than at any time since the Great Depression.

That being the case, it becomes extremely important for Neoliberal apologists to reassure the people upon whose political support Neoliberalism relies that the whole exercise has been a rip-roaring success.

Unfortunately for these apologists they can no longer use people’s lived reality to make the case for them. There is simply no way the conditions of the pre-Neoliberal era can be honestly presented as worse than those of the present. From the purchasing power of the average weekly wage to the lack of affordable housing for young families, the conditions of life for ordinary New Zealanders under Neoliberalism have got worse – not better.

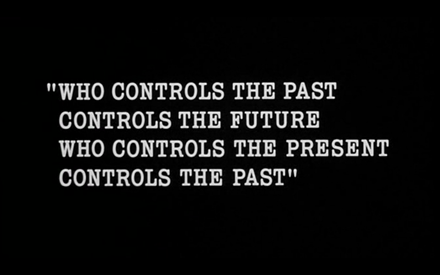

As a consequence, Neoliberal apologists are forced to falsify the past: to create a narrative that unequivocally inverts historical reality.

This falsification of the past, in order to justify the ways of Neoliberalism to Man, has no more energetic champion than the New Zealand Herald columnist, John Roughan. In the paper’s Saturday’s edition (30/3/13) he calls for the closure of the Tiwai Point aluminium smelter – evoking, in justification, a quite extraordinarily tendentious, and just plain wrong, version of this country’s post-war history:

Acknowledging that “one or two” of his relatives have enjoyed “a lifetime of employment” at Tiwai, he concedes a debt of gratitude to the National Government of the 1960s for its decision to “turn hydroelectricity into aluminium ingots”.

“It might have been a good idea”, says Mr Roughan, “if the price of electricity had been right – the price we have never been allowed to know.

“The price of most things at that time was controlled or subsidised and nobody knew or cared that prices didn’t align the item’s cost of production to its value in a competitive market. The economy was a job-creation scheme that ended with double-digit unemployment in the 1970s.”

This is an outrageous falsification.

At no time during the 1970s did unemployment ever climb above 2 percent of the workforce. The highest unemployment total of the decade was recorded in 1979 when just under 25,000 people – out of a workforce of 1.3 million – were registered as unemployed. (Source: New Zealand Official Yearbook, Department of Statistics, 1983) In the year ended December 1974, the number of people registered as unemployed in New Zealand had numbered less than a thousand!

Of course Mr Roughan has no choice but to turn the 1970s into an unmitigated economic failure. To do otherwise would call into question the wisdom and efficacy of the entire Neoliberal Revolution. After all, the only time since the Great Depression when unemployment exceeded 10 percent of the New Zealand workforce was 1991 – the year of National’s arch-Neoliberal Finance Minister, Ruth Richardson’s “Mother of All Budgets”.

The extent to which Mr Roughan has succumbed to Neoliberalism’s absurd mythology is revealed in the next passage of his column. Here he compares Keynesianism to a steam-engine and Neoliberalism to an automobile!

“It was then that governments everywhere learned elementary economics. They realised an economy was not a steam engine that you stoked with as much money, labour, land and fuel that you could lay your hands on. It was more like an automobile that operated best for those inside it when the engine was tuned with precision.

The best method of tuning it, economists said, was a market price. A price set by competition and consumer choice would give each cog in the engine as much fuel, capital, labour and other resources it could efficiently use, and tell you which industries would boost the country’s wealth.”

Clearly those responsible for the Global Financial Crisis: all those expert auto-mechanics at Lehman brothers, Merrill Lynch, Fannie Mae, Freddie Mac, Washington Mutual, Wachovia, Citigroup and AIG were not at work the day those cogs and wheels ground themselves into piles of useless junk? A mess which only the despised State’s capacity to borrow from itself was big enough to clean up.

It is rare to encounter Neoliberal self-delusion on such an all-encompassing scale as Mr Roughan’s. Such egregious historical distortion should make us all very angry, but it can also, in a curious way, comfort us. What it reveals is an ideology entering the twilight of it reign: a system requiring only a few solid blows to send it crashing down.

When a revolution can only be defended by lies, then it’s no longer a revolution.

A comment I left after Mr Roughan’s BS column,

I recall the 1970s. My first job, in 1975 didn’t go well (harassment by a very dodgy character), and I walked straight into another job. I was “unemployed” for less than a day.

Unfortunately, judging by some of the low-information comments left by some readers, it seems that some are only too willing to buy into Roughan’s fantasies.

“The price of most things at that time was controlled or subsidised and nobody knew or cared that prices didn’t align the item’s cost of production to its value in a competitive market. The economy was a job-creation scheme that ended with double-digit unemployment in the 1970s.”

That’s an interested observation Frank, along with all the rest of the man’s complete and utter kaka.

Is the man so deluded as to think that prices today align with costs of production? (I.e when we have vertically & horizontally integrated supply chains wrapped up in monopolies and duopolies offering ‘loss-leader’ bargains such that CocoCola can be cheaper than bottled water; where small producers are dictated to by retail outlets and are shut out if they can’t deliver in bulk; and INDEED when the entire Neo-liberal mantra has in itself been undermined by the existence of the tendancy towards monopoly/duopoly/cartel. You’ll probably remember how we were all sold on the idea that COMPETITION between private operators et al was the natural leveller of all things in the de-regulated market-place. Max Bradford springs to mind – as does Maurice Williamson).

I’m interested to know your opinion. Did they lie? or were they just simply deluded. If it’s the latter – then they’re sure as hell just lying now in the face of overwhelming historical evidence.

I think Chris could probably answer that with greater eloquence and insight than I could, Tim.

My view of human nature is that economic theories – like religions – are more faith-based than an actual science.

In science, if I’m standing on a sufficient mass; hold out a hammer; let it go; I don’t need to see it fall to know that it has. The laws of gravity are pretty strict in such matters.

In economics everything is subject to a belief system; political views; personal circumstances and experiences, etc.

In economics, for example, if I eliminate trade barriers, the result is… cheaper imports. That’s good, right?

But it also means higher local unemployment as businesses collapse; a loss of skilled people to overseas destinations; a rise in crime; greater demand for social welfare; wages being driven downward; more poverty; increased transience; and needing more government tax-dollars to pay for said welfare.

And what happens to the children in such families? If joblessness becomes a generational problem (I refuse to call it an “issue”), then the cost to society increases and worsens.

Related to that is, if a right-wing government then cuts taxes (as in 2009 and 2010), how do we pay for the dole?

We can borrow from overseas.

We can slash services?

We can implement user-pays in other areas of State activity (eg; prescription charges, fuel taxes, student loan repayments)?

So are imported goods really cheaper? Or have we simply shifted the cost from, eg; a pair of shoes, to paying someone the dole?

That’s why, to me, economics isn’t a science. It’s a faith-based world-view. One person will view that situation with dismay as unemployment grows, and social services are cut back to pay for welfare.

Another person will look at that situation and blame the unemployed for being unemployed, and see the benefit of cheaper shoes in retail outlets. This person will be angry that his/her economic belief system isn’t working as it should . Hence why the right wing continually blame the unemployed, solo-mums (but rarely solo-dads), etc for socio-economic problems – their economic belief-system is being challenged.

(You can substitute “economics” with “god/religion”, and you get the idea. People don’t like their gods/religion being challenged either.))

Interestingly, at least one politician has since recanted. His faith-based-belief system in free market economic theory has changed; http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10680372

And some research on unemployment in the 1970s…

Mar-70 0.8

Jun-70 0.8

Sep-70 0.8

Dec-70 0.8

Mar-71 0.8

Jun-71 0.9

Sep-71 1.0

Dec-71 1.2

Mar-72 1.3

Jun-72 1.3

Sep-72 1.3

Dec-72 1.3

Mar-73 1.2

Jun-73 1.1

Sep-73 1.1

Dec-73 1.0

Mar-74 1.0

Jun-74 1.0

Sep-74 1.0

Dec-74 1.0

Mar-75 1.1

Jun-75 1.2

Sep-75 1.2

Dec-75 1.2

Mar-76 1.2

Jun-76 1.1

Sep-76 1.0

Dec-76 0.9

Mar-77 0.8

Jun-77 0.8

Sep-77 0.8

Dec-77 1.2

Mar-78 1.5

Jun-78 1.7

Sep-78 1.7

Dec-78 1.4

Mar-79 1.4

Jun-79 1.5

Sep-79 1.4

Dec-79 1.3

Not one single “double digit anywhere.

Thanks Chris – These ideologues give me the runs – it’s the lies that hurt. They still think the world is in a better place and that they are to be congratulated for changing it for the better.

They are more like Stalin than they wish to acknowledged, and a blind devotion to ideology of any ilk – will destroy rather than enhance.

Now I wonder if any will be brave enough to jump from that sinking ship of neoliberalism – the labour party?

Where will it end? Rack and Roughan.

[…] Chris Trotter […]

This article seems to me full of murky thinking.

The entire globe still runs by keynesianism 100%. All stimulus packages are Keynesian Macro-economic injections of liquidity.

The MAIN criticism of Keynesianism is that eventually someone has to pay the billl. Well, USA has debt of over 100% of GDP and the enitrely of Europe is in debt that will stick around for at least 50 years (and I don;t write to be sensationalist, Britain in particular is a dire case). Debt is due to recent Keynesianist injections.

EVERY first world Government still uses Keynesianism to combat contracting markets…

The author of this article has an agenda (opposition to NZ Labour party of 1984’s policy sweeping changes)…

The author himself clearly peddles a ton of ideology and his polemic detracts from intelligent discourse…

We have greater inequality due to many different reasons (including immense international power accumulation leading to legislative changes – see Chomsky) but we are also much freer from inhumane, time consuming, boring ass bureaucracy.

No: the Economics that informs governments is for the most part Neo-Classical. Quite a few Neo-Classicals – Paul Krugman is one of them I believe – call themselves Neo-Keynesians, very well. The problem there is that Neo-Keynesian economics is so watered down by Neo-Classical thinking that you could just about call it Homeopathic Keynesianism. Hardly anything remains in this incarnation of Maynard Keynes’s own critique of Neo-Classical Economics.

You know all those managers and CEOs in the multi-national corporations? Yeah, they’re bureaucrats and the ones at Rio Tinto, as one example, presently have their hands out for lots of our money which this government will give them and thus make life harder for most NZers.

They are top-tier businessmen operating in a high-wire game of career. Going by the numbers they’re not who I’m talking about.

The boring bureaucracy that we have cast aside is that which employs hundreds of thousands of workers (us folks) in pointless jobs who by way of repressed psychology end up carrying out small progroms against their fellow countrymen thereby limiting the volition of everyone. Ever heard of red tape? The natural by-product of bureaucracies when allowed to evolve unimpeded.

It is evidentally challenging to get a social system right, but pre-1984 NZ was a champion example of boring-ass static-ism. Vivat Status Quo!

OMG! (as they say in the connected world). Where TF have you been living?

“They are top-tier businessmen operating in a high-wire game of career.”

That’d be top-tier businessmen held up as examples of foreskins of management – such as those that have run breweries in a country/state such as NZ; or bankers – those a few of us at the ‘coalface’ used to monitor and who could regularly be seen on TV nightly giving ‘market advice’ (The Tony Alexanders and Cameron Baglys in their early days whose records could only realistically be guzumped by throwing a dart at a dart board ……. perhaps even those CEOs of corporatised Gubbamint Departments in the name of fishinsy in fectivniss – mostly out of their depth and whose (now increasingly being made redundant) underlings operated INSPITE of them, rather than BECAUSE of them.

Do you mean those top tier businessmen?

Holla. Nowhere in my statement is a a perjorative or prescription.

My point being that the element at the top of the chain remains highly ambitious and competitive regardless of the social system – could be a bolshevik or a new-wave businessmen.

The invective u and Draco want to throw my way doesn’t stick because you see me as some kind of supportive element. – “By the numbers” means that quantitively many people would be bureaucrats and the Good New Zealand Wizard among many others educates those who listen that bureaucrats are tedious folk who suck life.

And they’re also bureaucrats no matter how much you want the not to be and they’re destroying the economy and the earth’s ecology. I’d take boring over that.

There was probably more constant change happening before the imposition of neo-liberalism than after. Since then we’ve gone into a default set of moves that never changes.

What – – – ?!?!

Are you trying to dismiss the last 30 to 40 years of Friedmanite “reforms”, de-regulation, “free” trade deals, etc?

It’s somewhat laughable that you’re blaming everything of Keynesian economics after Thatcher and Reagan implemented their “Chicago School” neo-liberal ideology.

Where, precisely, does Keysian economic come into it?!

And more importantly, John, what are you proposing as an alternative system?

No, I believe he is stating that the ideas of Keynesianism never really left the picture. Neo-liberalism was merely a mild rejigging of the equation not such a radical shake up as some would have you think. Only a few countries really embraced neo-liberalism with any vigour. Many of them are doing better than places such as Greece and Cyprus which still have a large State sector involvement in the economy.

Hey Frank, what I am saying is that keynesianism was an economic theory over top of which social programs have been laid.

Keynes’s contribution is to Economics (he never said we should apply it through pre-thatcher or post-thatcher style government. He’s morally and politically neutral which seems to be overlooked) is the notion that spending will create an increase of exchange. It is this theory that leads governments to continue to pump money into an economy. End of story. Everything else that goes on is other peoples shtick.

Of course Freidman’s cronies went down. So did the Neo-Cons. Nowhere do I summarise an entire era as “Neo-Liberal”. I was referring

The article above, Frank, was an attempt to obfuscate clear thinking by throwing Keynesianism as a catch all term for a solution. But perhaps you didn’t read it? Or maybe u support dogmatic writing?

Since you seek closure so heavily and heatidly, Frank, I will offer an economic solution that I quite like and that I learnt when reading the thoughts of a 19th C entrepreneur – Silvio gesell.

In the present this style of thought has best been presented by an ex-top level Belgian Central Banker (as well as founder of the leading international currency trading firm ’87-’91) BERNARD LAIETAER.

A great solution in alternative currencies. This occurs internationally in the form of consumer points cards, and even occurs explicitly in the funding of 1.8million elderly Japanese in old peoples homes, among many many many other cases with success…. The cases MOST successful historically applied a demurrage to money.

The simple fact of our currency is that it is geared for recession and depression cycles and this favours large equity holders (see-income inequality). The crash of the late 90’s was the biggest land EVER in history as banks siezed control of Russia and South East Asia.

INTEREST was applied to currency following the Golden Age of Medieval ages – the last most prosperous time economically, according to the data. There was huge social development, including the construction of all the Gothic Cathedrals (see Notre Dame). Following this period came the birth of the “code” of what we would now call Coporations.

Interstingly Napoleon & Hitler both kicked the bankers out of their countries, removed interest from the creation of money, and pegged their currency to something more tangible (labour in Hitler’s case). I’m NO supporter of megalomania. However these guys both rode the biggest waves of economic growth in the modern era, and there was no fucking way that it was ideology alone that did it. It was a shrewd play against equity lords.

Not much closure for you Frank, its an open field of interesting data. **Cue false assumptions from what i write.

John Roughan is just like the very Ministry of Truth that he purportedly despises. I’m tempted to think this should go to the Press Council for blatantly rewriting history, but Roughan just happens to be on it.

The whole of the Neoliberal programme was informed by the beguiling and bullshit advices of the Chicago School of Economics. These were not adherents of Keynesian ‘mixed economy’ ideas, but the utter crackpot notions of Neo-Classical Economics, a branch of economics totally lacking in the slightest scintilla of intellectual or scientific rigour; based upon assumptions that are so far divorced from the real world that Disneyland looks like gritty realism. And these pirates and pilferers of the public good have had the ears of governments world wide for the last thirty to forty years.

It might surprise readers to learn that in Neo-Classical Economic Theory, money has no place; banks have no place; debt has no place; time has no place. Even the (relatively) liberal Neo-Classicist Paul Krugman can not see how debt has any relevance in economic theory (the lender’s loss of spending power is the borrower’s increase, as he sees it). Which tells me that Paul Krugman, Nobel Laureate in Economics, has not a clue about how banks work.

But of course the ideas of a crackpot like Milton Friedman and his acolytes (like Roger Douglas and Ruth Richardson in this country) gained a good deal of traction with the Fat Cattists, didn’t they? Licence to loot. How could the Fat Cattists resist? They were into this like a robber’s dog. And they have been looting the Common Weal ever since.

They began in South America in the 1970s. It never even crossed Mr Friedman’s mind that a programme that required for its fulfilment the wholesale murders, rapes, beatings and disappearances of the dissenting, might actually be flawed in some way. Perhaps Mr Friedman hugged himself to sleep at night by assuring himself that in their ignorance the opposition were being irrational. You should see how Neo-Classical economists define rational behaviour; a real eye-opener that one!

Governments world wide have become kleptocratic idiotocracies, benefiting the Fat Cattists at everyone else’s expense, impoverishing the Commons and yet blaming the victims of this global burglary.

Look, don’t fool yourself that the Neo-liberal ideologues have recently begun lying to prop up a failing programme. Their whole programme has been a lie from Day One, based on a lie, and fueled by lies. I am utterly convinced that the cannier among them knew that Neo-Classical Economic theory that informed their advisors was a complete and utter crock of ordure, and exploited the hell out that knowledge – once they had persuaded incompetent Governments that it was all kosher.

Governments are pig ignorant, haven’t the slightest notion of what they are doing. John Key ought to know better – he was one of the beneficiaries, but I’m not getting any impression that he’s all that bright to be honest. I’d describe his integrity as questionable as well, but that I’m pretty sure I know the answer. Nor is the rest of his Cabinet illumined by the light of the slightest intelligence nor by a ray of the slightest humanity. They are too easily persuaded, and it suits their world view, to continue to toe the Neo-Classical line.

The very notion behind the Open Banks Resolution, promulgated by the Reserve Bank since 2011 has been described (in the context of the ECB’s diktat to Cyprus) as political suicide by Centrist political leaders. I don’t see the Nats as centrist, but the point made is that if ordinary Joe and Jo can’t trust the integrity of Banks to keep their fat little fingers out of their savings accounts, then look out for a surge in popularity for left and extreme right wing political movements. The centre, I infer from this writer, has become a political vacuum for almost any polemicist to fill.

You know: the recent news item that changes to the Kiwisaver scheme will encourage and increase saving behaviour is pitifully risible in view of the Open Banks Resolution. You can always tell when a politician is lying. You can see his lips move.

Keynesianism has no social prescriptions. It is economic theory.

Your pre-1984 social construction of large bureaucracies running SOE’s was an overlay of Keynesian economic theory on top of existing ideas of governance.

This is what is wrong with the above article.

Keynes said that to exit economic recessions we should inject liquidity into an economy.

Essentially a dichotomy, the opposite end of the spectrum is Hayek – who said that injections of capital create false markets, because organic and lasting entrepreneurial activity is not the natural result of pumping money into large state-centred infastructure building programs.

Hayek was proven right in the 70’s with Oil shock and is being proven correct again.

This is elementary thinking I’m putting forward here, from the book, if you havent even read the wikipedia article on Keynes then I don’t know how you can expect to comment on a blog post whose crutch is a yearing-for-the-days of Keynes (murky thinking – Keynesianism is an economic stratagem that continues today).

Neo-CLASSICISM is the Architectural aesthetic that the Colonial Americans bought into, as did Hitler. It is also the guiding principle behind the brightest spark in the past 600 years of Western thought – Hermeticism…

Neo-LIBERALISM is the mantra of the USA and now of Mr Key. This is what you mean.

Neo-liberalists are crooked, and I am equally infuriated by their vile activities. They have more than just economic ideas, they are modern Machiavellian politicians….However I think it behooves anybody who actually wants to make a difference that we follow the trail accurately and carefully. There is a limited amount of data to learn but no one seems to think its worth learning. Instead sassy comments on blogs pass off as a social contribution.

Neo-Liberalist thinking kicked off the notion that there must be a boogey man to chase so that the public at home are kept fearful and accepting of any legislative changes. Neo-Liberal economic thinkers were born with the Walter Lippman Colloquism in the 30’s, with small victories here and there. Over time they took on social engineering ideas and they took real power under Regan – leading us to the war on drugs and the war on terror (or the war on bikers in Australia, lol) – a perpetual war which facilitates the implementation of a world wide police force that acts with impunity outside of the rules of any “democratic” people.

You’re not from Chicago are you John-O?

You have a point?

OK the politicians are (soi-disant) Neo-Liberal. But this Neo-Libralism is informed by Neo-Classical economics.

Just because there are a hell of a lot of Neo-Classical economists out there calling themselves Neo-Keynesian, does not mean their economic understanding is any rounder than the all powerful Neo-Classical claptrap, nor indeed that they have the slightest understanding of Maynard Keynes’s argument. They have watered it down to preserve the holy equilibrium – or tendency toward equilibrium – economies are supposed to exhibit. Spare me.

So far as injecting liquidity into the economy, there were a number of ways of doing that. So far governments have tried a form of quantitative easing whereby the Banks get the liquidity.

That this hasn’t worked out very well, hasn’t stopped successive attempts to kickstart economies well beyond the point at which Einstein’s definition of insanity comes to mind. What could banks do with this extra money when no one was borrowing? It has done nothing for the productive sector of the economy, who don’t see any percentage in increasing production if consumers aren’t in a position to buy. So what do the Banks do? Continue paying out large bonuses to executives, and reboot the housing bubble – or some other Ponzi scheme?

Fritz Hayek’s comment in respect of building large scale infra-structural programmes isn’t necessarily correct. For one thing, such programmes may well help the private sector in a position to make use of that infrastructure.

But, absent the private sector capable of so doing, what is to stop the State itself building up a productive sector. State owned, or mixed owned? You see I have no quarrel in principle with John Key’s mixed ownership model, but with this proviso: that the enterprise was built up from scratch with that model in mind, and that model remains in force for the life of the project (there is room for flexibility in such a model, too).

Shovelling money at the banks I have likened elsewhere as attempting to break a log jam by piling in more and more logs at the upstream end. It might work, but there is a high likelihood that the jam gets larger and tighter, or, if it does break, things will get very exciting downstream for a while.

An alternative idea has been to shovel money into the productive sector. The productive sector is then likely to deposit some of it in the banks (building their reserves), and maybe spend some of it. There remains the problem of the impecunious consumer, though. Where are the buyers?

The idea I find most compelling is a debt jubilee to consumers. This I liken to shoving in a bunch of dynamite at the downstream end of the log jam. You lose some logs, no error, but you’ve got a good chance of clearing the blockage. Leaving aside the mechanics, what it ensures is: debts get paid, consumers get spending power, the productive sector will have reason to up production, banks get liquidity at the other sectors deposit moneys, and also get their lending business going as the other sectors have the wherewithal to buy stuff.

That there are fishhooks to this is true enough, but they were there whatever the State did. The failure of Neo-classical economics was: 1.It failed utterly to predict the GFC; 2.It has failed utterly to find solutions to the GFC; 3.It believes (with a few exceptions) that if it keeps its eyes closed the GFC will all go away.

Here is a question to address a core belief of Neo-Classical economists of the IMF, World Bank, and Government advisors, that debt is irrelevant to how the economy functions. What happens if the debt can not be repaid? Keynes knew damned well that a debt that could not be paid, would not be paid.

Oh… of course: more State sponsored private infrastructural programmes, such as debtors’ prisons.

OK you got me.

Oh, I forgot to mention: it is Neo-Classical Economics that has informed the ‘austerity’ measures visited upon the victims of the criminal and fraudulent activities of the Financial sector world wide. Quite why the thieves, con-artists and pilferers of the Commons have been appointed to clean up the global shambles they created has confirmed for me something I have believed for decades: the loonies have long since taken over the asylum.

It is now becoming apparent even to (some) people in high places that (so-called) austerity was the worst possible line that could have been taken: worsening the crisis for the countries thus stripped inter alia of their sovereignty, and bringing no particular benefit to creditor nations like France and Germany. France has already been badly hurt; Germany is starting to feel the pain as well.

I now realise, having read your gig a second time that you didn’t realise that I was speaking of the Neo-Classical School of Economics (of which the Chicago School of which Milton Friedman was a notable member was a subset). Neo-Classical Economics has dominated what might be laughingly be called a discipline (I can’t call it scientific and keep a straight face) for the last – oh, I don’t know how long – before Keynes’s time anyhow.

Neo-Liberal and Neo-Classical are the same thing.

I would like it if someone would address the points raised by this post rather than simply carry out ad hominem attacks as per the one below.

There was an interesting article on CNN regarding the splurge of infrastructure spending carried out by the Obama administration on such things as so called ‘fast rail’ Despite spending $12 Billion on it all that is to show for it is slightly less slow rail. One place spent $800 million and increased travel times by an astonishing 10 minutes. Yet they still have plans to spend Billions more despite the chronic budget problems in the US.

That is the problem with Keynesian economics. As stated above by John Ormond, eventually someone has to pay for it.

How can neo-liberalism be dying when those countries that got themselves into big trouble, (by following pretty much standard Keynesian policies it must be stated), are having to take a healthy dose of it to get themselves out of the mess they created for themselves.

You just have to look at the recent bailout of Cyprus to see this. They will be forced to reduce the size of the state and divest themselves of surplus state assets. That is hardly the stuff of a dying ideology.

Comments are closed.